Unobtanium

Big Eyed Bug

- Messages

- 461

- Reaction score

- 19

- Points

- 143

Its not really a disaster for the gold community is it ?

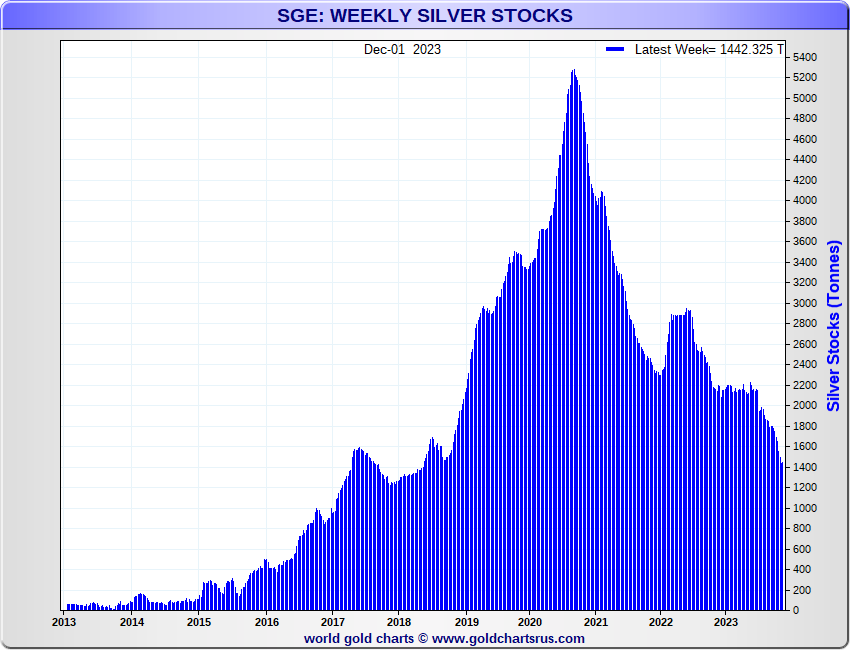

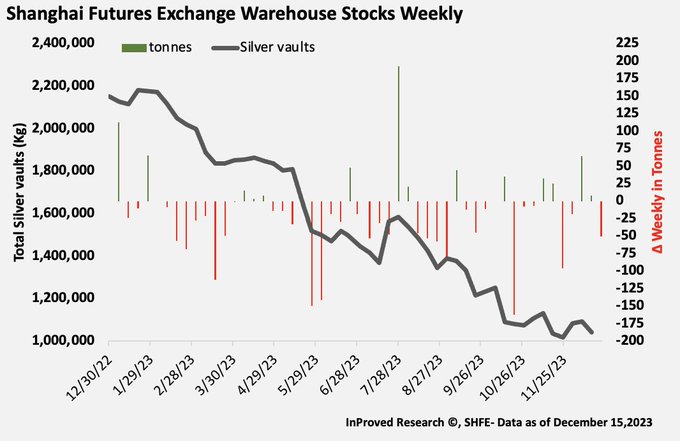

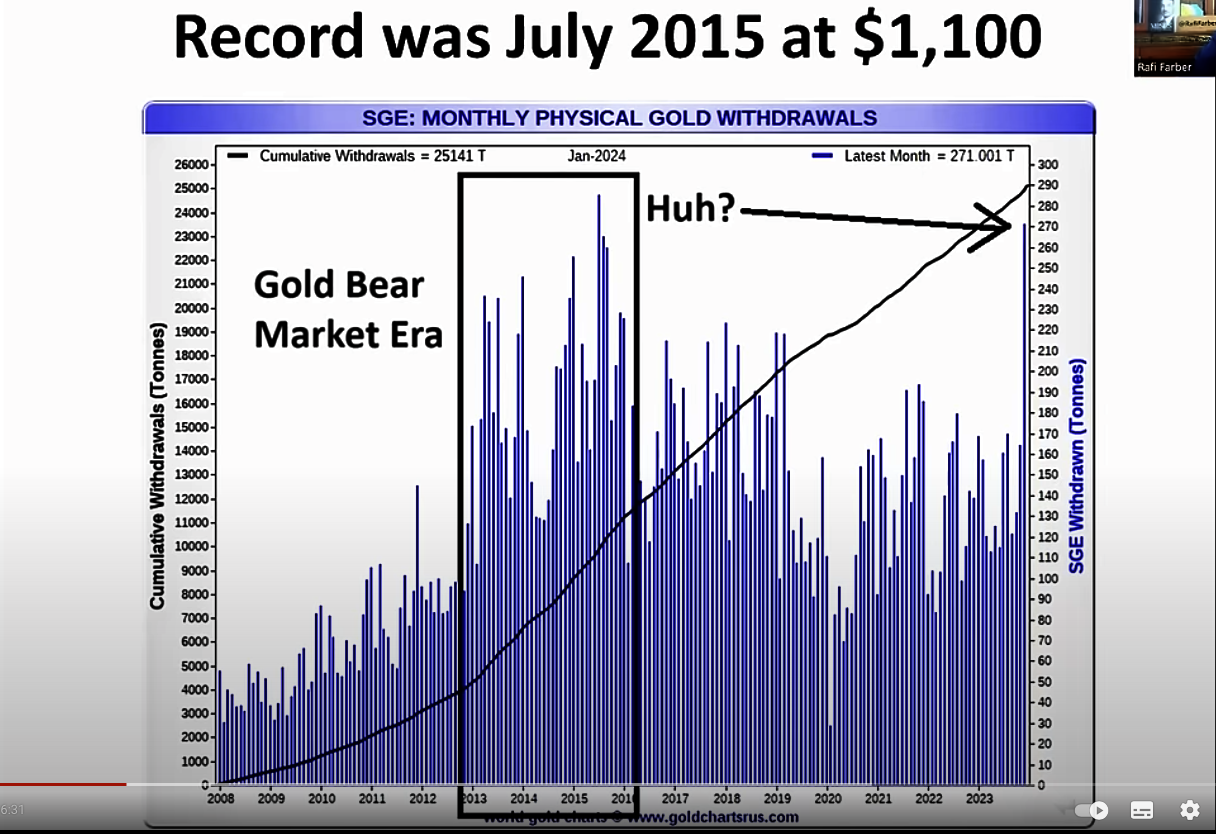

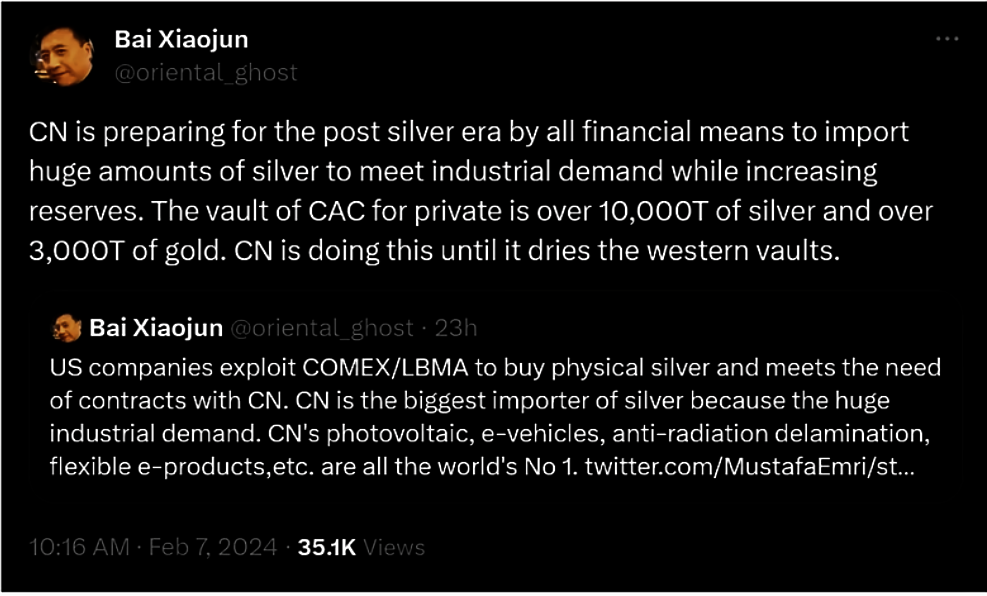

China feels the need to hide its gold strategy and a few watchful commentators / analysts loose access to a useful piece of data.

Availability of real gold and demand for delivery is not easy to identify though and probably never will be, even after paper suppression blows up.

Whether or not it is a real disaster or not to the gold community, I do not know. However I find it intriguing that each time some aspect of the world financial community starts to unravel, TPTB either discontinue information, change the rules, or cook up new definitions.

The fact that the Shanghai gold withdrawal data is being discontinued is enough evidence for me that something else is coming unraveled that they do not want seen.