swissaustrian

Yellow Jacket

- Messages

- 2,049

- Reaction score

- 0

- Points

- 0

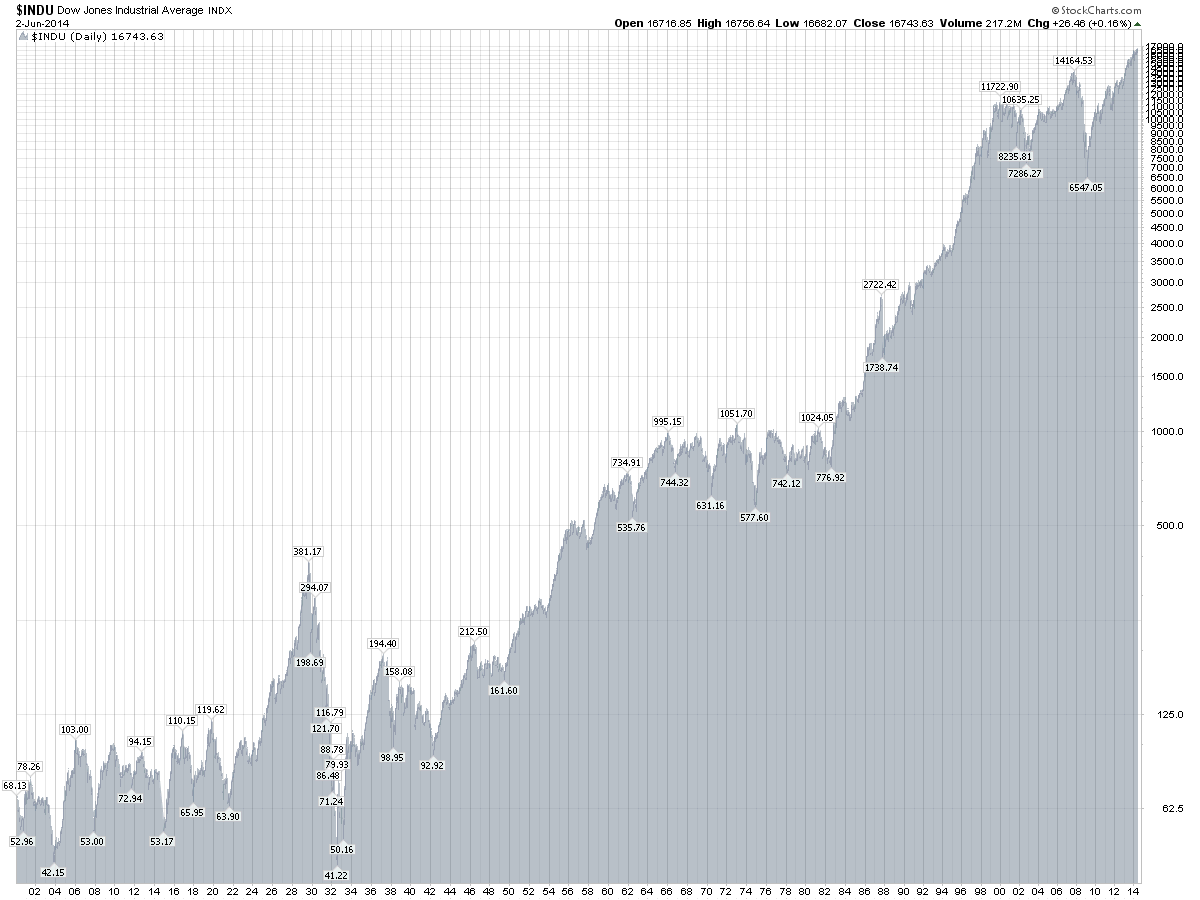

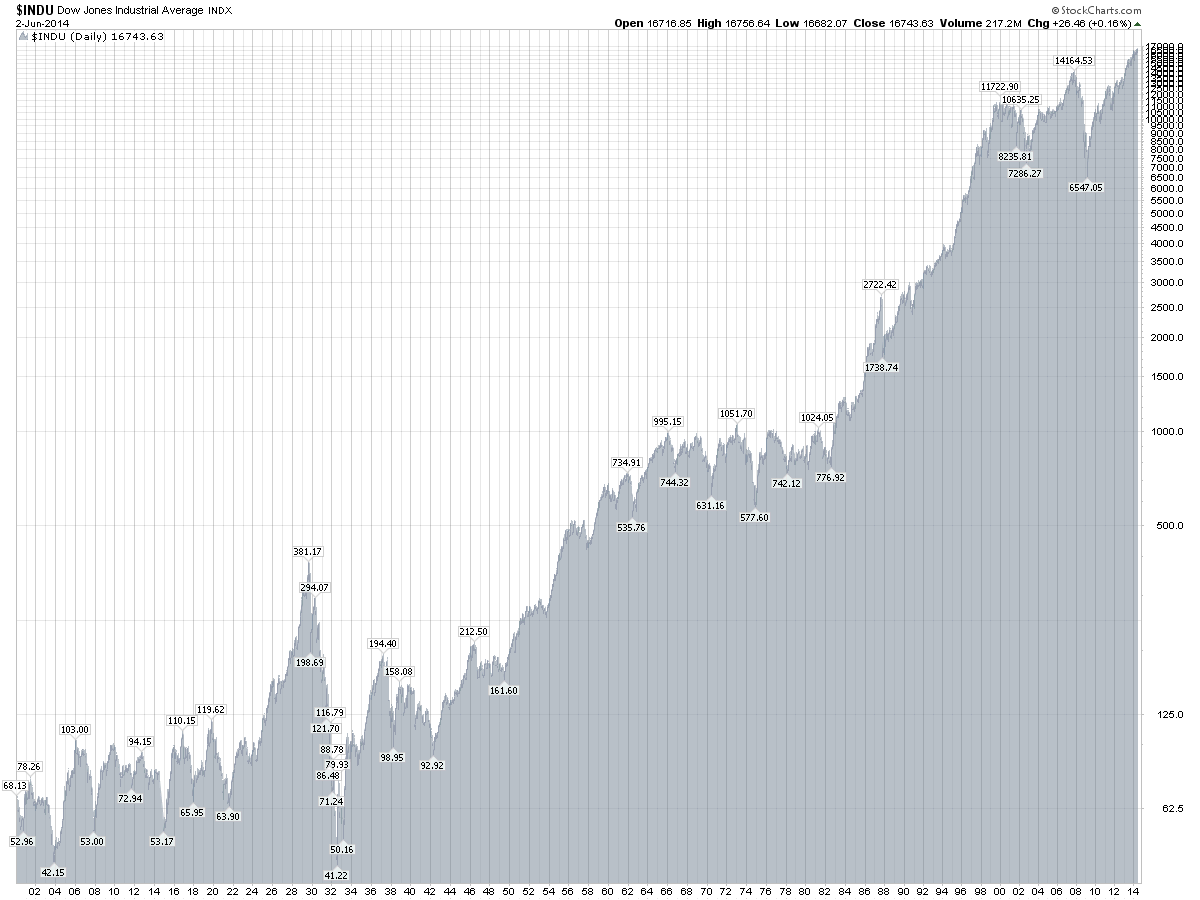

The Dow and S&P500 closed at all-time highs of 14,164 and 1,565 in October 2007.

Dow is at 14080 and S&P500 at 1508.

Now we have to keep in mind that the indices had different components in 2007 (Lehman, GM, Bear, AIG), so it's not a fair comparison, but watch out for pundits pumping the all time highs. For me, this means shorting is gonna be a good bet soon.

Stock markets have been in a huge trading band since 2000 and if history is any guide (e.g. 1964-1982), then we're gonna see another downturn before the stock market gets another sustainable rally like 1982-1999.

Let's say the DOW were to be cut in half to 7000 from here, wouldn't that make a good DOW/gold ratio of 1:1 withing say 2-3 years?

Dow is at 14080 and S&P500 at 1508.

Now we have to keep in mind that the indices had different components in 2007 (Lehman, GM, Bear, AIG), so it's not a fair comparison, but watch out for pundits pumping the all time highs. For me, this means shorting is gonna be a good bet soon.

Stock markets have been in a huge trading band since 2000 and if history is any guide (e.g. 1964-1982), then we're gonna see another downturn before the stock market gets another sustainable rally like 1982-1999.

Let's say the DOW were to be cut in half to 7000 from here, wouldn't that make a good DOW/gold ratio of 1:1 withing say 2-3 years?

Last edited:

Let's all party like it's 1999:

Let's all party like it's 1999: