...

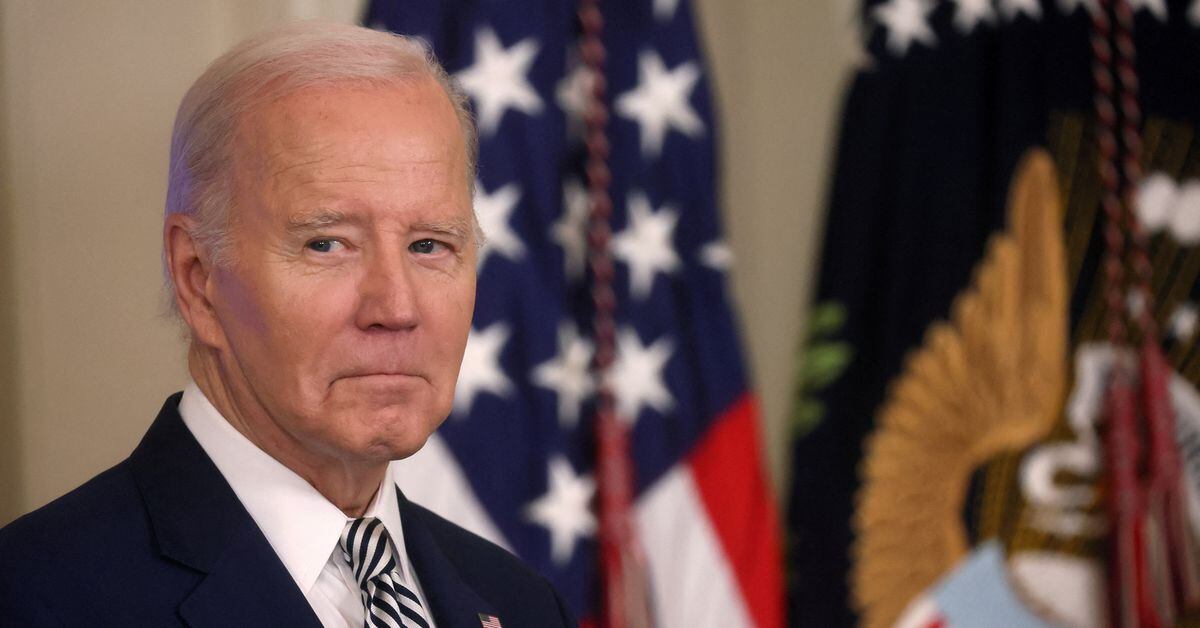

President Joe Biden, along with Federal Trade Commission Chair Lina Khan and Consumer Financial Protection Bureau Director Rohit Chopra, will reveal new policy proposals from the two agencies aimed at banning junk fees in certain sectors.

The FTC's rule proposal would prohibit businesses from burying fees within a transaction and force them to present the amount and purpose of surcharges, upfront — potentially saving consumers over $10 billion over the next decade, according to a release. Under the rule, the commission would be able to secure refunds for consumers if the mandate is violated.

...

The CFPB is targeting big banks by highlighting consumers' rights to access complete, accurate and free account information upon request according to a 2010 federal law.

"When people request basic information about their accounts, big banks cannot charge them massive fees or trap them in endless customer service loops," Chopra told reporters on Tuesday. "Charging a competitive price for a legitimate service makes sense but charging junk fees for basic customer responsiveness doesn't.

The CFPB has slapped Wells Fargo, Bank of America and Regions Bank with fines, citing extraneous overdraft fees or overcharges in recent years. Further, to address big banks' monopoly, the bureau will issue a proposal later this month to require financial companies to allow the easy transfer of customers' banking transaction data to competitors.

...

Both the FTC and the CFPB have taken preliminary actions toward cracking down on junk fees over the past few months. Earlier this year, the CFPB released a rule proposal on excessive credit card fees, while the FTC began targeting unfair practices in ticketing and other fees in late 2022.

The commission will consider a final rule after a 60-day comment period, according to a senior administration official.

White House announces new efforts to crack down on 'tens of billions' in junk fees

The White House, in partnership with the Federal Trade Commission and the Consumer Financial Protection Bureau, will reveal plans aimed at banning junk fees.

Banks will look to replace any lost revenue from this by other means. The consumer will not get a free lunch.