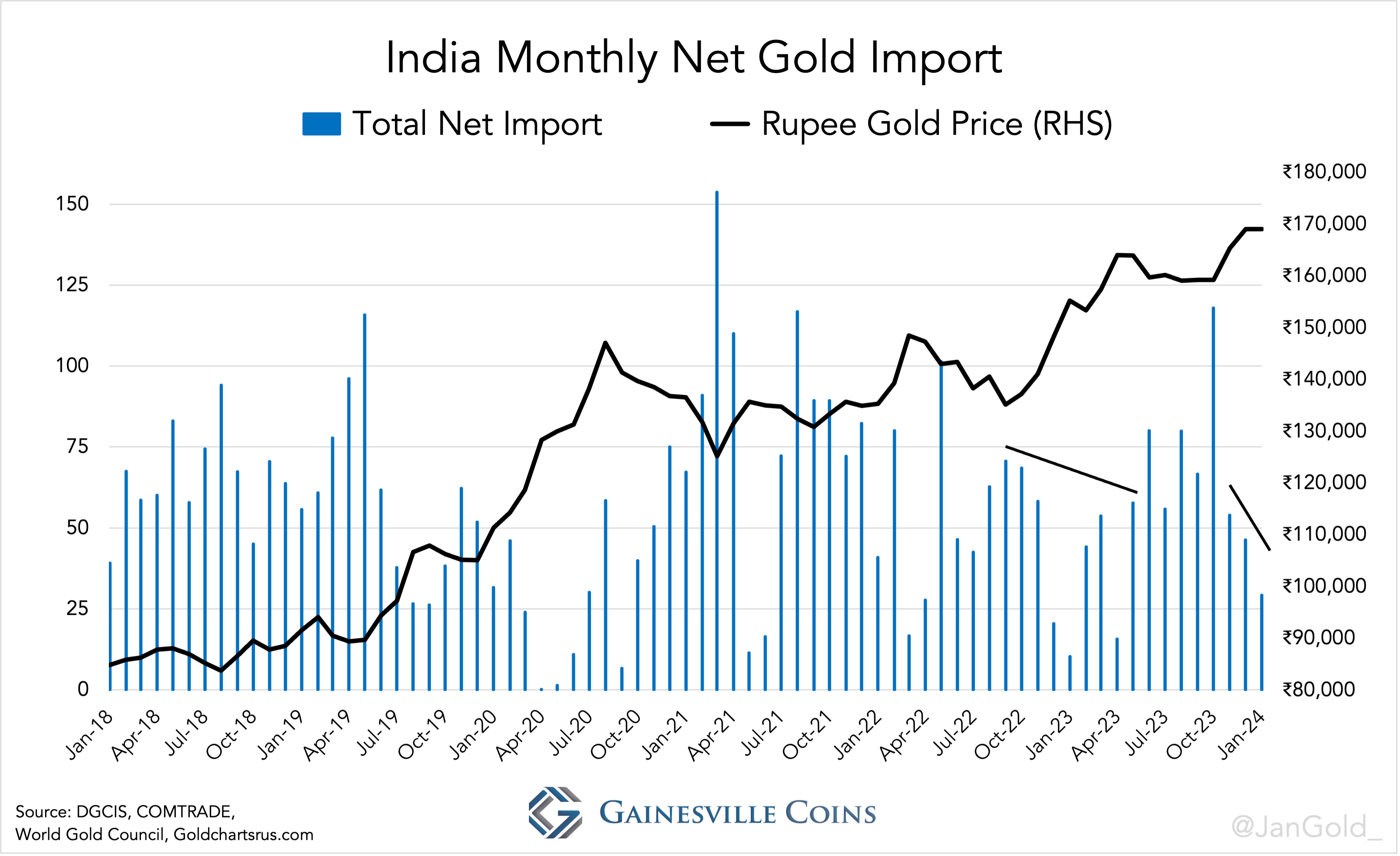

Looks like gold demand in India is charging full speed ahead:

More: http://www.goldmoney.com/gold-research/roman-baudzus/gold-price-hits-new-record-high-in-india.html

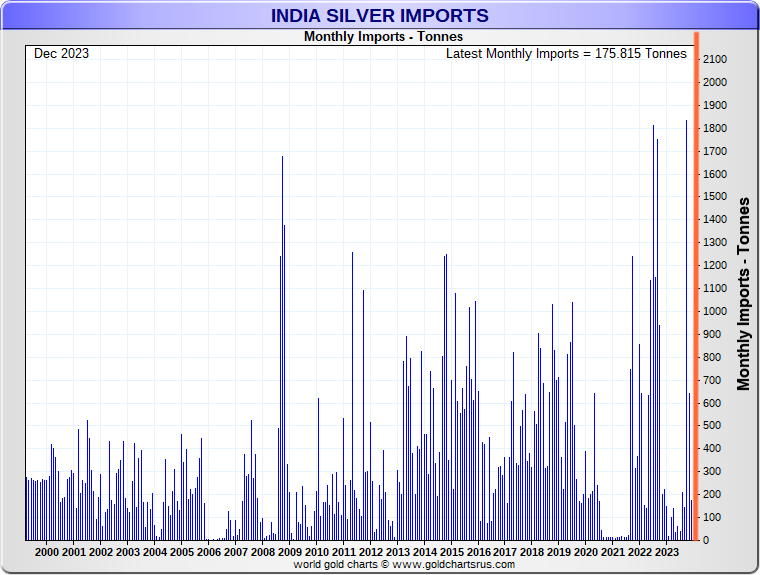

Yesterday the Indian gold price rose 30 rupees to hit a new record high of 29,296 rupees per 10 grams. But rising prices are not scaring investors away - Indians keep transferring their funds to precious metals. The silver price also benefited from this trend, rising 150 rupees to consolidate at 58.000 rupees per kilo.

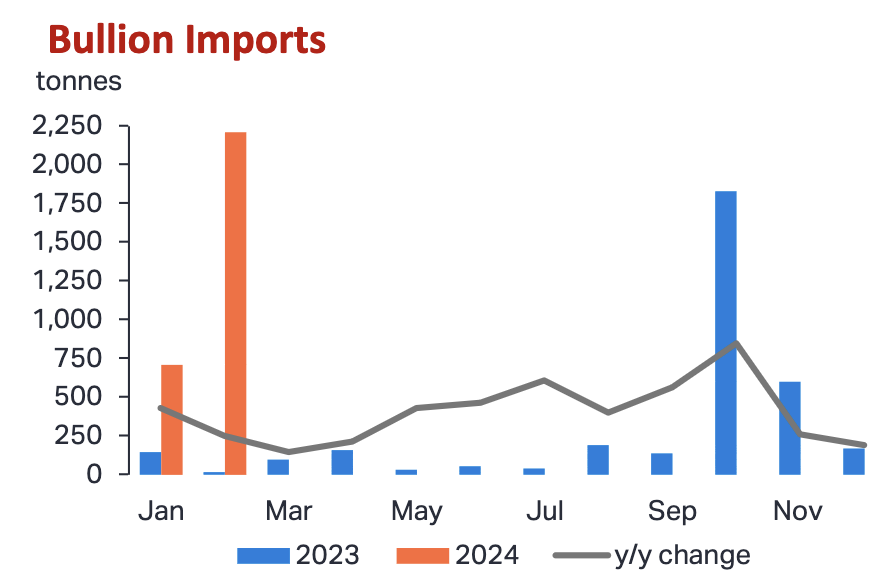

During the five days of Diwali, the Indian festival of light, gold and silver price registered record sales. But buying interest has not declined. Now that the wedding season has started, Indian gold dealers and jewellers continue to sell large quantities of precious metals. Furthermore, in recent weeks Indian investors have been withdrawing large sums of capital from bond and investment funds, since they expect that in coming weeks stock markets will continue to be under sales pressure. Large amounts of this capital is obviously flowing into the gold and silver markets. ...

...

More: http://www.goldmoney.com/gold-research/roman-baudzus/gold-price-hits-new-record-high-in-india.html

in this article (bolded parts - emphasis mine):

in this article (bolded parts - emphasis mine):