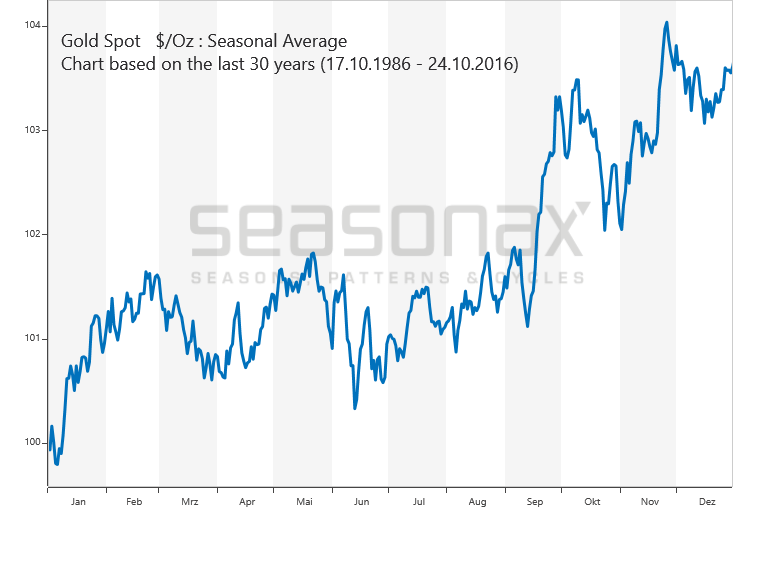

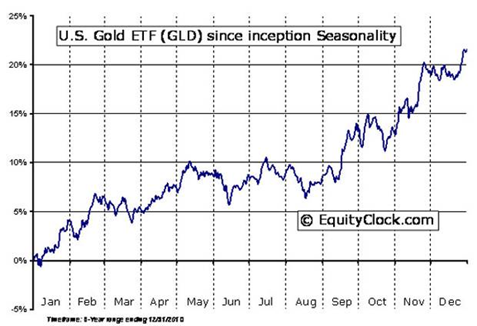

Thackray’s 2012 Investor’s Guide notes that the optimal time to invest in gold bullion from a seasonal perspective is today,

July 12.

The summer months normally see seasonal weakness and it is thus a good time to buy on the seasonal dip.

The Global and Mail reports that Thackray’s 2012 Investor’s Guide shows that

the optimal time to invest in gold bullion for a seasonal trade is from July 12th to October 9th (see news:

http://www.theglobeandmail.com/glob...rength-nearly-here/article4403228/?cmpid=rss1 ).

“The

trade has been profitable during 11 of the past 14 periods.”

During the past 25 years, gold bullion has outperformed the S&P 500 Index by a very significant 4.7% during the period.

The Globe and Mail notes that “traditionally, advances in gold during its period of seasonal strength is attributed to precious metal fabricators in India who purchase bullion to make into jewellery for the

Indian wedding season that starts in late October. India is the second-biggest consumer of gold jewellery in the world behind China.”

The trend may also be due to more sophisticated investors using gold as a hedge and diversification and increasing allocations to gold during the late summer and early autumn months which traditionally see weakness in stock markets.

Timing markets is extremely difficult - even for the few successful traders. However, there are clear seasonal patterns that long term physical gold buyers can use to their advantage.