vox

Predaceous Stink Bug

- Messages

- 124

- Reaction score

- 0

- Points

- 0

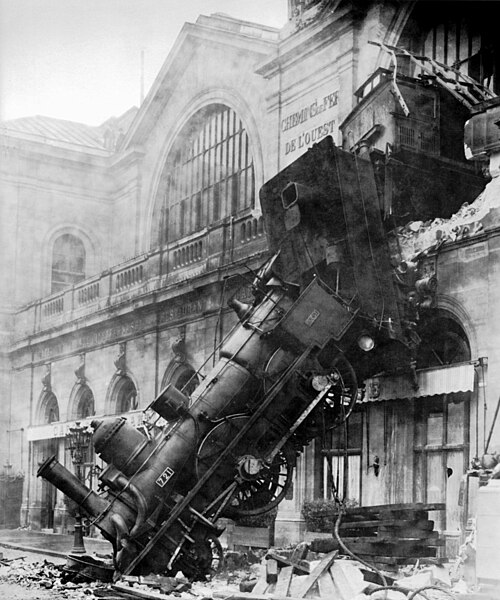

Offered without comment...

http://www.cnbc.com/id/45219555

Full text follows:

========================================================

Published: Wednesday, 9 Nov 2011 | 4:26 AM ET

By: Shai Ahmed

CNBC Associate Editor

The world is definitely going to face another financial crisis stemming from problems in Europe, Jim Rogers said Wednesday.

"We're certainly going to have more crises coming out of Europe and America; the world is in trouble. The world has been spending staggering amounts of money that it doesn't have for a few decades now, and it's all coming home to roost," Rogers, CEO and chairman Rogers Holdings told CNBC.

He added that the crisis would be much worse than the one markets saw in 2008 because the debt is much higher now.

"Last time, America quadrupled its debt. The system is much more extended now, and America cannot quadruple its debt again. Greece cannot double its debt again. The next time around is going to be much worse," Rogers said.

"In 2002 it was bad, in 2008 it was worse and 2012 or 2013 is going to be worse still – be careful," he added.

Rogers said he was long the euro despite the euro zone facing deep crises, but said all paper money was now under duress.

"I own several paper currencies. My theory is that if things get better I will make money in commodities, and if they don't get better I'll make money in commodities because they'll print more money and stocks will be going down a lot," he said.

"I own the euro because everyone is beating it down so badly and the US dollar too," he added.

He said all the main currencies were in terrible shape but he still expected to make money from them.

Rogers told CNBC the only solution to the crisis was to let everyone go bankrupt.

"Get everyone in a room and decide you will go bankrupt. You will survive and we're going to ringfence you. We'll make sure your checks clear. Everyone's deposits are going to be ok, the system's going to survive.

"But we are going to have a lot of pain that way the system would survive because some countries including Germany have credibility," Rogers said.

He said if Greece left the euro it would be a disaster for the Greeks because they would go back to the "same old ways".

"They would start printing money. No one would lend them money. Inflation would go through the roof and the Greek economy would get worse and worse. That's not good for Greece. It's not good for the world," he said.

"It would be better off if we can hold the euro together and we reorganize. People are bankrupt and when people are bankrupt you might as well face reality. Reorganize the assets, competent people (will) come in and you start over from a sound base," Rogers said.

http://www.cnbc.com/id/45219555

Full text follows:

========================================================

Published: Wednesday, 9 Nov 2011 | 4:26 AM ET

By: Shai Ahmed

CNBC Associate Editor

The world is definitely going to face another financial crisis stemming from problems in Europe, Jim Rogers said Wednesday.

"We're certainly going to have more crises coming out of Europe and America; the world is in trouble. The world has been spending staggering amounts of money that it doesn't have for a few decades now, and it's all coming home to roost," Rogers, CEO and chairman Rogers Holdings told CNBC.

He added that the crisis would be much worse than the one markets saw in 2008 because the debt is much higher now.

"Last time, America quadrupled its debt. The system is much more extended now, and America cannot quadruple its debt again. Greece cannot double its debt again. The next time around is going to be much worse," Rogers said.

"In 2002 it was bad, in 2008 it was worse and 2012 or 2013 is going to be worse still – be careful," he added.

Rogers said he was long the euro despite the euro zone facing deep crises, but said all paper money was now under duress.

"I own several paper currencies. My theory is that if things get better I will make money in commodities, and if they don't get better I'll make money in commodities because they'll print more money and stocks will be going down a lot," he said.

"I own the euro because everyone is beating it down so badly and the US dollar too," he added.

He said all the main currencies were in terrible shape but he still expected to make money from them.

Rogers told CNBC the only solution to the crisis was to let everyone go bankrupt.

"Get everyone in a room and decide you will go bankrupt. You will survive and we're going to ringfence you. We'll make sure your checks clear. Everyone's deposits are going to be ok, the system's going to survive.

"But we are going to have a lot of pain that way the system would survive because some countries including Germany have credibility," Rogers said.

He said if Greece left the euro it would be a disaster for the Greeks because they would go back to the "same old ways".

"They would start printing money. No one would lend them money. Inflation would go through the roof and the Greek economy would get worse and worse. That's not good for Greece. It's not good for the world," he said.

"It would be better off if we can hold the euro together and we reorganize. People are bankrupt and when people are bankrupt you might as well face reality. Reorganize the assets, competent people (will) come in and you start over from a sound base," Rogers said.