Summary

...

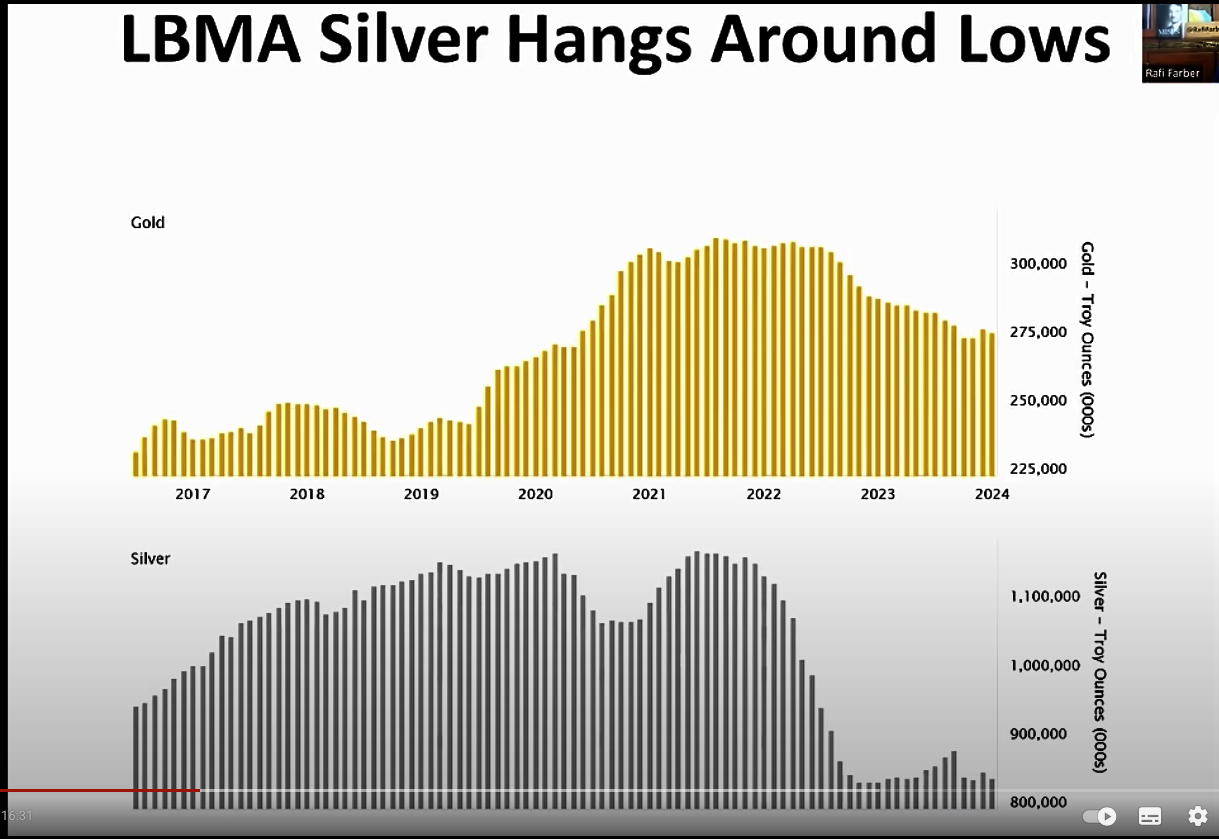

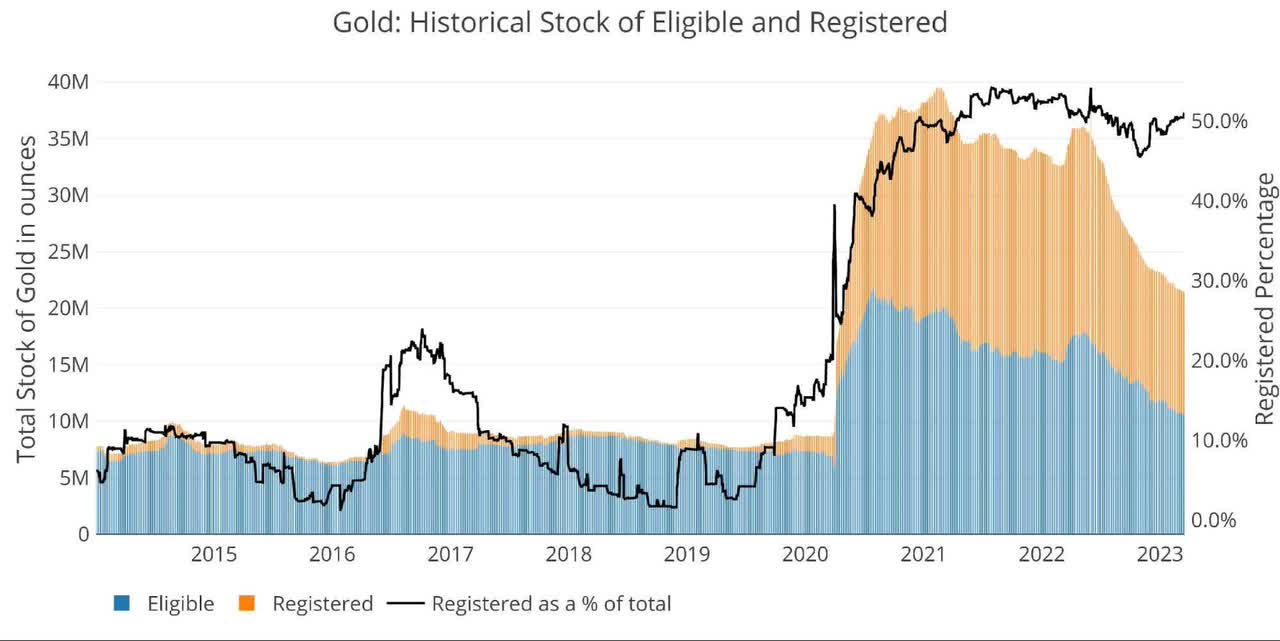

- Gold is now in its 11th straight month of net outflows, seeing 285k ounces leave the vault so far in March.

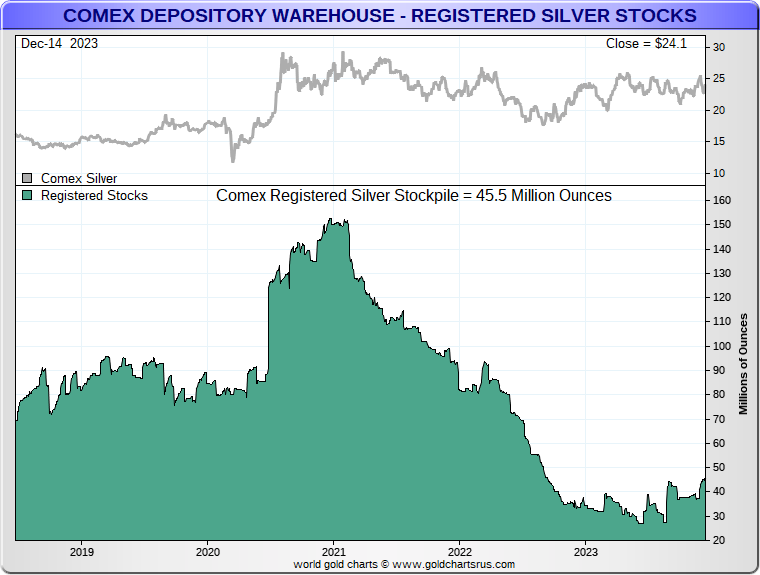

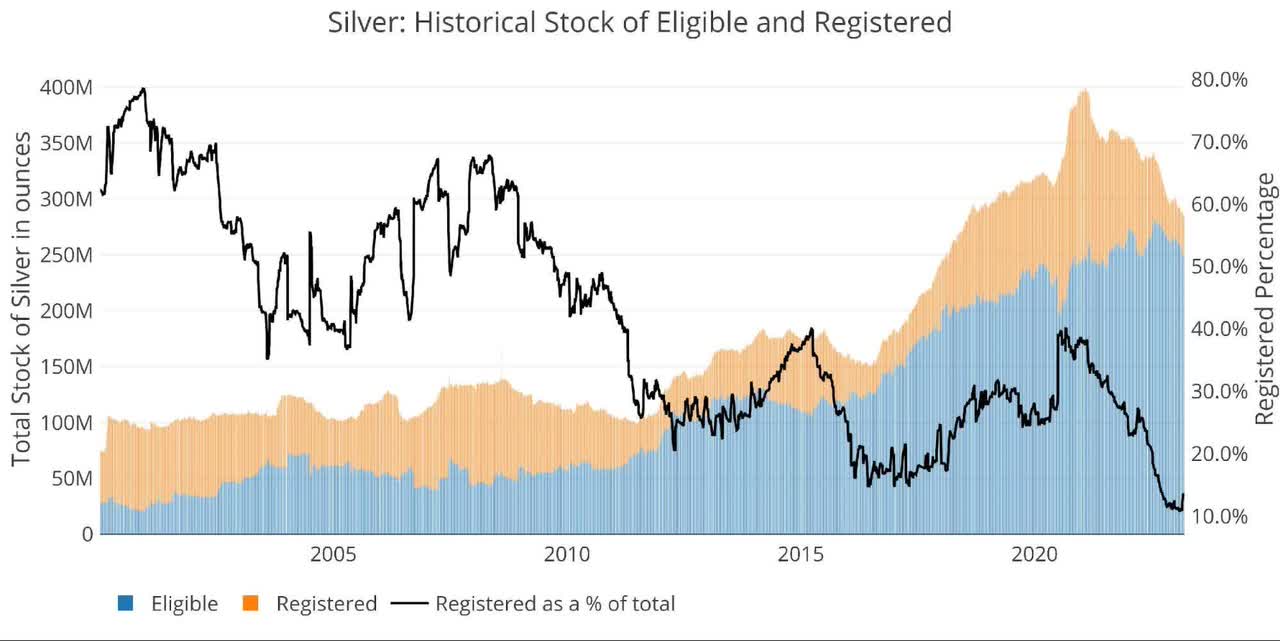

- Silver has seen far more concentrated outflows from Registered, getting as low as 10.9% of total inventory in February.

- On Jan 26, before the recent sell-off in gold, the amount of paper gold for each Registered physical ounce was 4.6.

...

more:

The Comex Is In Far Worse Shape Than SVB If The Run On Physical Accelerates

Gold is now in its 11th straight month of net outflows, seeing 285k ounces leave the vault so far in March.