We're just exploiting the system to the max...

Hmmm.... Credit Suisse using the Fed for fast and easy profits? Couldn't be because they are desperate for capital to prevent their own failure becoming a systemic risk to the global financial system, could it?

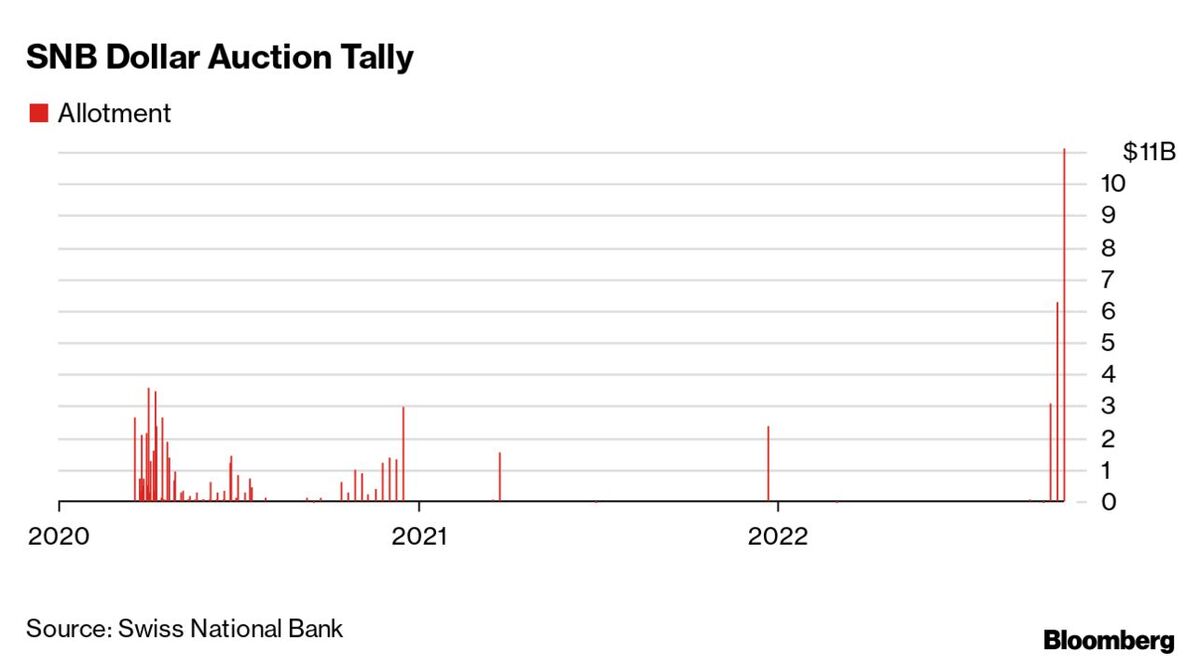

Banks in Switzerland sought the most dollars since 2008 using an emergency dollar swap facility provided by the Federal Reserve in what is likely to be a bid for easy profits.

In today's auction conducted by the Swiss National Bank, 17 institutions took up $11.09 billion. That's the most since October 2008, when the Global Financial Crisis was raging in the wake of Lehman Brothers' collapse.

This is the fourth week in a row when banks have accessed the facility. Last Wednesday 15 banks took up $6.27 billion in funds.

According to economists at Credit Suisse, Swiss banks swap the dollars into francs in order to generate a profit. The lenders can even sell the cash back to the Swiss National Bank using its reverse repo auctions, or deposit it at the institution to benefit from a positive interest rate.

"We do not believe that the increased demand for U.S. dollar liquidity by domestic banks reflects any liquidity issues in the Swiss banking system," Credit Suisse economist Maxime Botteron wrote in a report last week. ...

Hmmm.... Credit Suisse using the Fed for fast and easy profits? Couldn't be because they are desperate for capital to prevent their own failure becoming a systemic risk to the global financial system, could it?