You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Itching to pull the trigger!

- Thread starter .snap

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more. You can visit the forum page to see the list of forum nodes (categories/rooms) for topics.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

ancona

Praying Mantis

I'm waiting until 28.75 or so.

mmerlinn

Ground Beetle

No point in buying while crashing unless your model requires you to scale in, which may be a good idea.

Lows should come in a week or so as everyone in the markets seems to be unwinding in anticipation of all of the changes coming the first of the year. My guess is any time between Christmas and New Years will be the low with a base forming for a broad upswing next year.

Lows should come in a week or so as everyone in the markets seems to be unwinding in anticipation of all of the changes coming the first of the year. My guess is any time between Christmas and New Years will be the low with a base forming for a broad upswing next year.

No point in buying while crashing unless your model requires you to scale in, which may be a good idea.

Lows should come in a week or so as everyone in the markets seems to be unwinding in anticipation of all of the changes coming the first of the year. My guess is any time between Christmas and New Years will be the low with a base forming for a broad upswing next year.

Drops this severe usually don't give you a week or more to make a purchase. At least not for silver.

Premiums have dropped and i'm going to be doing some buying today.

DCFusor

Yellow Jacket

A wise trader once told me, one of the major skills is the ability to NOT trade when the setup isn't right. This isn't juicy yet. I'd at least wait for 26 or so.

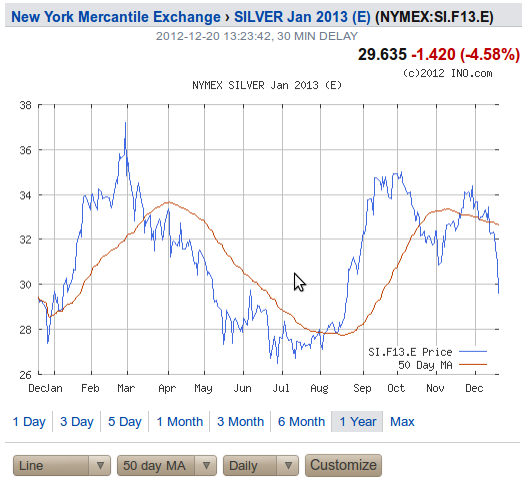

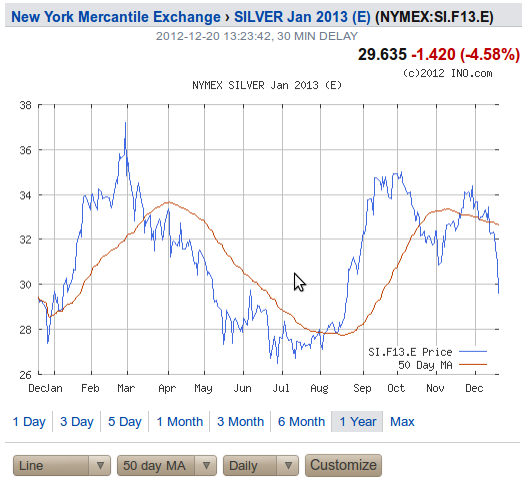

Looking at this, the last time we had this steep a drop was May, and you had June, July, and most of August to buy before the runup returned. Maybe a year isn't long enough context, but the rule I use is obvious - breaks above the 50 sma that hold for a day - buy - with trailing stop. Else, stay away. Works for gold too. You're out about half the time (and can use that money trading elsewhere), and only in for the middle of the runup. It's the highest risk-adjusted reward I can find in this metal, or gold for that matter.

Curtis Faith, master trader of "turtles" fame, told me he had no trouble publishing rules like this (his are different) - because emotionally, you won't follow them and therefore won't break his system (in general when everyone is onto something, it stops working).

Looking at this, the last time we had this steep a drop was May, and you had June, July, and most of August to buy before the runup returned. Maybe a year isn't long enough context, but the rule I use is obvious - breaks above the 50 sma that hold for a day - buy - with trailing stop. Else, stay away. Works for gold too. You're out about half the time (and can use that money trading elsewhere), and only in for the middle of the runup. It's the highest risk-adjusted reward I can find in this metal, or gold for that matter.

Curtis Faith, master trader of "turtles" fame, told me he had no trouble publishing rules like this (his are different) - because emotionally, you won't follow them and therefore won't break his system (in general when everyone is onto something, it stops working).

superhero

Predaceous Stink Bug

Drops this severe usually don't give you a week or more to make a purchase. At least not for silver.

Premiums have dropped and i'm going to be doing some buying today.

Where have the premiums dropped? From what I see, they've either stayed the same, or gone up.

Sad to see Goldmart's premium on Walking Liberties go from $0.79 to $1.09 to $1.29 to ???

DCFusor

Yellow Jacket

Suppose you were a retailer of PM's. You have to have some stock. You bought it before the drop unless you have a time machine. Are you going to reduce premiums to try and sell more now, low? Only if you're stupid and planning to self-destruct. Common sense. So you keep your premium high to not lose as much on every sale.

Would YOU sell today with low premiums over the paper price? I didn't think so.

After this kind of monkey-hammering, I fully expect a little bounce - it happened last time, the time before, and so forth. Don't get head-faked by those, follow the rule. The opportunity cost is less than the risks that it will get hammered again. Maybe not all the way to 26 (bordering on negative returns for digging it up), but...28 perhaps? Wait for a real rise that lasts a few days, you won't miss much.

Had you followed this rule, you'd have been long 3 times this year, the last time you'd not have made much money - or even lost a little depending on that all important number on your trailing stop. But you made tons the first two times...and missed all those breathtaking drops along the way, or most all of them.

Would YOU sell today with low premiums over the paper price? I didn't think so.

After this kind of monkey-hammering, I fully expect a little bounce - it happened last time, the time before, and so forth. Don't get head-faked by those, follow the rule. The opportunity cost is less than the risks that it will get hammered again. Maybe not all the way to 26 (bordering on negative returns for digging it up), but...28 perhaps? Wait for a real rise that lasts a few days, you won't miss much.

Had you followed this rule, you'd have been long 3 times this year, the last time you'd not have made much money - or even lost a little depending on that all important number on your trailing stop. But you made tons the first two times...and missed all those breathtaking drops along the way, or most all of them.

Looking at this, the last time we had this steep a drop was May, and you had June, July, and most of August to buy before the runup returned.

The selloff in the summer was not the same as the selloff we are seeing today. We are selling off and making a higher low while putting in divergences all over the place. This is just a completely different chart pattern. This is much more similar to the sharp decline we had last winter when Silver went into backwardation. Oh wait.. we just went into backwardation today.

DCFusor

Yellow Jacket

How do you know we are making a higher low? I think you have to wait, you can only know things like that in hindsight, after the low is in and the next rise has become significant to call the thing before it "the" low. Yes, this is steeper than the drop in spring (May - summer begins June 21 ) but...nothing is ever exactly the same twice - we rhyme, not loop.

) but...nothing is ever exactly the same twice - we rhyme, not loop.

Even if this were the low...we're looking at this priced in something that is also losing value, so this low might look higher, but not actually be higher re purchasing power.

Of course, it's your money - do what you think best. As will I.

Even if this were the low...we're looking at this priced in something that is also losing value, so this low might look higher, but not actually be higher re purchasing power.

Of course, it's your money - do what you think best. As will I.

bushi

Ground Beetle

- Messages

- 968

- Reaction score

- 7

- Points

- 143

:agree::clap:(...)The opportunity cost is less than the risks that it will get hammered again.

something like this was brewing for a while, it was either going straight up, or big offensive from The Brotherhood of Darkness (

Thus, IMHO, some epic hammering is to be expected, and not just your typical whams we are already getting used to - do not expect they will let it just rise peacefully. They would rather try and destroy the metals paper market, than let it out of control - which BTW, shall we listen to the likes of Alasdair McLeod, might very well happen next year, given the size of shorts vs. physical availability :loco:

Icy roads ahead. Act wisely - my $.02

Last edited:

ILOVETRADING

Fly on the Wall

- Messages

- 34

- Reaction score

- 0

- Points

- 0

We going lower today boys. ES plummeted and future flash crashed overnight (saw it happen actually), apparently the Boner's plan didn't get enough votes.

Sorry, meant Boehner. Ah, that's right. Hah.

All in my opinion GLTYA

Sorry, meant Boehner. Ah, that's right. Hah.

All in my opinion GLTYA

ILOVETRADING

Fly on the Wall

- Messages

- 34

- Reaction score

- 0

- Points

- 0

OK this is probably very naive for this site, but does anybody here BORROW money to buy PM's? I'm so itchy but its Christmas and we've got other stuff going on also...

Negative on my end.

I mean the main thing you'd want to ask is : Do I expect the percentage of Silver gains to outperform the percentage of interest for this loan- by the time this loan is paid off?

Hope that made sense.

... does anybody here BORROW money to buy PM's? ...

I do not.

bushi

Ground Beetle

- Messages

- 968

- Reaction score

- 7

- Points

- 143

Jay,OK this is probably very naive for this site, but does anybody here BORROW money to buy PM's? I'm so itchy but its Christmas and we've got other stuff going on also...

Scenario A: all is rosy, metals are going after your purchase, where we all expect them to go eventually. Cool!

Scenario B: what are you gonna do, if you borrow some money, buy some metals, only to see them smacked down the very next day/week, like we just had? :doodoo: :flail:

Like Fusor said - your money, your decisions, but personally I am too cautious to play that hard.

ancona

Praying Mantis

I am actually considering tapping my line of credit to load up some more. I am cash tight right now but credit rich. With the cost of money at a little oveer 3% right now, it is beginning to make sense for me to take a note for three to five years.

I am actually considering tapping my line of credit to load up some more. I am cash tight right now but credit rich. With the cost of money at a little oveer 3% right now, it is beginning to make sense for me to take a note for three to five years.

have never done it before, but we are credit rich and have NO debt except for a nominal mortgage. Just toying witht the idea, but it wouldn't be a long term thing anyway, just to get past the holidays...

I wouldn't do it, not because of the fear of the potential financial loss, but the fear of the wife! Hahaha

used to be same here, but this morning the wife said "Isn't physical getting harder to get now, though?" Boy that was a paradigm change for her....

Jay,

Scenario A: all is rosy, metals are going after your purchase, where we all expect them to go eventually. Cool!

Scenario B: what are you gonna do, if you borrow some money, buy some metals, only to see them smacked down the very next day/week, like we just had? :doodoo: :flail:

Like Fusor said - your money, your decisions, but personally I am too cautious to play that hard.

you call it caution, I call it greed/cupidity (mine). Thats why I don't play poker, to stingy to lose my money...

Negative on my end.

I mean the main thing you'd want to ask is : Do I expect the percentage of Silver gains to outperform the percentage of interest for this loan- by the time this loan is paid off?

Hope that made sense.

It does.

Jay.. If you are seriously considering using leverage to buy PMs, allow me to slap you in the face over the internet.

There is absolutely no 100% certain way to tell how long or deep this correction is going to be. We might think it's going to be "quick" but there are no certainties. so please walk away from the cliff.

There is absolutely no 100% certain way to tell how long or deep this correction is going to be. We might think it's going to be "quick" but there are no certainties. so please walk away from the cliff.

There are ten axioms that are often falsely attributed to Abe Lincoln. They are actually the writings of a minister, Rev. John William Henry Boetcker, and were published in 1916.

However, though they are often attributed in error, they are none the less true. They are:

"You cannot bring about prosperity by discouraging thrift.

You cannot help small men by tearing down big men.

You cannot strengthen the weak by weakening the strong.

You cannot lift the wage-earner by pulling down the wage-payer.

You cannot help the poor man by destroying the rich.

You cannot keep out of trouble by spending more than your income.

You cannot further the brotherhood of man by inciting class hatred.

You cannot establish security on borrowed money.

You cannot build character and courage by taking away men's initiative and independence.

You cannot help men permanently by doing for them what they could and should do for themselves."

However, though they are often attributed in error, they are none the less true. They are:

"You cannot bring about prosperity by discouraging thrift.

You cannot help small men by tearing down big men.

You cannot strengthen the weak by weakening the strong.

You cannot lift the wage-earner by pulling down the wage-payer.

You cannot help the poor man by destroying the rich.

You cannot keep out of trouble by spending more than your income.

You cannot further the brotherhood of man by inciting class hatred.

You cannot establish security on borrowed money.

You cannot build character and courage by taking away men's initiative and independence.

You cannot help men permanently by doing for them what they could and should do for themselves."

Jay.. If you are seriously considering using leverage to buy PMs, allow me to slap you in the face over the internet.

There is absolutely no 100% certain way to tell how long or deep this correction is going to be. We might think it's going to be "quick" but there are no certainties. so please walk away from the cliff.

DSA, thanks for that (really). No I'm not going to borrow any money to buy silver (although I sure WANT to). Have never done it, don't guess I'll start now. Instead, Bing and I went to the library thrift store, where I bought a whole shelf full of classics (Mark Twain, Jack London, Steinbeck, etc.) for 37 dollars to add to the library. Now if I could only interest the kids into reading them... however, I really appreciate ALL the comments on this site, I'm getting quite the education! Bings comment; now they'll have something to do when they no longer have HALO. (they ARE avid readers...)

mmerlinn

Ground Beetle

If I can't pay cash, I don't need it.

If you borrow, and silver goes to $10, you still have to pay today's price plus interest for something that you could not afford when you bought it, but probably can afford at $10, but still can't afford because you are still paying yesterday's prices.

Sure, the reverse would be true if it goes up, but how do you know whether your crystal ball is broken or not?

If you borrow, and silver goes to $10, you still have to pay today's price plus interest for something that you could not afford when you bought it, but probably can afford at $10, but still can't afford because you are still paying yesterday's prices.

Sure, the reverse would be true if it goes up, but how do you know whether your crystal ball is broken or not?

As silver bumps along in $29-32 per ounce range, I hope everyone is buying the sub $30 price drops. I am enjoying them!

I'm finally in a position where I can again

drAGonfly47

Predaceous Stink Bug

- Messages

- 107

- Reaction score

- 0

- Points

- 0

OK this is probably very naive for this site, but does anybody here BORROW money to buy PM's? I'm so itchy but its Christmas and we've got other stuff going on also...

I did in 2008.

Played the 0% transfer game, and won.

I could have easily just paid minimums, waited, sold half, and kept the rest for free. But no, I just could not part with the shiny. I could not do that now as I have closed all credit accounts.

I would be cautious. As much as it may seem silver should rise. The govt, da FED, and wall st. corporations are defining their above the law power.

Do not over extend oneself. Even though it feels so good.. because you get to hold PM's in your hand and laugh at the credit bill.

If you can, buy metal, pay 4 months, default, wait for letters, do NOT reply, wait, wait, wait, and accept the 10% of total final payment. This is if you do not need credit in future 7 years +- or give a damn. Only viable if making credit purchase of more than $10,000. Go online and investigate what many have done.

Wait for the credit company to take you to court and make them pay you back the money they loaned you. As they used your credit(name, SS#, birth certificate) to create and loan digitally. Credit companies incriminate themselves with their own paper recorded process. The money does not exist without your name. So cc company, where did the money come from? ahh mmm well hhmmmm, ... guilty. Procurement is the question.

This does take time, and time is silver.

drAGonfly47

Predaceous Stink Bug

- Messages

- 107

- Reaction score

- 0

- Points

- 0

There are ten axioms that are often falsely attributed to Abe Lincoln. They are actually the writings of a minister, Rev. John William Henry Boetcker, and were published in 1916.

However, though they are often attributed in error, they are none the less true. They are:

"You cannot bring about prosperity by discouraging thrift.

You cannot help small men by tearing down big men.

You cannot strengthen the weak by weakening the strong.

You cannot lift the wage-earner by pulling down the wage-payer.

You cannot help the poor man by destroying the rich.

You cannot keep out of trouble by spending more than your income.

You cannot further the brotherhood of man by inciting class hatred.

You cannot establish security on borrowed money.

You cannot build character and courage by taking away men's initiative and independence.

You cannot help men permanently by doing for them what they could and should do for themselves."

One can establish security with borrowed FIAT CURRENCY, by purchasing MONEY.

Abe knew, so they killed him.

bushi

Ground Beetle

- Messages

- 968

- Reaction score

- 7

- Points

- 143

One can establish security with borrowed FIAT CURRENCY, by purchasing MONEY.

Abe knew, so they killed him.

Well, for some ppl, there is that little moral issue: is it just thing to do, to steal from the thief?

I do not think so, personally.

Sent from my Nexus 7 using Tapatalk HD

drAGonfly47

Predaceous Stink Bug

- Messages

- 107

- Reaction score

- 0

- Points

- 0

Surprised I am. No person here willing to take a risk. A risk which all must take with every piece of paper currency they earn. A risk which the vast majority of Wall St., US Govt., & Corporatocracy operate within.

What fear drives this dissent. Could this meme fear be taught by above mentioned risk takers. These risk takers drape the wool over eyes of those who follow their double standards. Gleefully imbedding "Do as I say, not as I do". Why else would we all be paying for their errors.

Capitalism is dead in the US. How did the old rich become so? They broke the "rules". Taking risk is not breaking a rule. However, meme challenges a singulars inner voice, "take the risk". Only maintaining a position of security imposes risk. Belief is the spine of such. "It is safe over there". Just who, told you so?

What fear drives this dissent. Could this meme fear be taught by above mentioned risk takers. These risk takers drape the wool over eyes of those who follow their double standards. Gleefully imbedding "Do as I say, not as I do". Why else would we all be paying for their errors.

Capitalism is dead in the US. How did the old rich become so? They broke the "rules". Taking risk is not breaking a rule. However, meme challenges a singulars inner voice, "take the risk". Only maintaining a position of security imposes risk. Belief is the spine of such. "It is safe over there". Just who, told you so?

drAGonfly47

Predaceous Stink Bug

- Messages

- 107

- Reaction score

- 0

- Points

- 0

Well, for some ppl, there is that little moral issue: is it just thing to do, to steal from the thief?

I do not think so, personally.

Sent from my Nexus 7 using Tapatalk HD

Justification of servitude with morals, is littler than you imagine.

How does one steal, when retrieving what was stolen.

Watch the "Matrix" again, consider the parameters which we are taught, and duly limited unto.

bushi

Ground Beetle

- Messages

- 968

- Reaction score

- 7

- Points

- 143

The fact remains, you were able to spend <whatever-you-want-to-call-them-units-of-accounting>, that you have not honestly earned yourself, and then you have broken the promise to repay them. Worse still, you did it on purpose, from the very start, from what I can read? That's your part in it, if I understand you correctly? You have broken the contract, that you entered into willingly, and you did it on purpose? Well, maybe it is possible legally, but I certainly don't think, that it is just.

Somebody, somewhere, is picking the tab for your actions (credit created, no goods produced in exchange = inflation). Tiny impact in the grand scheme of things, I agree. So, another "victimless crime"? So, it is OK, if we do immoral things, because there are other, much more criminal people somewhere around, do I understand you correctly? And rejecting their criminal ways, and not following quite the same path, is now "servitude", right?

We have a proverb in Poland, called "Kali's morality". Roughly translating, in the words of Kali himself: "if Kali gets his cow stolen, that is Bad deed. If Kali steals a cow from another, that is a good thing". Sorry I cannot express the subtleties of mocked "tribal-man slang" in English, as it is not my mother's tongue.

EOT, as I am concerned, everybody has his own conscience and will be making his own decisions, and rationalize them as he wants/needs.

Somebody, somewhere, is picking the tab for your actions (credit created, no goods produced in exchange = inflation). Tiny impact in the grand scheme of things, I agree. So, another "victimless crime"? So, it is OK, if we do immoral things, because there are other, much more criminal people somewhere around, do I understand you correctly? And rejecting their criminal ways, and not following quite the same path, is now "servitude", right?

We have a proverb in Poland, called "Kali's morality". Roughly translating, in the words of Kali himself: "if Kali gets his cow stolen, that is Bad deed. If Kali steals a cow from another, that is a good thing". Sorry I cannot express the subtleties of mocked "tribal-man slang" in English, as it is not my mother's tongue.

EOT, as I am concerned, everybody has his own conscience and will be making his own decisions, and rationalize them as he wants/needs.

Last edited:

drAGonfly47

Predaceous Stink Bug

- Messages

- 107

- Reaction score

- 0

- Points

- 0

The fact remains, you were able to spend <whatever-you-want-to-call-them-units-of-accounting>, that you have not honestly earned yourself, and then you have broken the promise to repay them. Worse still, you did it on purpose, from the very start, from what I can read? That's your part in it, if I understand you correctly? You have broken the contract, that you entered into willingly, and you did it on purpose? Well, maybe it is possible legally, but I certainly don't think, that it is just.

Somebody, somewhere, is picking the tab for your actions (credit created, no goods produced in exchange = inflation). Tiny impact in the grand scheme of things, I agree. So, another "victimless crime"? So, it is OK, if we do immoral things, because there are other, much more criminal people somewhere around, do I understand you correctly? And rejecting their criminal ways, and not following quite the same path, is now "servitude", right?

We have a proverb in Poland, called "Kali's morality". Roughly translating, in the words of Kali himself: "if Kali gets his cow stolen, that is Bad deed. If Kali steals a cow from another, that is a good thing". Sorry I cannot express the subtleties of mocked "tribal-man slang" in English, as it is not my mother's tongue.

EOT, as I am concerned, everybody has his own conscience and will be making his own decisions, and rationalize them as he wants/needs.

I did not state, I have broken any contracts. In fact, my personal credit purchasing was funded with 0% transfers, after a 0% initial purchase. However, I did state one may go online and research how others have utilized credit "free" PM purchases. As well as how one may challenge the contract legally, as it is laden with loopholes for the wealthy. The one who can afford cost of legal process.

The inflationary cost, devaluing, is imposed upon all regardless of the contracts outcome. As debt is the only way to create currency today. The more currency created, the less value each and every piece maintains. I personally am amused by those who attempt to maintain moral standards during war, including myself. War is being committed upon the masses by $TPTB$. One must strongly stand ones ground, or lose. Assuming to lead, by exemplifying high moral standards, leads one unto slaughter. I by no means direct this personally. Viewing history, guaranteed the slaughter is, financial, social, population, moral, etc.

Thus informing others of how to perform for their own benefit. From a position which they have been forced into or succumbed unto. Allowing them to arm themselves with the weapons being used against them. Additionally wounding the opposing forces, and lessening the control of applied viral disease, fiat currency.

Reread what I have written please, and see the separation of what I have done; and information given.