You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tin Foil Hats, Economic Reality and the Total Perspective Vortex

- Thread starter pmbug

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more. You can visit the forum page to see the list of forum nodes (categories/rooms) for topics.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

From a few weeks ago:

No word on whether or not this suggestion has any relation to interest in gold dinars.

Prime Minister Sheikh Hasina suggested on Tuesday that the Muslim countries introduce a common currency like the euro of the European Union to facilitate trade and commerce among them.

“It would be very good if we could introduce a common currency following the European Union to facilitate trade and commerce among us,” she said.

The prime minister said this while a delegation of D-8 trade ministers led by Turkish Deputy Minister of Trade Mustafa Tizcu called on her at her official residence, Ganabhaban.

PM’s speech writer, M Nazrul Islam, briefed the reporters after the call.

Sheikh Hasina said that the D-8 was formed with the eight Muslim-majority countries of the world, aiming to enhance trade and commerce among them along with improving friendship to develop the socioeconomic status of the people of these countries.

The group comprises Bangladesh, Egypt, Indonesia, Iran, Malaysia, Nigeria, Pakistan, and Turkiye.

....

No word on whether or not this suggestion has any relation to interest in gold dinars.

- Messages

- 12,097

- Reaction score

- 2,609

- Points

- 238

Digital euro development update IIF Staff Note April 2, 2024

This staff note reports on recent developments in the digital euro project, focusing on the launch of mandates for seven new workstreams under the project’s Rulebook Development Group(RDG), the publication of a technical note on enforcing the digital euro holding limit across multiple wallets, and the European Central Bank’s (ECB’s) ongoing exploratory work on new technologies for wholesale central bank money settlement, including an invitation for financial market stakeholders to participate in planned trials in 2024.

More (pdf):

This staff note reports on recent developments in the digital euro project, focusing on the launch of mandates for seven new workstreams under the project’s Rulebook Development Group(RDG), the publication of a technical note on enforcing the digital euro holding limit across multiple wallets, and the European Central Bank’s (ECB’s) ongoing exploratory work on new technologies for wholesale central bank money settlement, including an invitation for financial market stakeholders to participate in planned trials in 2024.

More (pdf):

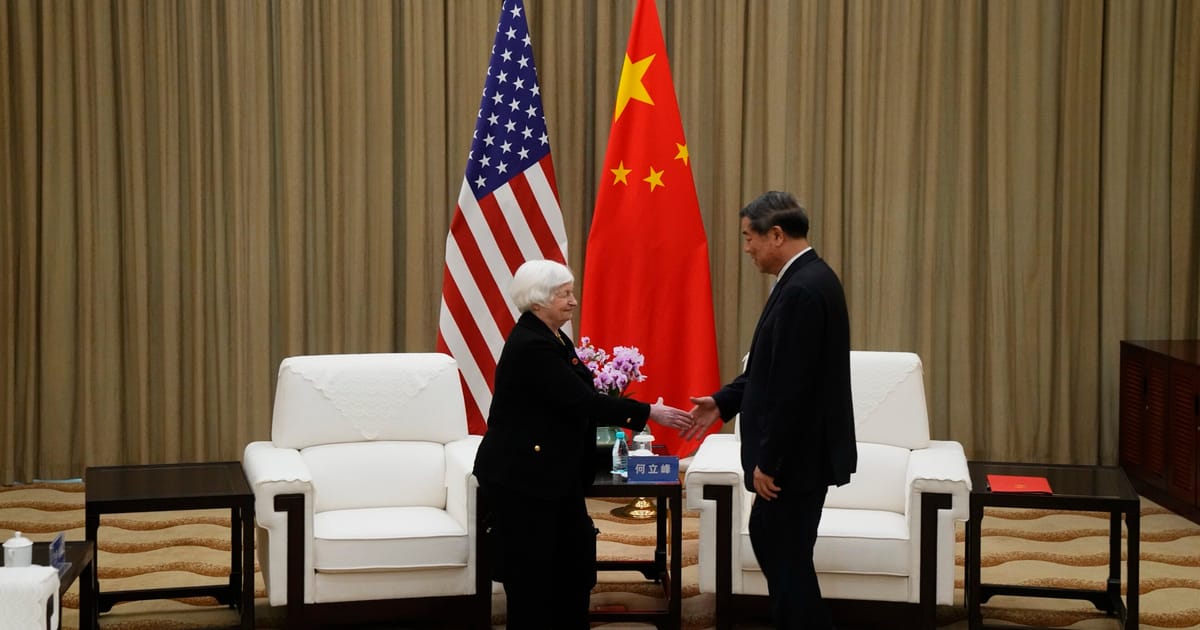

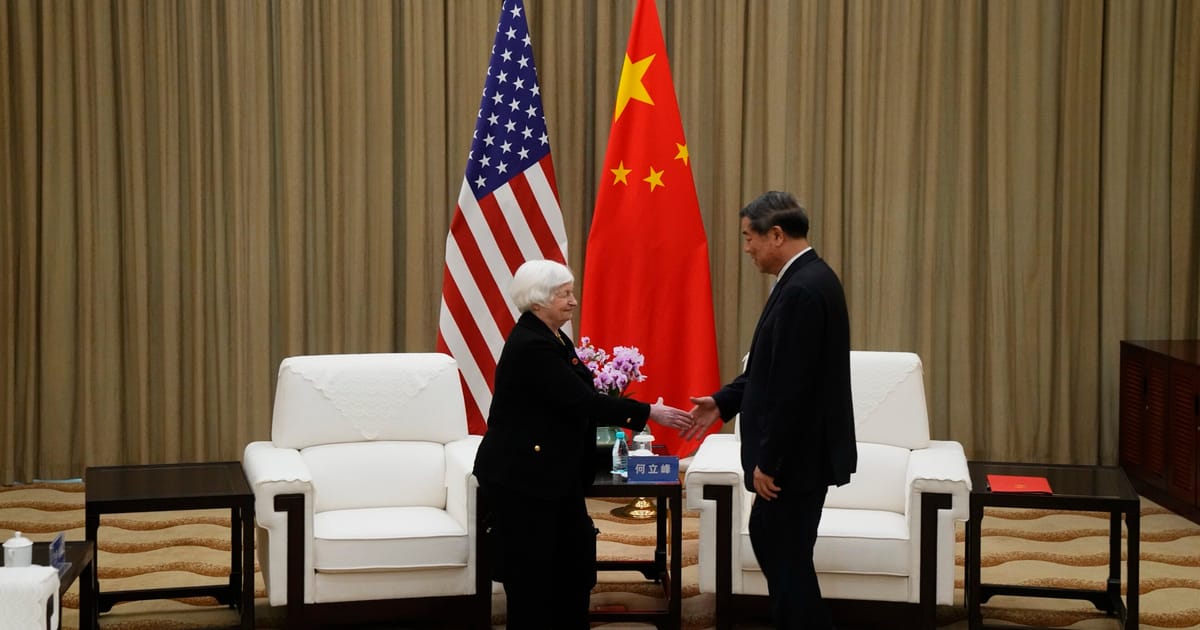

Anyone see this? The real reason for Janet's second China visit in less than a year.

Yellen warns China of "significant consequences" over it's trade with Russia on anything that could be used to help them in their efforts in Ukraine.

Which, depending on how that's defined, could mean anything. Food could be considered as being "help". Gotta feed the troops somehow.

www.politico.eu

www.politico.eu

Yellen warns China of "significant consequences" over it's trade with Russia on anything that could be used to help them in their efforts in Ukraine.

Which, depending on how that's defined, could mean anything. Food could be considered as being "help". Gotta feed the troops somehow.

‘Significant consequences’ if Chinese firms help Russia’s war in Ukraine, US’s Yellen warns

U.S. Treasury secretary’s admonition comes after Blinken said China is aiding Moscow’s war effort.

- Messages

- 12,097

- Reaction score

- 2,609

- Points

- 238

For the First Time in History, the Fed Is Reporting Billions in Losses Weekly; It's Still Paying High Interest Income to the Mega Banks on Wall Street

By Pam Martens and Russ Martens: April 8, 2024 ~ As of April 3 of this year, the Federal Reserve (Fed) has racked up $161 billion in accumulated losses.

wallstreetonparade.com

- Messages

- 12,097

- Reaction score

- 2,609

- Points

- 238

Article contains a link to a 9-page pdf. It's a quick and easy read.

www.bis.org

www.bis.org

Klaas Knot: Public money - keeping up with the times

Opening remarks by Mr Klaas Knot, President of the Netherlands Bank, to the European House-Ambrosetti's panel on "Central Bank Digital Currencies (CBDCs): The Future of Money", Cernobbio, 5 April 2024.

- Messages

- 12,097

- Reaction score

- 2,609

- Points

- 238

Contains link to 4-page, quick and easy read pdf.

www.bis.org

www.bis.org

Thomas Jordan: Towards the future monetary system

Introductory remarks by Mr Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank, at the event "Towards the future monetary system", Zurich, 8 April 2024.

- Messages

- 12,097

- Reaction score

- 2,609

- Points

- 238

Contains link to pdf. Easy read / scan.

www.bis.org

www.bis.org

Abstract

This paper lays out a vision for the Finternet: multiple financial ecosystems interconnected with each other, much like the internet, designed to empower individuals and businesses by placing them at the centre of their financial lives. It advocates for a user-centric approach that lowers barriers between financial services and systems, thus promoting access for all. The envisioned system leverages innovative technologies such as tokenisation and unified ledgers, underpinned by a robust economic and regulatory framework, to dramatically expand the range and quality of financial services. This integration aims to foster greater participation, offer more personalised services and improve speed and reliability, all while reducing costs for end users. Most of the technology needed to achieve this vision exists and is fast improving, driven by efforts around the world. This paper provides a blueprint for how key technical characteristics like interoperability, verifiability, programmability, immutability, finality, evolvability, modularity, scalability, security and privacy can be incorporated, and how varied governance norms can be embedded. Delivering this vision requires proactive collaboration between public authorities and private sector institutions. The paper serves as a call for action for these entities to establish a strong foundation. This would pave the way for a user-centric, unified and universal financial ecosystem brought into the digital era that is inclusive, innovative, participatory, accessible and affordable, and leaves no one behind.

Finternet: the financial system for the future

This paper lays out a vision for the Finternet: multiple financial ecosystems interconnected with each other, much like the internet, designed to empower individuals and businesses by placing them at the centre of their financial lives. It advocates for a user-centric approach that lowers...

- Messages

- 12,097

- Reaction score

- 2,609

- Points

- 238

Introduction

Welcome to today's conference and a very warm welcome to those who have joined us from overseas. I would like to spend the next 15 minutes to share my thoughts on central bank digital currencies, or CBDCs, and what it means for the future of money and payment systems.Throughout history, the evolution of money and its institutional foundations have closely followed the advancements in technology. Today, we are witnessing a significant shift in how we view and use money in our increasingly digital world.

The way we make payments is changing, with a decline in cash transactions and a growing trend towards digital payments for goods and services. The developments in the online space are even more interesting, with an explosion of new asset classes and transaction protocols.

In response, some 130 central banks have been conducting research on CBDCs as an advanced representation of central bank money for the digital economy. The HKMA is an early mover in this respect, having started CBDC explorations since 2017 with Project LionRock, which has since evolved into Project mBridge, one of the more advanced explorations of a multi-CBDC platform globally.

Eddie Yue: Keynote speech - International Conference on Central Bank Digital Currencies and Payment Systems

Keynote speech by Mr Eddie Yue, Chief Executive of the Hong Kong Monetary Authority, at the International Conference on Central Bank Digital Currencies and Payment Systems, Hong Kong, 11 April 2024.

...

This paper lays out a vision for the Finternet: ...

I have not yet read the paper, but I assume they propose a system based upon a centralized authority for the backbone. It's unnecessary. Free market innovation in the decentralized crypto space is already developing the interconnectedness like neurons in the brain forging synapses.

- Messages

- 12,097

- Reaction score

- 2,609

- Points

- 238

Contains link to 3 page pdf. Easy read / scan.

www.bis.org

www.bis.org

Luke Forau: Launch of Solomon Island's payment system SOLATS

Remarks by Mr Luke Forau, Governor of the Central Bank of Solomon Islands, at the Launch of the National Payments System SOLATS, Honiara, 8 April 2024.

AEP talking about things financial media rarely talks about:

www.telegraph.co.uk

www.telegraph.co.uk

I think the SGE price premium is letting the cat out of the bag on this one.

A powerful force is stalking the world’s gold market. It is operating in the shadows.

None of the normal footprints are visible on the London bullion market or the Chicago Mercantile. Retail goldbugs have not been buyers: ETF gold funds have been shrinking since December. The crowd is piling into the Bitcoin scam instead.

Yet gold has smashed through a four-year barrier around $2,000 an ounce, rising in parabolic fashion since mid-February, and hitting an all-time high of $2,431 on April 11. Is somebody preparing for an escalation of the shadow Third World War?

“It is not a Western institution behind this. It is a massive player with very deep pockets. I have never seen this kind of buying before,” said Ross Norman, a veteran gold trader and now chief executive of Metals Daily.

Gold has been ratcheting up fresh records against the headwinds of a strong dollar, a 70 point jump in 10-year US Treasury yields, and hawkish talk from the Federal Reserve. This mix would normally spell trouble for gold.

Whoever it is – or they are – seems insensitive to cost. Central banks do not behave like this. “They buy on the London benchmark and they don’t chase the price,” said Mr Norman. This rally is happening off books in the OTC market.

Yes, China’s central bank has been adding to its declared gold reserves for 17 consecutive months, part of the gradual portfolio shift away from US Treasuries and European bonds by the Global South.

Dollar weaponisation since the war in Ukraine has unnerved every country aligned with the authoritarian axis of China and Russia. None can feel safe parking money in Western securities after Russia’s foreign reserves were frozen.

Yet the scale is modest. The World Gold Council said central banks bought a net 18 tonnes in February: 12 in China, six in Kazakhstan and India, four in Turkey, partly offset by Russian sales. This hardly moves the needle.

...

But this alone cannot account for the price surge, either. Mr Norman says the gold flow to Asia has been within normal bounds.

...

There is a strong suspicion among gold experts that China is behind the surge in buying, building up a war-fighting bullion chest through state-controlled banks and proxies. But others, too, can see that we are living through a fundamental convulsion of the global order, and that the dollarised financial system will not be the same at the end of it. Gold is the hedge against dystopia.

However, there is a parallel explanation. Covid finally broke our spendthrift governments. The talk in hedge fund land is that some big beasts are taking bets against “fiscal dominance” across the West.

It is a collective judgment that too many countries have pushed public debt beyond 100pc of GDP and beyond the point of no return under prevailing economic ideologies and political regimes. Budget deficits have broken out of historical ranges and are running at structurally untenable levels for this stage of the cycle.

Central banks will bottle it – under this scenario – in order to mop up issuance of treasury bonds. They will let inflation run hot to help states whittle down debts by stealth default. You might argue that this is what they already did by letting rip with extreme money creation during the pandemic.

...

Of course, the gold spike may be nothing more than wolf pack speculation by funds orchestrating a squeeze on bullion shorts through the options market, knowing that this sets off a self-fueling feedback loop. If so, the rally will short-circuit soon enough.

My bet is that a big animal with a Chinese accent is bracing for geopolitical or monetary disorder on a traumatic scale.

Gold is sniffing out monetary and geopolitical dystopia

‘Never seen before’ levels of buying could be the makings of a war chest

I think the SGE price premium is letting the cat out of the bag on this one.

- Messages

- 12,097

- Reaction score

- 2,609

- Points

- 238

Israel and South Korea expand CBDC exploration, announce upcoming pilot projects

(Kitco News) – The testing of central bank digital currencies (CBDCs) continues to ramp up despite rising geopolitical tensions and a struggling global economy as Israel and South Korea have both announced new pilot projects as they advance toward releasing digital fiat for public use.According to Andrew Abir, deputy governor of the Bank of Israel, the central bank is preparing to launch a sandbox environment for testing CBDC use cases in an effort to refine the design of the digital shekel and ensure its capacity to facilitate advanced applications.

“We are now building the system and intend to officially announce the project in the coming weeks,” Abir said in a statement released Tuesday.

Abir reiterated that “a digital shekel is a liability of the Bank of Israel to the public – and in that sense, it is similar to cash, whose holding does not involve credit risk.”

More:

...

The BRICS bloc is considering several options in the design of an inter-member economic settlement system. In an interview with TV BRICS, Russian Deputy Foreign Minister Sergey Ryabkov stated that the international bloc, integrated by Brazil, Russia, India, China, South Africa, Saudi Arabia, the United Arab Emirates (UAE), Iran, Egypt, and Ethiopia, was mulling the use of stablecoins and other digital currencies as part of this new payment network.

...

More:

BRICS Bloc Mulls Stablecoins, CBDC-Based System for International Settlements – Bitcoin News

Russian Deputy Foreign Minister Sergey Ryabkov revealed BRICS has been considering the use of stablecoins for its common payment system.

No mention of gold at all.

Former President Donald Trump’s economic advisers are considering ways to actively stop nations from shifting away from using the dollar — an effort to counter budding moves among key emerging markets to reduce exposure to the US currency, according to people familiar with the matter.

Discussions include penalties for allies or adversaries who seek active ways to engage in bilateral trade in currencies other than the dollar — with options including export controls, currency manipulation charges and tariffs, the people said, speaking on the condition of anonymity.

...

“I hate when countries go off the dollar,” Trump said in a March 11 interview on CNBC. “I would not allow countries to go off the dollar because when we lose that standard, that will be like losing a revolutionary war,” he said. “That will be a hit to our country.”

As president, Trump weighed forcibly weakening the dollar to support the domestic manufacturing sector. But now, so far he has privately said he doesn’t currently see the merits of dollar intervention, according to one person familiar with the matter. The Trump campaign referred to the former president’s latest remarks on the dollar Thursday morning.

“With Biden, you’re going to lose the dollar as the standard. That’ll be like losing the biggest war we’ve ever lost,” he said, blaming Biden’s policies for damaging views toward the dollar.

Trump has favored a stable dollar, and for other countries to match that policy by refraining from interventions seeking to devalue their currencies. With the Federal Reserve holding off on lowering interest rates, the dollar lately has been on the rise, spurring authorities overseas to consider interventions to prop up — not devalue — their currencies.

...

Trump Advisers Discuss Penalties for Nations That Move Away From the Dollar

(Bloomberg) -- Former President Donald Trump’s economic advisers are considering ways to actively stop nations from shifting away from using the dollar — an effort to counter budding moves among key emerging markets to reduce exposure to the US currency, according to people familiar with the...

More muscle flexing isn't going to fix the root issue. Pandora's box has already been opened and opening it further with emphasis isn't going to stop traffic across the threshold. The recent shift in BRICS+ and Venezuela to talking about Tether/stablecoins shows that the dollar isn't really the issue (they are backed by dollars). The issue is control of the payments system. SWIFT is going to die. The only question remaining is what ends up replacing it.

- Messages

- 12,097

- Reaction score

- 2,609

- Points

- 238

Quick, easy read.

www.bis.org

www.bis.org

Joachim Nagel: Digital euro - vision, advances and challenges

Introductory remarks by Dr Joachim Nagel, President of the Deutsche Bundesbank, at the fireside chat with Massachusetts Institute of Technology students, Cambridge, Massachusetts, 16 April 2024.

- Messages

- 12,097

- Reaction score

- 2,609

- Points

- 238

Experts, politicians call for scrutiny of Venezuela's use of cryptocurrency

April 29 (Reuters) - Venezuela's use of digital currencies, expected to increase after the United States ordered a wind-down of oil deals with the sanctioned country by May 31, will require greater scrutiny by regulators and law enforcement, experts said on Monday.Venezuela's state oil company PDVSA plans to increase cryptocurrency transactions for its crude and fuel exports as the U.S. reimposes oil sanctions on the country, sources told Reuters earlier this month. It is unclear if payments in digital currency Tether by PDVSA will be targeted by Washington from June 1.

More:

- Messages

- 12,097

- Reaction score

- 2,609

- Points

- 238

Nothing to see, can listen in one tab, play around the forum in a different tab.

19:41

Trump Advisers Plan to Punish Countries That Abandon the Dollar.

Mario talks about the dollar standard, debt and more in this one.19:41

- Messages

- 12,097

- Reaction score

- 2,609

- Points

- 238

Nothing special, just something to look through if you are into banking statistics.

www.bis.org

www.bis.org

Statistical release: BIS international banking statistics and global liquidity indicators at end-December 2023

Key takeaways

- In Q4 2023, cross-border claims fell by $377 billion as banks in several advanced economies (AEs) reported lower derivatives claims on the United Kingdom, a centre for derivatives clearing. The outstanding stock settled at $39 trillion.

- Cross-border credit (ie loans plus holdings of debt securities), however, grew by $319 billion in Q4, driven by lending to non-banks. Banks in Japan reported higher claims on the non-financial sector in the United States.

- Cross-border dollar credit recovered in 2023, after having declined during the Federal Reserve's policy tightening and dollar appreciation in 2022.

- Credit to emerging market and developing economies (EMDEs) increased by $30 billion in Q4 2023, mostly driven by an expansion in renminbi credit.

- The BIS global liquidity indicators (GLIs) show a slight drop in US dollar-denominated foreign currency credit overall in Q4 2023; US dollar credit to EMDEs, however, grew by $12 billion.

Statistical release: BIS international banking statistics and global liquidity indicators at end-December 2023

In Q4 2023, cross-border claims fell by $377 billion as banks in several advanced economies (AEs) reported lower derivatives claims on the United Kingdom, a centre for derivatives clearing. The outstanding stock settled at $39 trillion. Cross-border credit (ie loans plus holdings of debt...

SilverSamurai

Fly on the Wall

- Messages

- 33

- Reaction score

- 10

- Points

- 38

Fiat currencies

Not in equilibrium

Global payments flow

Not in equilibrium

Global payments flow

Pepe is generally well informed but he was recently fed disinformation in regard to Ukraine/ Russia

But this sounds more like a slow burn source for a developing situation rather than a headline scoop.

The problem with working hard to create a professional reputation is that you will get fed stuff that apparently comes from reliable sources……

Same thing seems to have happened with Seymour Hearsch and whodunnit on NS2 .

But this sounds more like a slow burn source for a developing situation rather than a headline scoop.

The problem with working hard to create a professional reputation is that you will get fed stuff that apparently comes from reliable sources……

Same thing seems to have happened with Seymour Hearsch and whodunnit on NS2 .

Bold emphasis is mine:

https://www.msn.com/en-us/money/mar...raw-that-breaks-the-dollar-s-back/ar-BB1lRjK9

The gold market is not large enough at current prices.

Some commentators have spent decades predicting the imminent demise of the US dollar’s special status as the world’s international reserve currency.

Eventually, they will be right, and that day may be drawing much closer. As usual, China could hold the key.

...

... Beneath the surface, though, the diversification out of US assets has continued.

As part of this trend, central banks have been adding to their holdings of gold. The People’s Bank of China (PBOC) has been at the forefront here, with official data showing that March was the 17th successive month of net purchases. Industry insiders suspect there has been a large amount of covert buying by the authorities too.

...

... There are clear strategic advantages to China diversifying out of US assets, largely given rising geopolitical tensions over Taiwan and Beijing’s growing assertiveness in the South China Sea.

As Matthew Henderson has argued in The Telegraph, the switch to gold has helped China build up a war chest safe from US sanctions. Russia has already taken this step, and other states may follow.

China’s stockpiling of gold could also be a warning that the country could use its large holdings of US government bonds as a weapon.

...

The gold market is simply not large enough to absorb all of the capital that China has parked overseas.

...

https://www.msn.com/en-us/money/mar...raw-that-breaks-the-dollar-s-back/ar-BB1lRjK9

The gold market is not large enough at current prices.

- Messages

- 12,097

- Reaction score

- 2,609

- Points

- 238

Contains link to 4-page pdf. Quick, easy read.

The views expressed in this speech are those of the speaker and not the view of the BIS.

Ladies and Gentlemen

Let me thank the BIS for the opportunity to present and discuss Project Helvetia III. It is a great pleasure to give you some insights into this pilot project of the Swiss National Bank. The pilot represents the world's first issuance of a wholesale CBDC on a regulated third-party platform to settle commercial transactions with tokenised assets.

Helvetia III is a good example of how learnings from BIS Innovation Hub projects can be leveraged for real world use. We started this work together with the Hub's Swiss Centre and the private sector more than four years ago. In Helvetia I and II, we jointly expanded our understanding of wholesale CBDC and shared the findings with the central bank community. We took advantage of this groundwork to launch Helvetia III in December 2023, bringing Swiss franc wholesale CBDC from a test setting to real use.

More:

www.bis.org

www.bis.org

Thomas Jordan: Project Helvetia III - The Swiss National Bank's pilot for wholesale CBDC

Remarks by Mr Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank, at the BIS Innovation Summit 2024, Basel, 6 May 2024.The views expressed in this speech are those of the speaker and not the view of the BIS.

Ladies and Gentlemen

Let me thank the BIS for the opportunity to present and discuss Project Helvetia III. It is a great pleasure to give you some insights into this pilot project of the Swiss National Bank. The pilot represents the world's first issuance of a wholesale CBDC on a regulated third-party platform to settle commercial transactions with tokenised assets.

Helvetia III is a good example of how learnings from BIS Innovation Hub projects can be leveraged for real world use. We started this work together with the Hub's Swiss Centre and the private sector more than four years ago. In Helvetia I and II, we jointly expanded our understanding of wholesale CBDC and shared the findings with the central bank community. We took advantage of this groundwork to launch Helvetia III in December 2023, bringing Swiss franc wholesale CBDC from a test setting to real use.

More:

Thomas Jordan: Project Helvetia III - The Swiss National Bank's pilot for wholesale CBDC

Remarks by Mr Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank, at the BIS Innovation Summit 2024, Basel, 6 May 2024.

- Messages

- 12,097

- Reaction score

- 2,609

- Points

- 238

Russia, Iran team up on digital currencies to bypass Western sanctions

(Kitco News) – As geopolitical tensions in Europe and the Middle East rise, the governments of Iran and Russia are reportedly working on central bank digital currency (CBDC) and digital financial asset (DFA)-powered trade solutions, Iranian officials have confirmed.According to a report from Russian media outlet Izvestia, Rahimi Mohsen, the trade attaché of the Iranian Embassy in Russia, said the countries were “exploring the use of DFAs and central bank digital currencies,” which can help simplify trade between Tehran and Moscow and potentially mitigate the effects of sanctions.

More:

The BIS and Eurozone central banks are leading the charge in the western world for CBDC and digital ID development. Australia is a step ahead in it's digital ID program. Everyone is trying to catch up to China's Draconian social credit system.

- Messages

- 12,097

- Reaction score

- 2,609

- Points

- 238

^^^^^^^

Thoughs:

- What'll happen if a CBDC / digital ID is universally enacted, and some countries don't go along with it?

- I'm really not religious but this do come to mind on occasion:

www.biblegateway.com

- Things are accelerating pretty darn quick

www.biblegateway.com

- Things are accelerating pretty darn quick

- What pretext will be used to bring tis about

Thoughs:

- What'll happen if a CBDC / digital ID is universally enacted, and some countries don't go along with it?

- I'm really not religious but this do come to mind on occasion:

Bible Gateway passage: Revelation 13 - King James Version

And I stood upon the sand of the sea, and saw a beast rise up out of the sea, having seven heads and ten horns, and upon his horns ten crowns, and upon his heads the name of blasphemy. And the beast which I saw was like unto a leopard, and his feet were as the feet of a bear, and his mouth as...

- What pretext will be used to bring tis about

...

- What pretext will be used to bring tis about

Look at what's happening in Australia and Europe. It won't be forced on people - not overtly. The digital ID is introduced as a voluntary option. Incentives and benefits are given to adoptees. Slowly, services will be restricted for those that don't adopt - much like how access to cash is slowly disappearing. Eventually, you'll be forced to adopt if you want to participate in the economy.

... Australia is a step ahead in it's digital ID program. ...

Verifying your identity is something we all have to do fairly regularly, but it's about to fundamentally change as Australia passes legislation for a national digital ID.

The laws passed the Senate in late March and will go before the lower house in the upcoming parliamentary sitting period, although the ID itself (called myGovID) is already up and running.

...

More:

The BRICS group of nations could offer an alternative currency in the event of a collapse of the dollar and the international monetary system, according to Russia's executive director at the International Monetary Fund, Alexey Mozhin.

In an interview with RIA Novosti published on Friday, the expert noted that the shortcomings of the current financial system are becoming more apparent and that many publications have started to mention BRICS "in the context of the fact that this association can offer an alternative."

Mozhin explained that it is possible for the economic bloc's member countries to create a currency that would be "built on a basket of currencies of the five member countries," which would include the Chinese yuan, Indian rupee, Russian ruble, Brazilian real, and the South African rand.

"Such a proposal is being discussed. In the event of the collapse of the dollar and the international monetary system, it will be necessary to turn the said BRICS accounting unit into a real currency, backed by exchange goods," the director told the outlet.

...

According to a report by the Izvestia newspaper citing Vietnam's embassy in Russia, Vietnam is actively exploring the possibility of joining the BRICS economic group. BRICS, comprising Brazil, Russia, India, China, and South Africa, has seen recent expansion with the inclusion of four additional countries earlier this year. While Vietnam has yet to make a formal decision regarding membership, it is laying the groundwork for potential participation in BRICS activities.

The report indicates that Vietnam is in the process of establishing a framework for engagement with BRICS and considering the feasibility of submitting a membership bid. However, it remains unclear whether Vietnam will send a delegation to the upcoming BRICS summit scheduled for October in the Russian city of Kazan.

...

More:

Vietnam explores possibility of BRICS membership

According to a report by the Izvestia newspaper citing Vietnam's embassy in Russia, Vietnam is actively exploring the possibility of joining the BRIC

The World Gold Council’s demand trends report for the first quarter of this year showed that Việt Nam gold demand was strong in the quarter, supporting record-high prices.

The report pointed out that Việt Nam registered the strongest bar and coin demand in the first quarter of this year since 2015, at over 14 tonnes.

Việt Nam experienced a 12 per cent year-on-year rise in demand for gold bars and coin investments, with total consumer demand increasing by 6 per cent year-on-year.

...

VN registers strongest bullion demand since 2015

The World Gold Council’s demand trends report for the first quarter of this year showed that Việt Nam gold demand was strong in the quarter, supporting record-high prices.

The article was not explicit or clear, but it seems to imply that the Vietnam central bank increase gold buying by 6%? It would make sense that they are buying gold if they are serious with their BRICS flirtation.

More than unnecessary, it's sinister.I have not yet read the paper, but I assume they propose a system based upon a centralized authority for the backbone. It's unnecessary. Free market innovation in the decentralized crypto space is already developing the interconnectedness like neurons in the brain forging synapses.

If they have to engineer it, then it's not organic. It's an artificial construct, and at the hidden base of it is probably either the bankster cabal or other Deep State players, terrified they're losing control over who they view as their chattel.