How did I miss this story!?!?

October 2022 (emphasis mine):

www.africa.com

www.africa.com

This looks like Ron Paul's competing currencies bill in action, but on a limited scale/basis.

December 2022:

October 2022 (emphasis mine):

The introduction of gold coins by the Reserve Bank of Zimbabwe (RBZ) to mop up excess liquidity in the market and halt runaway inflation seems to be bearing fruit, at least for now. Individual buyers had taken up 35% of the bullion, with 65% being snapped up by corporates. As at 22 September 2022, a total of 9,516 gold coins had been sold to both individuals and corporate buyers, according to the Reserve Bank of Zimbabwe Governor, Dr John Mangudya. The gold coins are minted by the RBZ-owned Fidelity Printers, the sole buyer of gold in the country. Their price is determined by the international market rate for an ounce of gold, plus five per cent for the cost of producing the coin. Each coin weighs one troy ounce and has a purity of 22 carats. The Zimbabwe government took the unprecedented step of introducing gold coins as legal tender after inflation spiked from 191% in June to 257%. Currently, the central bank has been supplying the market with one-ounce coins, which hit the market at US$1,884.80, which saw fewer ordinary people participating because of the elevated price. The RBZ will in November introduce lower denomination gold coins to enable the participation of ordinary citizens. The smallest, a tenth of an ounce, will be made available to the public through banks and approved dealers.

IMF Believes Zimbabwe's Gold Coins are a Missed Chance to Build the Nation’s Gold Reserves - Africa.com

The introduction of gold coins by the Reserve Bank of Zimbabwe (RBZ) to mop up excess liquidity in the market and halt runaway inflation seems to be bearing

www.africa.com

www.africa.com

This looks like Ron Paul's competing currencies bill in action, but on a limited scale/basis.

December 2022:

An International Monetary Fund (IMF) team led by Dhaneshwar Ghura conducted a visit to Zimbabwe from December 1 to 15.

At the conclusion of the mission, Ghura issued a statement, which, among other things, encouraged the Reserve Bank of Zimbabwe (RBZ) “to wind down the use of gold coins”.

...

The Monetary Policy Committee and the RBZ never viewed gold coins as a silver bullet, but a necessary intervention at the time. It was an idea mooted to contain and reverse the accelerated depreciation of the local currency.

The product worked, as we had imagined it would. Immediately after introduction, gold coins drew away attention from the United States dollar. In our books, the effect was very impactful.

Gold was seen as the best product to contain local currency volatilities, as it offered a viable alternative to the United States dollar.

There has been some misconception, with some referring to gold coins as a currency. For the record, gold coins are not a currency. By design, the RBZ did not intend to issue them without limit.

The authorities’ intention and logic were very clear.

They sought to achieve major gains in exchange rate stability from a limited number of gold coins.

This is why, as of November 2022, the RBZ had only issued 14 200 gold coins worth Z$13.6 billion.

The target was always to issue a maximum of 15 000 gold coins; this is why the IMF agreed with the authorities to wind down their issuance.

The next step, after achieving a measure of stability, is now on attractive local currency investment instruments to anchor our currency.

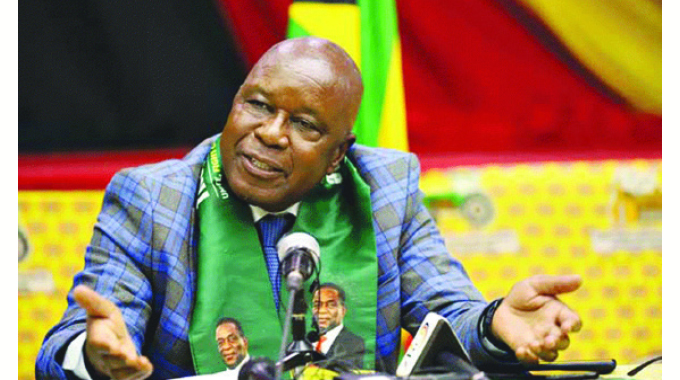

By Persistence Gwanyanya- Member of the RBZ Monetary Policy Committee

Zimbabwe gold coins have done their job | The Insider

An International Monetary Fund (IMF) team led by Dhaneshwar Ghura conducted a visit to Zimbabwe from December 1 to 15. At the conclusion of the mission, Ghura issued a statement, which, among other things, encouraged the Reserve Bank of Zimbabwe (RBZ) “to wind down the use of gold coins”. Ghura...

insiderzim.com