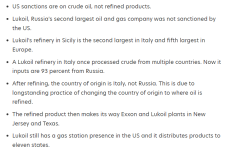

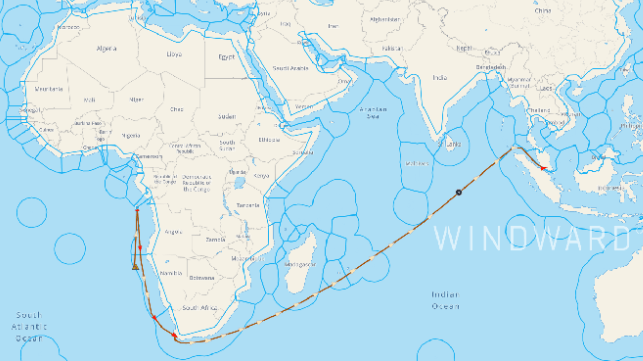

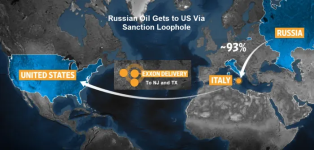

the roundtrip process in which Russian oil refined in Italy makes its way to to the US. It's a real hoot.

mishtalk.com

mishtalk.com

Hoot of the Day: Russian Oil Gets to US Via Sanction Loophole

The Wall Street Journal has an interesting video that describes How Russian Crude Avoids Sanctions and Ends Up in the US. With an upfront ad, that is a free

mishtalk.com

mishtalk.com