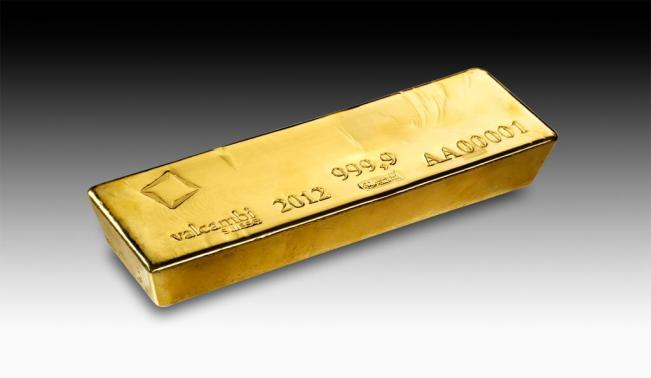

Not often in financial markets is the future price of gold is lower than the spot price (live), but lately we’ve witnessed such an event in both the New York and London gold market. This is called backwardation, the opposite of contango.

What causes backwardation and will it increase the price of gold? In my opinion there are two possible scenarios: the market expects the gold price to fall in the future, or there is scarcity now.

...

We could say, negative GOFO signals scarcity in the gold market. Unfortunately the LBMA ceased publishing GOFO rates with effect from 30 January 2015 “following discussions between the LBMA and … Market Makers”. Ironically, GOFO rates went dark right after dipping into negative territory in 2013 and 2014.

...

Currently there is said to be scarcity in gold in the market. Which of the two scenarios described above is true will be exposed in the future!

More:

New York & London Gold In Backwardation

Not often in financial markets is the future price of gold is lower than the spot price, but currently in London...

Koos elaborates on the case for both scenarios. Click the link for the details.

Last edited:

This post may contain affiliate links for which PM Bug gold and silver discussion forum may be compensated.