11C1P

Yellow Jacket

I find their lack of mentioning PM's as an investment option, disturbing! :sad$:

http://www.msn.com/en-us/money/mark...counts/ar-BBEquvw?li=BBnb7Kz&ocid=mailsignout

Cash — or something close to it — is king again.

Enjoying a steady job market but reluctant to spend freely due to economic uncertainty, a wide swath of middle-class Americans are hoarding money in banks.

Total bank deposits rose 6.6% last year to $10.7 trillion, extending steady growth seen in recent years, data from the Federal Deposit Insurance Corporation show.

Deposits measured as a percentage of bank assets are 77.6% in the first quarter of 2017, the highest since 2006, according to data economic research firm Moebs Services.

And Americans love liquidity. They hold about $2 trillion in checking account now, says Mike Moebs, CEO of Moebs Services, which provides research and consultancy services to financial institutions. The average U.S. checking account deposit is about $3,600, climbing from $1,000 in 2007, he says.

Much of deposit growth surely has to do with the resilient U.S. economy that continues to expand from the depths of the financial crisis. Steady paychecks are the industry's best friend.

"Incomes are up and people are choosing to deposit (their money) rather than increase spending," says Paul Merski, group executive vice president of congressional relations and strategy for the Independent Community Bankers of America.

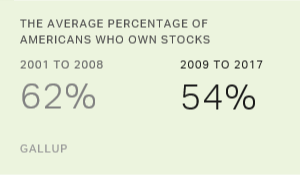

A dearth of investment options is also driving the hoarding behavior. Only about half of Americans are invested in the stock market, according to Gallup. And other common options, such as certificates of deposits and savings accounts, are offering interest rates that are barely above those of checking accounts.

While saving is deemed a personal finance virtue, would-be shoppers holding tightly onto their budgets can also be a drag on the economy. U.S. consumer spending was relatively flat, up only 0.1% in May, the latest data from the Commerce Department show. Retail and auto sales have also been sluggish.

http://www.msn.com/en-us/money/mark...counts/ar-BBEquvw?li=BBnb7Kz&ocid=mailsignout

Cash — or something close to it — is king again.

Enjoying a steady job market but reluctant to spend freely due to economic uncertainty, a wide swath of middle-class Americans are hoarding money in banks.

Total bank deposits rose 6.6% last year to $10.7 trillion, extending steady growth seen in recent years, data from the Federal Deposit Insurance Corporation show.

Deposits measured as a percentage of bank assets are 77.6% in the first quarter of 2017, the highest since 2006, according to data economic research firm Moebs Services.

And Americans love liquidity. They hold about $2 trillion in checking account now, says Mike Moebs, CEO of Moebs Services, which provides research and consultancy services to financial institutions. The average U.S. checking account deposit is about $3,600, climbing from $1,000 in 2007, he says.

Much of deposit growth surely has to do with the resilient U.S. economy that continues to expand from the depths of the financial crisis. Steady paychecks are the industry's best friend.

"Incomes are up and people are choosing to deposit (their money) rather than increase spending," says Paul Merski, group executive vice president of congressional relations and strategy for the Independent Community Bankers of America.

A dearth of investment options is also driving the hoarding behavior. Only about half of Americans are invested in the stock market, according to Gallup. And other common options, such as certificates of deposits and savings accounts, are offering interest rates that are barely above those of checking accounts.

While saving is deemed a personal finance virtue, would-be shoppers holding tightly onto their budgets can also be a drag on the economy. U.S. consumer spending was relatively flat, up only 0.1% in May, the latest data from the Commerce Department show. Retail and auto sales have also been sluggish.