Global Silver Demand Rising to a New High in 2022

Posted on 11 18, 2022

Silver Jewelry and Physical Investment both forecast to surge by 50 Moz to record highs this year

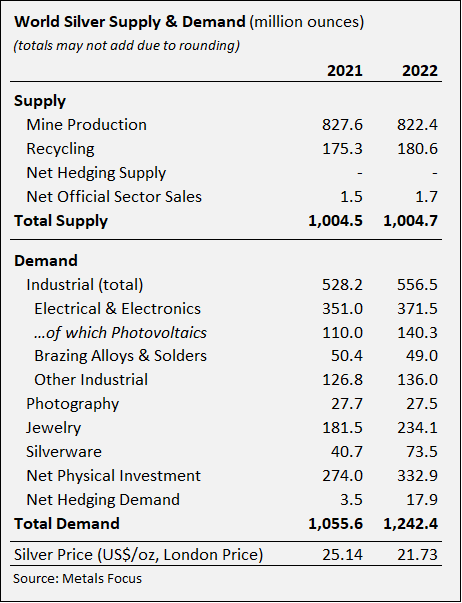

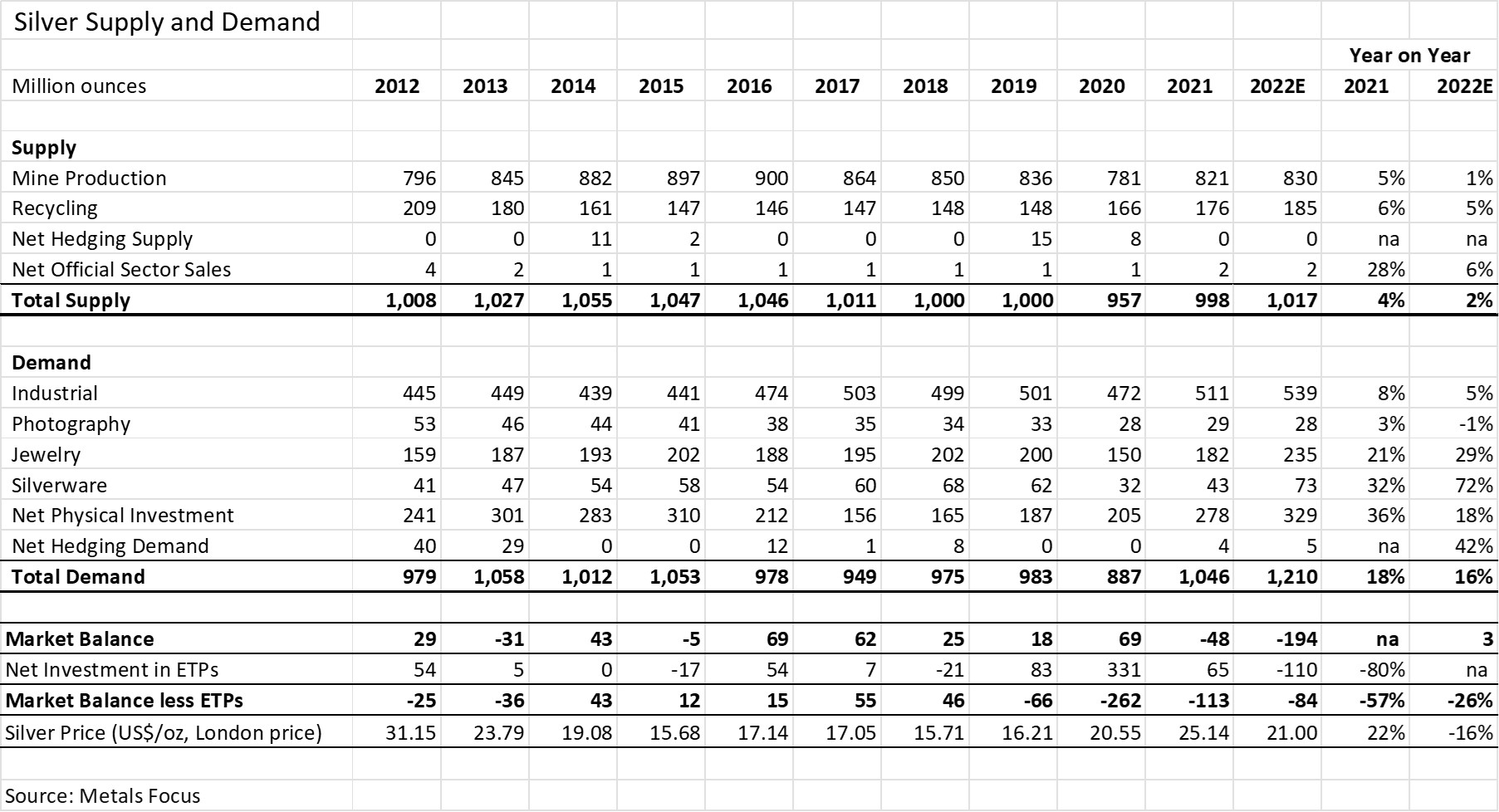

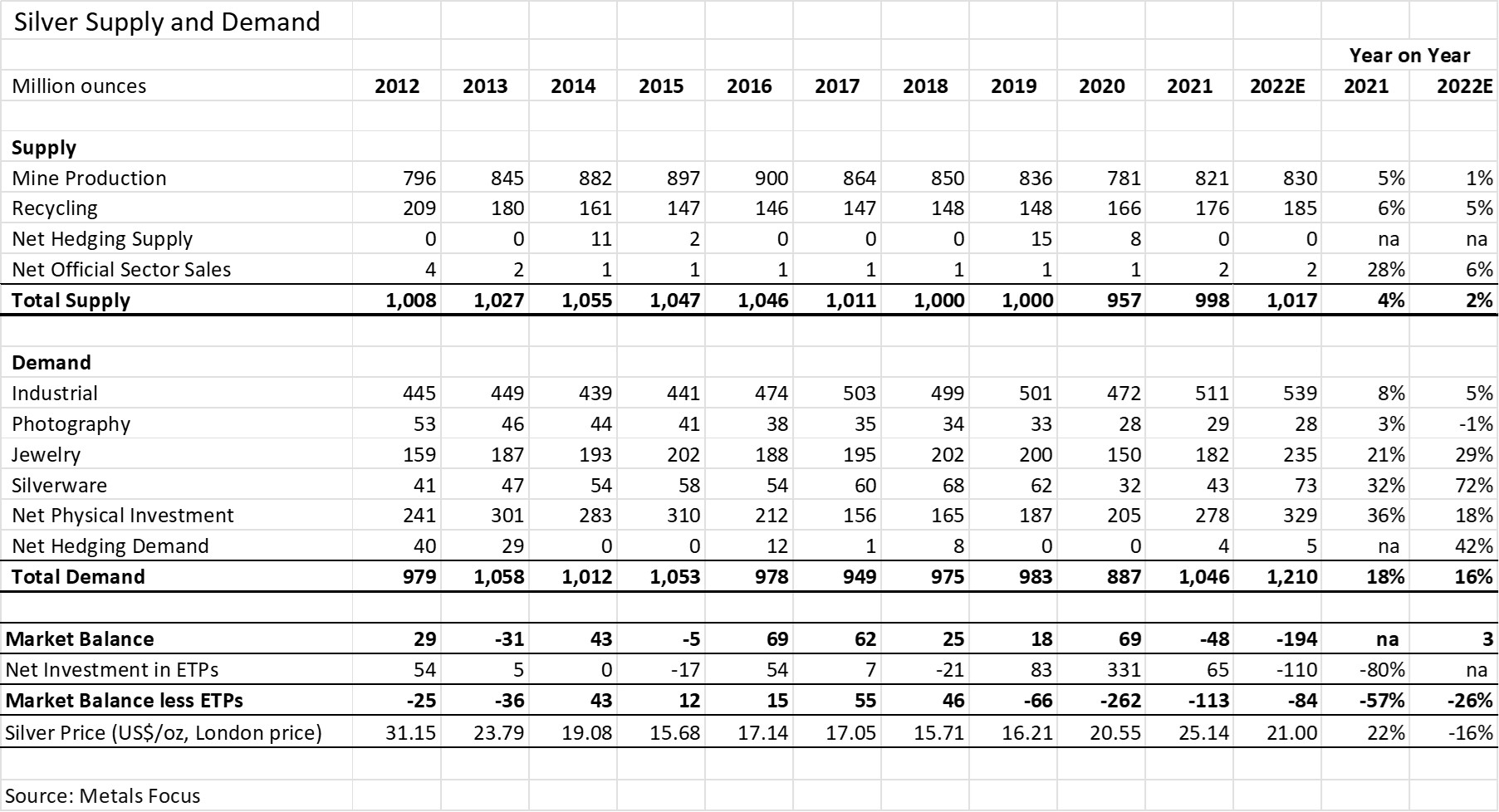

(November 17, 2022) – Silver demand is forecast to reach a record total in 2022, driven by new highs for industrial demand, jewelry and silverware offtake and physical investment. These were some of the key findings reported by Philip Newman, Managing Director at Metals Focus, and Adam Webb, Director of Mine Supply, during the Silver Institute’s Interim Silver Market Review in New York today, which featured historical supply and demand statistics and estimates for 2022. The following are the key highlights from the presentation:

- Global silver demand is expected to reach a new high of 1.21 billion ounces in 2022, up by 16% from 2021. Each key segment of demand, except photography, is set to post a new peak.

- Industrial demand is on course to grow to 539 million ounces (Moz). Developments such as ongoing vehicle electrification (despite sluggish vehicle sales), growing adoption of 5G technologies and government commitments to green infrastructure will have industrial demand overcome macro-economic headwinds and weaker consumer electronics demand.

- Physical investment in 2022 is on track to jump by 18% to 329 Moz, which would also be a new record. Support has come from investor fears of high inflation, the Russia-Ukraine war, recessionary concerns, mistrust in government, and buying on price dips. The rise was boosted further by a (near-doubling) of Indian demand, a recovery from a slump last year, with investors often taking advantage of lower rupee prices.

- Exchange-traded products, in contrast, are forecast to see the largest annual decline in holdings totaling 110 Moz, due in part to silver’s higher volatility than gold, which has made it more vulnerable to profit-taking. Institutional investors are expected to retain a bearish stance as real yields are likely to strengthen, encouraging further distance from the white metal.

- This year, Metals Focus expects the average silver price to ease by 16% year-on-year, to $21.00. Through to November 7, prices have fallen by 14% year-on-year. Metals Focus expects the U.S. Fed to continue lifting interest rates, raising the opportunity cost for precious metals and this, combined with rising yields and ongoing dollar strength, will continue to exert pressure on silver prices. Additional stress will also come from silver’s industrial nature, as growing fears over a possible recession will weigh on sentiment, despite its extremely favorable fundamental backdrop.

- In 2022, mined silver production is expected to rise by 1% year-on-year to 830 Moz. Output from Mexico will rise most significantly as several major new silver projects that have come online in recent years continue to ramp-up to full production rates. By-product silver production from existing mines and new projects in Chile will also be a major contributor to growth. Partially offsetting these rises will be lower output from major silver producers such as Peru, China, and Russia. Rising inflation, particularly from higher oil and natural gas prices, has put significant upward pressure on costs for miners in 2022. However, in the first half of the year rising operating costs for silver miners were surpassed by higher by-product revenues. As a result, the average all-in sustaining cost (AISC) in H1.22 fell by 10% y/y to $9.72/oz. By-product metal prices have fallen in the second half of the year and therefore silver miners’ costs are expected to increase in H2.22.

- Silver jewelry and silverware are set to surge by 29% and 72% respectively to 235 Moz and 73 Moz this year, mainly thanks to an unprecedented rebound in Indian demand. This has partly been driven by strong inventory replenishment ahead of the festive and wedding season, following heavy stock depletion in 2021.

- The global silver market is forecast to record a second consecutive deficit this year. At 194 Moz, this will be a multi-decade high and four times the level seen in 2021.

Global Silver Demand Rising to a New High in 2022

Silver Jewelry and Physical Investment both forecast to surge by 50 Moz to record highs this year (November 17, 2022) – Silver demand is forecast to reach a record total in 2022, driven by new highs for industrial demand, jewelry and silverware offtake and physical investment. These were some of...