http://www.sovereignman.com/importa...gold-storage-company-dumps-us-citizens-10958/

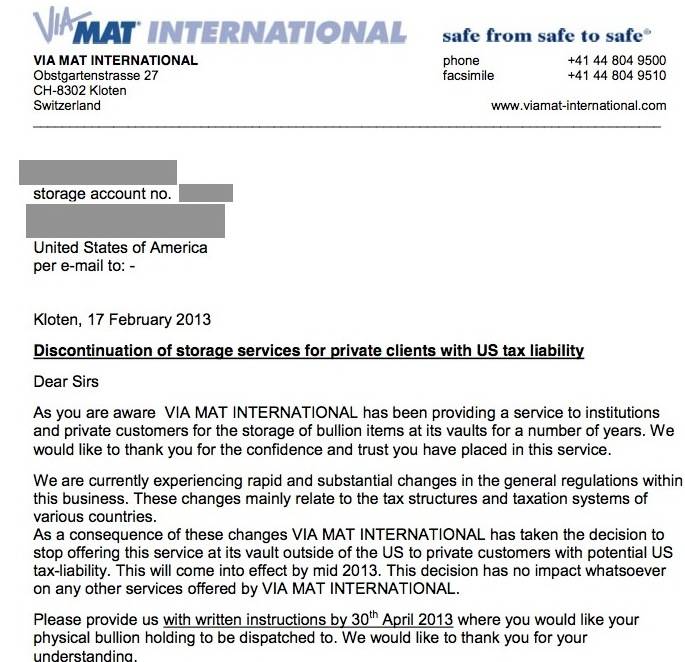

“We are currently experiencing rapid and substantial changes in the general regulations within this business. The changes mainly relate to the tax structures and taxation systems of various countries. As a consequence of these changes VIA MAT INTERNATIONAL has taken the decision to stop offering this service at its vault [sic] outside of the US to private customers with potential US-tax liability.”

“We are currently experiencing rapid and substantial changes in the general regulations within this business. The changes mainly relate to the tax structures and taxation systems of various countries. As a consequence of these changes VIA MAT INTERNATIONAL has taken the decision to stop offering this service at its vault [sic] outside of the US to private customers with potential US-tax liability.”