Nomi Prins said:...

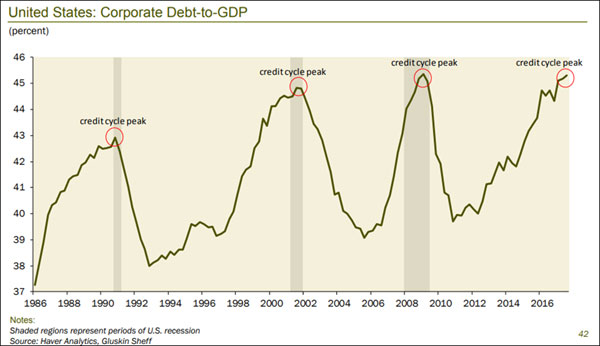

In its recent quarterly report, the BIS warned that low rates have catalyzed an increase in the number of “zombie” firms. The number of such firms has now risen to an all-time high.

Zombie firms are companies “that are at least 10 years old, yet are unable to cover their debt service costs from profits.” Their prospects for future growth aren’t so hot either.

According to the BIS, these zombies are still piling on debt and sucking money out of the real economy. Zombies “took on more debt and disposed of fewer assets after 2000.” This behavior accelerated after the financial crisis because of low interest rates.

The problem is that once a company becomes a “zombie” it tends to stay a zombie. That phenomenon is only getting worse. The BIS disclosed that “whereas in the late 1980s zombie firms had a 60% chance of staying in that condition the following year, the probability reached 85% in 2016.”

Zombies created from an influx of central bank money aren’t good long-term investments. It’s one thing for a company to take on debt to grow, but it is another to take on debt simply to re-pay other debt.

When the debt bomb finally detonates, it’s the rest of us who will suffer. Because of the collusion that’s gone on and continues to go on among the world’s main central banks, that problem is now an international one.

...

https://dailyreckoning.com/worlds-most-important-bank-issues-urgent-zombie-alert/