You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Oil Market News, OPEC+, sanctions and price shocks

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more. You can visit the forum page to see the list of forum nodes (categories/rooms) for topics.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

Exclusive: Venezuela to accelerate cryptocurrency shift as oil sanctions return

HOUSTON/CARACAS, April 22 (Reuters) - Venezuela's state-run oil company PDVSA plans to increase digital currency usage in its crude and fuel exports as the U.S. reimposes oil sanctions on the country, three people familiar with the plan said.The U.S. Treasury Department last week gave PDVSA's customers and providers until May 31 to wind down transactions under a general license it did not renew due to a lack of electoral reforms. The move will make it more difficult for the country to increase oil output and exports as companies will have to wait for individual U.S. authorizations to do business with Venezuela.

PDVSA since last year had been slowly moving oil sales to USDT, a digital currency also known as Tether whose value is pegged to the U.S. dollar and designed to maintain a stable value. The return of oil sanctions is speeding up the shift, a move to reduce the risk of sale proceeds getting frozen in foreign bank accounts due to the measures, the people said.

"We have different currencies, according to what is stated in contracts," Venezuelan oil minister Pedro Tellechea told Reuters last week, adding that in some contracts digital currencies might be the preferred payment method.

More:

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

China's Ships Are Winning the Battle for Energy in South China Sea

By Philip Heijmans (Bloomberg) — This was supposed to be the year that Vietnam reaped the benefits from one of its largest natural gas discoveries. An estimated 150 billion cubic meters...

gcaptain.com

gcaptain.com

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

Shadow-Fleet Oil Tanker That Crashed Had Void Western Insurance

By Alex Longley and Sanne Wass (Bloomberg) –A shadow-fleet oil tanker that crashed in Denmark’s vital straits produced a set of insurance documents that weren’t valid, a stark example of how...

gcaptain.com

gcaptain.com

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

International Group: Russian Oil Price Cap is Unenforceable

The International Group of P&I Clubs has informed the British Parliament that the G7 nations' partial sanctions on Russian oil shipping has become...

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

Texas operators turn to flaring amid weak gas prices

HOUSTON, April 30 (Reuters) - Operators drilling for oil in Texas are scrambling to dispose of their excess natural gas amid a supply glut and weak prices, prompting an uptick in flaring requests.The Railroad Commission of Texas (RRC), which regulates the state's oil and natural gas industry, last week approved 21 exemption requests from operators, mostly in the Permian and Eagle Ford shale fields, to flare, more than four times the level it approved this time last year.

Flaring, or the burning of unwanted gas, has come under greater regulatory scrutiny in recent years amid pushes by environmental groups and others to clamp down on the practice that releases greenhouse gases to help slow climate change.

Producers, however, now face a dilemma with crude oil prices trading above $80 a barrel, but gas remaining depressed and in some places falling into negative territory.

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

EC Expected To Propose Partial Ban of Russian LNG as Kremlin Issues Strong Rebuke

Following recent calls by Swedish and German officials to move toward restricting the inflow of Russian liquefied natural gas the European Commission has now taken up the issue. In discussions with member states the EU is suggesting a ban on transshipments.

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

Russian Oil Price Cap Failing! | Russia is Losing in the Black Sea but Winning on the High Seas?

Apr 30, 2024In this episode, Sal Mercogliano - a maritime historian at Campbell University (@campbelledu) and former merchant mariner - discusses Russia's ability to evade the Oil Price Cap by avoid traditional Insurance Clubs, new ship registries and new operating companies.

16:21

- Oil price cap ‘increasingly unenforceable’ insurers warn https://splash247.com/oil-price-cap-i...

- Insurers tell UK government that oil price cap is ‘increasingly unenforceable’ https://www.lloydslist.com/LL1148993/...

- International Group of P&I Clubs https://www.igpandi.org/group-clubs/

- Written evidence submitted by International Group of P&I Clubs https://committees.parliament.uk/writ...

- Ukraine strikes oil refineries deep inside Russia https://www.ft.com/content/4bd2b770-4...

- Tanker Trackers tankertrackers.com

- Marine Traffic marinetraffic.com

- Guinea-Bissau emerges as this year’s fastest-growing ship register https://splash247.com/guinea-bissau-e...

- Eswatini shipping registry flagged as ‘false’ operation by IMO https://www.lloydslist.com/LL1148912/...

- Shifty Shades of Grey https://images.intelligence.informa.c...

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

Canada's long-delayed Trans Mountain oil pipeline set to start operations

May 1 (Reuters) - After 12 years and C$34 billion ($24.7 billion), Canada's Trans Mountain pipeline expansion project (TMX) is set to start shipping oil on Wednesday, a major milestone expected to transform access to global markets for the country's producers.Pipeline constraints have forced Canadian oil producers to sell oil at a discount for many years, but TMX will nearly triple the flow of crude from landlocked Alberta to Canada's Pacific coast to 890,000 barrels per day.

For Canada, the world's fourth-biggest oil producer, the additional pipeline capacity is set to boost crude prices, lift national gross domestic product and open up access to Asian oil markets.

"It's an exciting day. Everyone has been waiting for this for literally years," said Rory Johnston, founder of the Commodity Context newsletter. "It's a fantastic thing for Canada and the Alberta oil patch."

More:

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

^^^^^^^

The C$34 billion ($24.82 billion) project to nearly triple the flow of crude from Alberta to Canada's Pacific Coast to 890,000 barrels per day is scheduled to start operating on May 1 after years of regulatory delays and construction setbacks.

The extra 590,000 bpd of oil will be delivered to the Westridge Marine Terminal where it can be loaded onto tankers, giving Canadian producers more access to U.S. West Coast and Asian markets.

Trans Mountain says it has capacity to load 34 Aframax ships a month, but ship brokers and analysts have pegged the likely number at less than 20, citing concerns about pilot and tug boat availability and loading restrictions.

More:

Port constraints for Canada's Trans Mountain pipeline may crimp oil exports

May 1 (Reuters) - Logistical constraints at the Port of Vancouver mean waterborne oil exports from the highly anticipated Trans Mountain pipeline expansion due to start up on Wednesday may only be around half what the Canadian government-owned corporation has forecast, traders and shipping sources said.The C$34 billion ($24.82 billion) project to nearly triple the flow of crude from Alberta to Canada's Pacific Coast to 890,000 barrels per day is scheduled to start operating on May 1 after years of regulatory delays and construction setbacks.

The extra 590,000 bpd of oil will be delivered to the Westridge Marine Terminal where it can be loaded onto tankers, giving Canadian producers more access to U.S. West Coast and Asian markets.

Trans Mountain says it has capacity to load 34 Aframax ships a month, but ship brokers and analysts have pegged the likely number at less than 20, citing concerns about pilot and tug boat availability and loading restrictions.

More:

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

Transocean Secures Offshore Drilling Contract at $505,000 Day Rate

Offshore drilling contractor Transocean has announced securing an offshore drilling contract above the highly coveted $500,000 day rate mark amid continued demand for high-specification floaters. Transocean secured a 365-day contract...

gcaptain.com

gcaptain.com

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

Shell smashes forecasts with $7.7 billion quarterly profit

LONDON, May 2 (Reuters) - Shell (SHEL.L), opens new tab reported first-quarter profit of $7.7 billion on Thursday, sharply beating expectations after disruptions in the Red Sea and Russia lifted oil refining and trading.

The company also said it will repurchase a further $3.5 billion of its shares over the next three months, at a similar rate to the previous quarter. Its dividend remained unchanged.

Shell's cashflow rose by 6% from the previous quarter to $13.3 billion reflecting strong operational performance, which together with trading helped offset a decline in natural gas prices that weighed on earnings of rivals including Exxon Mobil (XOM.N), opens new tab and Chevron (CVX.N), opens new tab last week.

More:

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

New U.S. Sanctions Target Arctic LNG 2 Blocking Red Box Shipping Company

With its latest round of sanctions the U.S. goes after Singaporean shipping operator Red Box. A notorious violator of Western sanctions the company continued delivering modules for liquefied natural gas from China to Russia throughout 2023 and into 2024. The new measures also target vessels working for Rosneft’s Vostok Oil project.The U.S. torrent of sanctions targeting Novatek’s Arctic LNG 2 project continues. Just months after blocking key Arc7 ice-class liquefied natural gas (LNG) carriers, the U.S. has taken aim at Novatek’s ability to finish the project and construct future LNG plants.

As part of expansive new measures announced by the State Department yesterday, Singapore-based shipping operator Red Box has now been sanctioned.

Red Box’s heavy lift vessels Audax and Pugnax repeatedly violated sanctions delivering prefabricated LNG modules from China to Russia. HNN documented Red Box’s activities in a number of articles over the past two years. During that time frame the company’s vessels completed five voyages carrying modules, including a two months-long journey across the frozen Northern Sea Route this winter.

More:

New U.S. Sanctions Target Arctic LNG 2 Blocking Red Box Shipping Company

With its latest round of sanctions the U.S. goes after Singaporean shipping operator Red Box. A notorious violator of Western sanctions the company continued delivering modules for liquefied natural gas from China to Russia throughout 2023 and into 2024. The new measures also target vessels...

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

Russia's Gazprom Sees First Loss in Two Decades as Gas Trade with Europe Plunges

By Bloomberg News (Bloomberg) — Russia’s state-controlled gas giant reported its first annual net loss since 1999 on falling shipments to Europe and lower prices for the fuel. Gazprom Group, which...

gcaptain.com

gcaptain.com

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

The Lloyd’s List Podcast: What happens next for tankers?

Listen to the latest edition of the Lloyd’s List’s weekly podcast — your free weekly briefing on the stories shaping shipping

Talking tankers. Andrew Wilson, Head of Research and Consultancy Services at BRS Shipbrokers talks to Lloyd’s List editor-in-chief Richard Meade about the dynamics shaping the tanker markets over the next few years

GEOPOLITICAL disruptions, wars, sanctions, Opec+ production cuts and even the weather have all added tonne-mile demand at a point when fleet growth is at a record low.

We are living through something of a golden age for tankers right now and certainly nobody is expecting anything particularly untoward to hit the positive sentiment until at least 2026. Beyond that though things get interesting and what’s happening now in terms of tanker orders flooding in will ultimately determine whether 2027 is a downward swing or a crash.

Because, while things are admittedly looking pretty rosy right now for the energy shipping markets, the risks are far from removed.

If the fleet supply inefficiencies caused by the redirection of Russian oil exports away from Europe, primarily east of Suez, were to suddenly evaporate we would be looking at a very different picture.

The wider market remains delicately poised with positive and negative drivers so far largely offsetting one another

And let’s not forget Opec.

The cartel has installed production cuts since November 2022 to artificially buoy oil prices. Analysts estimate Opec+ has about 6m barrels per day of spare capacity it can unleash on to global markets to lower prices if they spike into the triple digits to prevent demand destruction.

To guide you through the current state of affairs in the tanker sector Andrew Wilson, Head of Research and Consultancy Services at BRS Shipbrokers talks to Lloyd’s List editor-in-chief Richard Meade.

The Lloyd’s List Podcast: What happens next for tankers?

<p>Talking tankers. Andrew Wilson, Head of Research and Consultancy Services at BRS Shipbrokers talks to Lloyd’s List editor-in-chief Richard Meade about the dynamics shaping the tanker markets over the next few years</p>

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

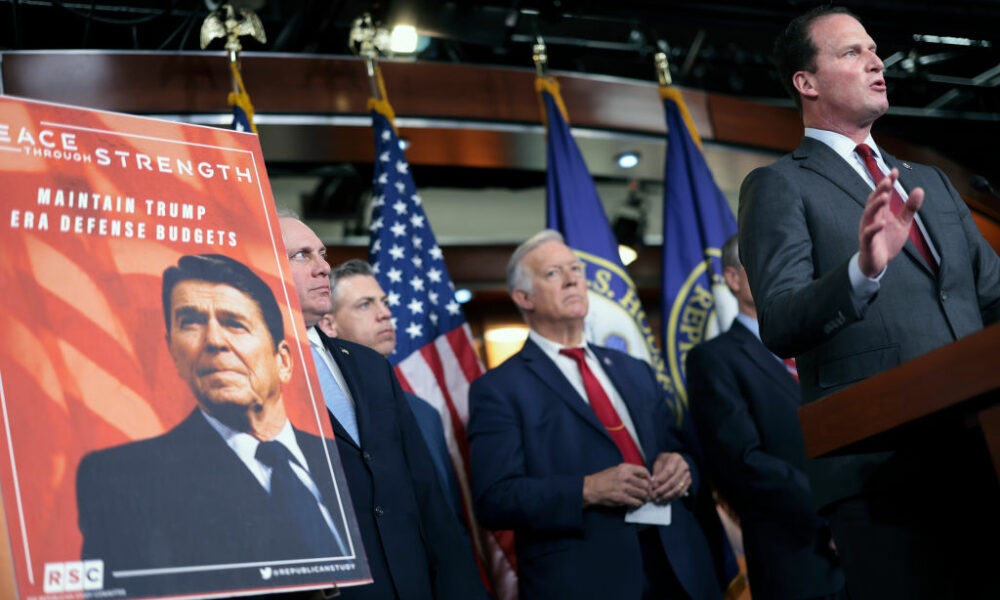

U.S. Oil and Gas Production Is Booming. So Are the Industry’s Donations to Its GOP Allies

Not Donald Trump. Not Ted Cruz. But a little known Republican from West Texas ranks as the top recipient of fossil fuel money.

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

Oil Prices Under Pressure as Bearish Sentiment Builds | OilPrice.com

Oil prices are under pressure after the latest U.S. economic data raised the likelihood of higher-for-long interest rates, raising demand concerns.

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

Big Oil's Embrace Of Deepwater Exploration

By Georgina McCartney HOUSTON, May 5 (Reuters) – As Big Oil returns this week to the industry’s annual showcase for offshore energy projects and equipment in Houston, deepwater discoveries off Guyana, Namibia and the...

gcaptain.com

gcaptain.com

How Western Sanctions Are Strangling Putin’s Arctic Gas Ambitions

By Stephen Stapczynski (Bloomberg) –Russia’s fortress economy has proved remarkably resilient to an onslaught of Western sanctions. Two years after the Kremlin’s invasion of Ukraine, it continues to fund a costly...

gcaptain.com

gcaptain.com

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

Exclusive: China's Sinopec in talks for gas offtake, stake in Canada's Cedar LNG

LONDON/SINGAPORE, May 6 (Reuters) - China's Sinopec is in discussions with Pembina Pipeline Corp (PPL.TO), opens new tab for a liquefied natural gas (LNG) offtake agreement and equity stake in the Canadian company's proposed Cedar LNG project, two sources with knowledge of the matter told Reuters.A joint venture between Haisla First Nation and Pembina, Cedar would be one of Canada's first LNG export terminals, costing roughly $4 billion. Cedar would produce 3 million metric tons of LNG per annum (MTPA) after completion in 2028, pending a final investment decision by mid-2024.

More:

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

Global Land Rigs Newsletter - 1Q 2024 - Westwood

1Q 2024 was defined by the continued escalation of geopolitical tension in the Middle East, although yet to have a significant impact on commodity prices.

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

Trump Reportedly Asks Fossil Fuel CEOs For $1 Billion

Former President Donald Trump is more than happy to fulfill the oil and gas industry’s wish list if he’s reelected — but he has an asking price.Trump reportedly solicited top oil and gas executives to give $1 billion for his campaign to return to the White House, vowing in return to undo many of President Joe Biden’s green energy policies if he is elected in November.

Trump hosted the country’s top fossil fuel CEOs at his Mar-a-Lago club in Florida last month when he “stunned” executives with the ask, according to The Washington Post. The $1 billion sum would ultimately be a “deal” for the fossil fuel industry, Trump reportedly told the executives, because of the money they would save with him in office. An anonymous industry source told the Post that Trump is likely to get some funds.

The oil and fossil fuel industry has long made its alliances with the Republican Party, which generally supports and promotes fossil fuels. Ahead of the 2024 election, the industry has been drawing up “ready-to-sign” executive orders for Trump if he wins the presidency, aimed at expanding natural gas exports and increasing offshore oil leases, Politico reported this week.

A second Trump term would mean a sharp departure from Biden’s agenda of clean energy, electric vehicles and historic efforts to fight climate change. The former president has falsely called global warming a “hoax” and has vowed to unravel Biden’s landmark climate programs included in the Inflation Reduction Act.

More:

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

^^^^^^^^

The U.S. oil industry is drawing up ready-to-sign executive orders for Donald Trump aimed at pushing natural gas exports, cutting drilling costs and increasing offshore oil leases in case he wins a second term, according to energy executives with direct knowledge of the work.

The effort stems from the industry’s skepticism that the Trump campaign will be able to focus on energy issues as Election Day draws closer — and worries that the former president is too distracted to prepare a quick reversal of the Biden administration’s green policies. Oil executives also worry that a second Trump administration won’t attract staff skillful enough to roll back President Joe Biden’s regulations or craft new ones favoring the industry, these people added.

Six energy industry lawyers and lobbyists interviewed by POLITICO described the effort to craft executive orders and other policy paperwork that they see as more effective than anything a second Trump administration could devise on its own. Those include a quick reversal of Biden’s pause on new natural gas export permits and preparations for wider and cheaper access to federal lands and waters for drilling.

More:

‘A little bold and gross’: Oil industry writes executive orders for Trump to sign

The effort stems from the industry’s skepticism that the Trump campaign will be able to focus on energy issues as election day draws closer.The U.S. oil industry is drawing up ready-to-sign executive orders for Donald Trump aimed at pushing natural gas exports, cutting drilling costs and increasing offshore oil leases in case he wins a second term, according to energy executives with direct knowledge of the work.

The effort stems from the industry’s skepticism that the Trump campaign will be able to focus on energy issues as Election Day draws closer — and worries that the former president is too distracted to prepare a quick reversal of the Biden administration’s green policies. Oil executives also worry that a second Trump administration won’t attract staff skillful enough to roll back President Joe Biden’s regulations or craft new ones favoring the industry, these people added.

Six energy industry lawyers and lobbyists interviewed by POLITICO described the effort to craft executive orders and other policy paperwork that they see as more effective than anything a second Trump administration could devise on its own. Those include a quick reversal of Biden’s pause on new natural gas export permits and preparations for wider and cheaper access to federal lands and waters for drilling.

More:

- Messages

- 12,128

- Reaction score

- 2,611

- Points

- 238

Europe takes action against Russian-linked tankers - Splash247

Moving Russian oil through Europe has come under far greater scrutiny in recent weeks with the bloc widely expected to take further measures against the so-called shadow fleet when further European Union sanctions are unveiled shortly. In the southeast of the continent, the Greek navy has this...