- Messages

- 471

- Reaction score

- 305

- Points

- 168

COMEX is the primary futures and options market for trading metals such as gold, silver, copper, and aluminum. COMEX is an abbreviation of the exchange's full name: The Commodity Exchange Inc.

COMEX merged with the New York Mercantile Exchange (NYMEX) in 1994 and became the platform responsible for its metals trading.

In 2008, the CME Group purchased the NYMEX, including its COMEX division.

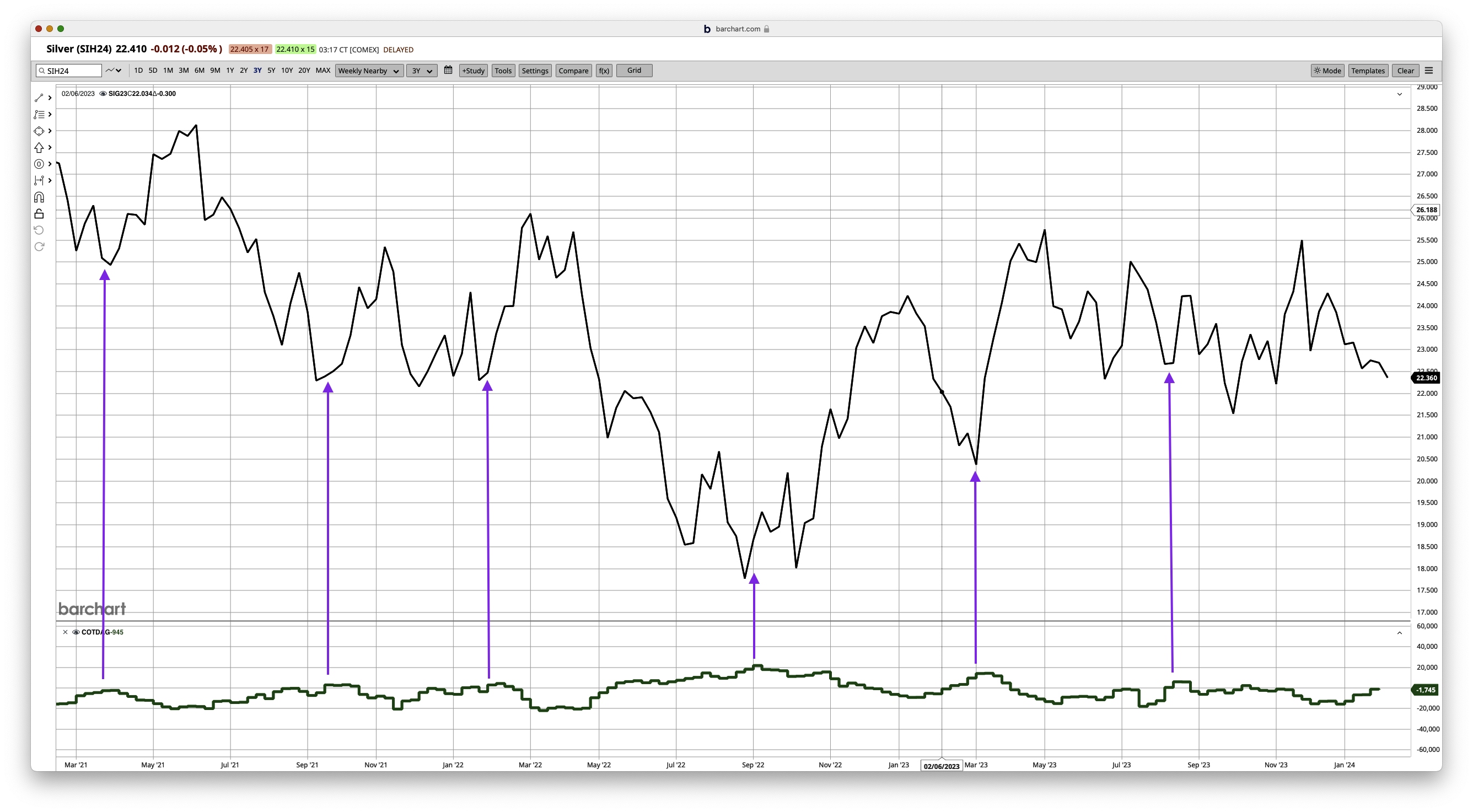

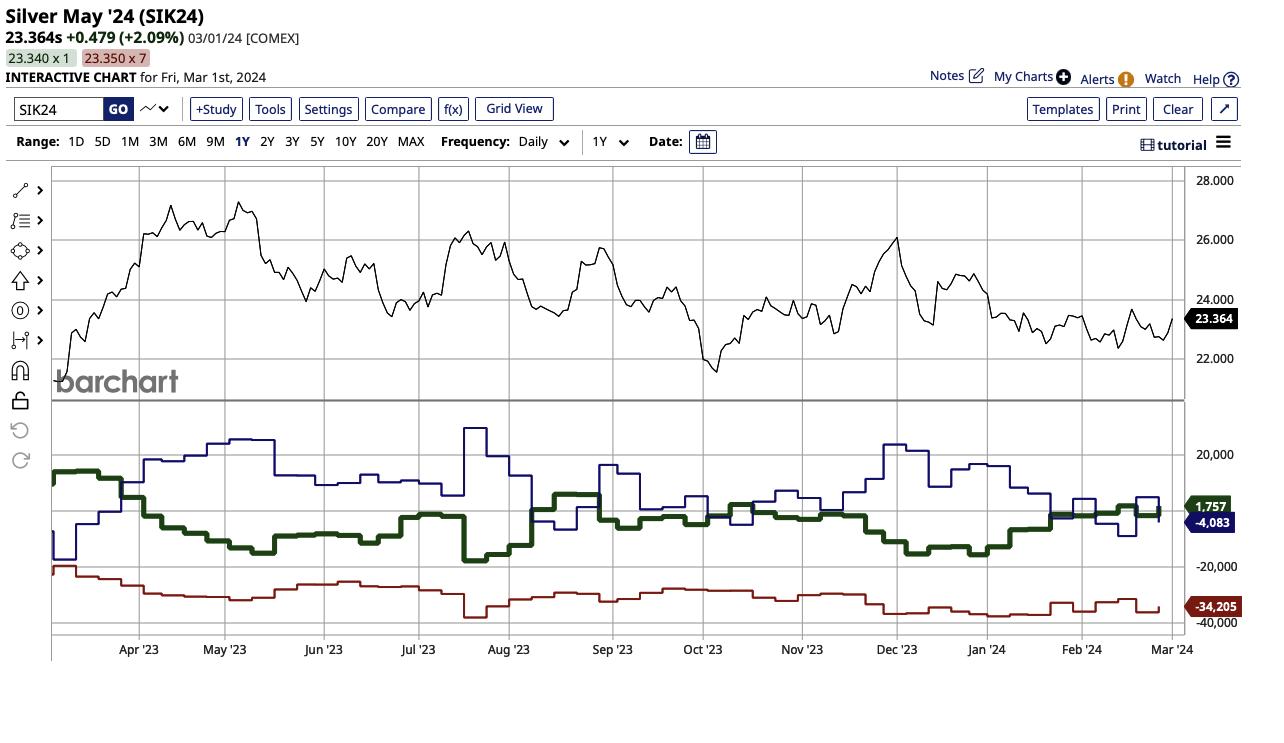

The Commitment of Traders (COT) report is a weekly publication that shows the aggregate holdings of different participants in the U.S. futures market. Published every Friday by the Commodity Futures Trading Commission (CFTC) at 3:30 E.T., the COT report is a snapshot of the commitment of the classified trading groups as of Tuesday that same week.

The report provides investors with up-to-date information on futures market operations and increases the transparency of these complex exchanges. It is used by many futures traders as a market signal on which to trade.

investopedia.com

COMEX merged with the New York Mercantile Exchange (NYMEX) in 1994 and became the platform responsible for its metals trading.

In 2008, the CME Group purchased the NYMEX, including its COMEX division.

- COMEX is the world's largest futures and options trading for metals.

- It is a division of the Chicago Mercantile Exchange (CME) Group.

- Metals futures are mostly used for hedging and are not typically delivered.

- The COMEX does not supply metals but instead acts as an intermediary.

The Commitment of Traders (COT) report is a weekly publication that shows the aggregate holdings of different participants in the U.S. futures market. Published every Friday by the Commodity Futures Trading Commission (CFTC) at 3:30 E.T., the COT report is a snapshot of the commitment of the classified trading groups as of Tuesday that same week.

The report provides investors with up-to-date information on futures market operations and increases the transparency of these complex exchanges. It is used by many futures traders as a market signal on which to trade.

investopedia.com