Unobtanium

Big Eyed Bug

- Messages

- 462

- Reaction score

- 21

- Points

- 143

Buy Silver – the War Against the China Bears Begins

Dr. Alex Cowie

http://www.silverbearcafe.com/private/02.13/buysilver.html

Here are some excerpts from the article:

Dr. Alex Cowie

http://www.silverbearcafe.com/private/02.13/buysilver.html

Here are some excerpts from the article:

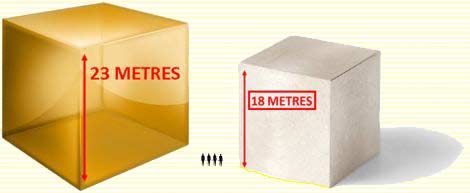

If you took all the gold bullion in the world, and melted it into a single cube, this would measure just 23 metres on each side. To use a timely illustration, it means that all of the world’s gold would fit on two tennis courts.

The world’s silver bullion would fit in a cube measuring just 17.9 metres on each side.

And I’m being generous here, using the largest estimate of the total investible silver bullion I would trust. According to CPM Group, the total global inventory for silver bullion is 1.9 billion ounces. This includes 711moz in futures exchanges, 38moz government stocks, 941moz in coin form and the rest in inferred & unreported private holdings.

Many analysts are less generous, and most work on the basis of just one billion ounces of silver. That would equate to a cube just 14.4 metres on each side

Source: Diggers and Drillers

So here’s a thought: When there is clearly far less silver bullion in circulation than gold… then why is silver 53 times cheaper than gold?

But the core reason for the different price is that gold is primarily an investors metal, be it punter, hedge fund or central bank – they are buying for its investment qualities.

Whereas silver has long been an industrial metal, with a few investors making up a portion of purchases.

But this is changing.

As recently as 2007, investment demand was just 5% of the market.

By 2012 investment demand was 30% of the market.

And this is where China comes in.

Chinese precious metals demand has exploded recently.

All the press focus on the gold side of the story, as China’s hunger for gold means it’s now the main player in the market. That’s what happens when an economy grows in size five-fold in a decade, and gold ownership becomes legal (and encouraged) along the way!

But the silver story is just as bullish.

The key point here is that China has only recently switched from being a silver exporter, to a silver IMPORTER.

Investors often wish that someone would ring a bell to signal the turning point in a market. Well this is just about as close as you’ll get. Whenever China’s hunger for any particular commodity has forced them to import the commodity, it has been a watershed moment.

Although Chinese gold imports have soared to record levels recently, China actually became a significant net importer of gold (5 tonnes/month) as far back as 2007.

And since then the gold price has climbed from $600/oz, to $1650/oz. China is still there now, buying all the dips with their ears pinned back.

Today silver is looking at a similar transformative event in its market as China is now a net importer here too. What’s great for investors today is that this has only just happened, which means you have time to act.

This is very bullish, and the last time we saw this pattern was back in 2010. And it was the prelude to the mother of all silver rallies, which saw the silver price more than double in just nine months.

I can’t tell you when exactly silver’s next move will begin. It could be a month, it could be six months. It doesn’t really matter. Silver is an investment to hold for many years – so waiting half a year for the move is immaterial. All that matters is buying it cheaply, before the rally happens.

But here’s something to think about. Chinese silver demand was a big factor in that nine month rally that saw silver more than double. So with China now making a clear move into the silver market today, we could well see more of the same.

With such a small amount of silver bullion available today, it really won’t take much Chinese demand to make a big difference to the silver price!

Dr Alex Cowie

Editor, Diggers & Drillers