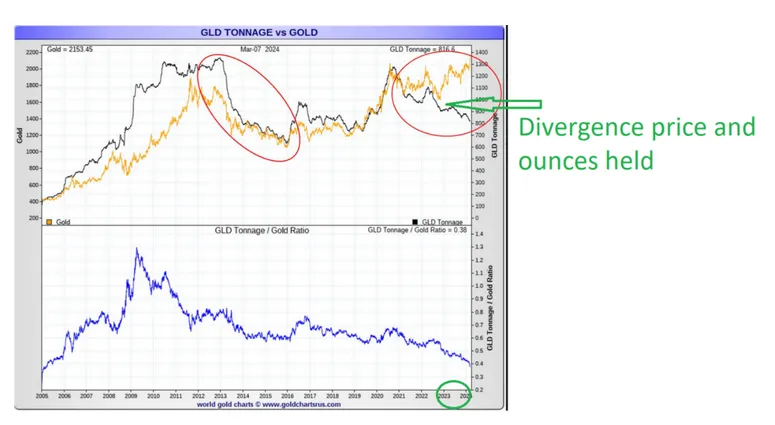

Here is another explanation for this

Credit to B. Coleman

Banks create PM derivatives and use ETFs like SLV and GLD as underlying instruments as benchmark:

"This meant that these large banks ... have deposited their ... metal or inventory ... to create ETF shares that could be then used to benchmark their tertiary derivative/structured investment vehicles..."

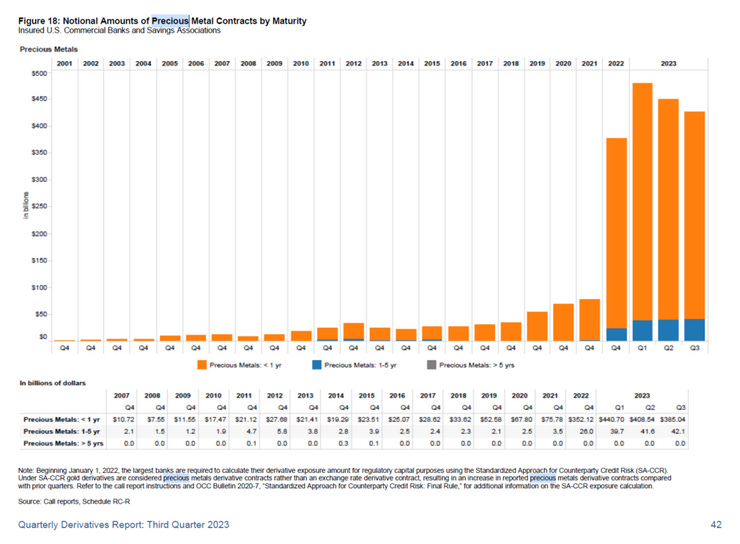

The market for PM derivatives products has been booming since 2022

"Something began to happen in 2023 that may have correlation to the secular decline in ounces held in ETFs. The structured products shown above which

were issued in 2020, 2021, etc, started to mature in 2023 and 2024. This is when the divergence in the ETF ounces held/ shares outstanding began to diverge.

There was no need by the investment banks to hold these shares of the ETF and tie up their metal inventory or collateral if these structured products were maturing and not reissued. This can also be corroborated by the large decline in notional value of derivative exposure held by these banks.

When one examines

Basel 3, the leverage of the financial system, and the profiteering by banks and the financial industry to issue derivative products/supply through the use of ETFs when demand is high, is there any wonder why these ETFs have begun to diverge with the underlying physical market?"

So, if I understand it correctly, Coleman is saying that GLD inventories are declining not because of a physical shortage but because

Basel 3 has lowered demand for gold derivatives -->

derivatives maturing in 2023 and 2024 don't get re-issued -->

derivatives issuers don't need ETF shares anymore -->

they sell their ETF shares -->

they don't need to keep their gold in GLD as ETF shares collateral

:flail:

:flail: