Mining student

Fly on the Wall

- Messages

- 16

- Reaction score

- 1

- Points

- 13

Abcourt Mines Stock is a good gold long term investment stock because in the last 5 years Abcourt Mines saw its revenue grow at 34% per year. Even measured against other revenue-focused companies, that's a good result. Arguably, this is well and truly reflected in the strong share price gain of 44%(per year) over the same period. Despite the strong run, top performers like Abcourt Mines have been known to go on winning for decades. On the face of it, this looks like a good opportunity, although we note sentiment seems very positive already.

Abcourt price stock right now 10/29/2020 $0.18 CAD.

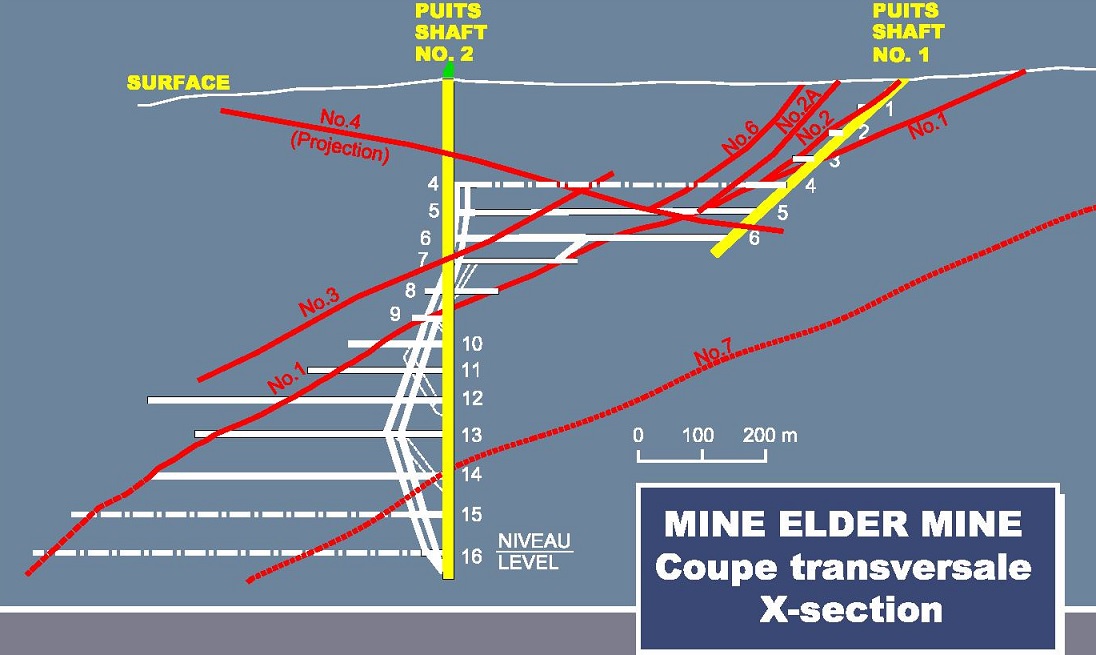

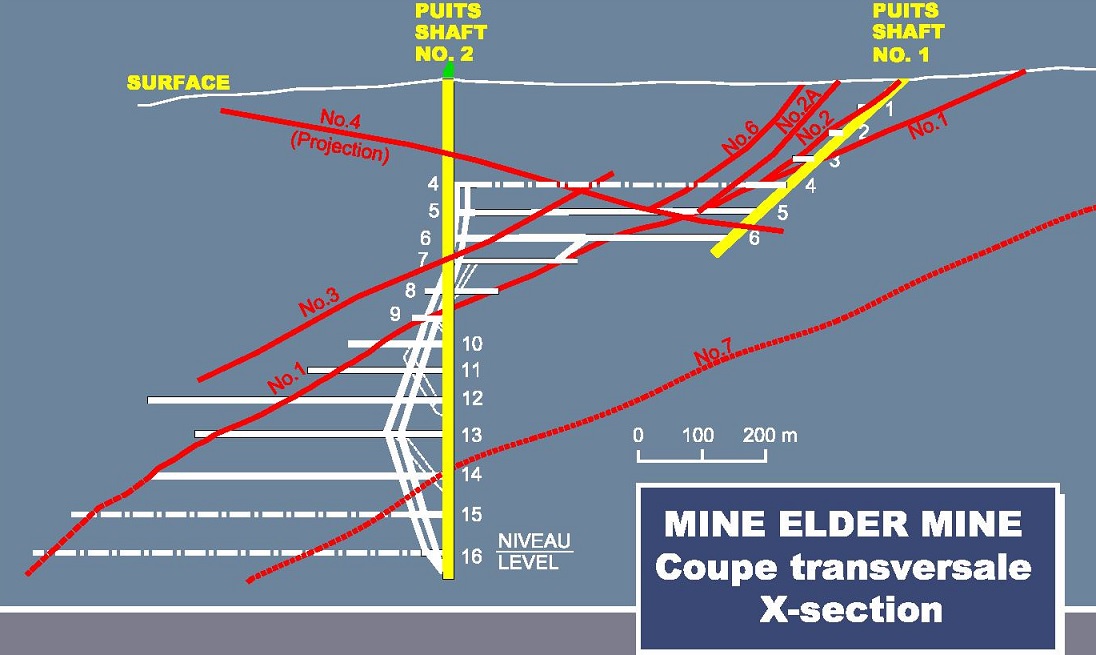

February 15, 2018, The surface drilling at Elder Mine found and has intersected an excellent value in gold. Mr. Renaud Hinse, President and Chief Executive Officer of Abcourt Mines Inc. is pleased to announce that excellent results were obtained in a recent surface drilling program at the Elder mine. Forty-four holes were drilled, for a total of 7,288 meters. At the Elder mine, the No.1 vein is the main vein. It extends over a strike distance of about 650 meters, from surface to the bottom of the mine. The dip is 22 degrees to the South. It is accompanied by vein #3 and #6 with the same strike and dip. There are also veins No.2 and No.2A, from the 4th level to surface, with the same strike and a dip of 40 degrees S and vein No.4 with a North-South direction and a dip of 22 degrees to the East.

March 12, 2018, Abcourt announces their excellent operation and financial results for Elder Mine for the the three-moth and six-month periods that ended December 31,2017

Mont-St-Hilaire, Québec, Canada, March 12, 2018

Mr. Renaud Hinse, President and Chief Executive Officer of Abcourt Mines Inc. is pleased to announce excellent operating and financial results for the Elder mine for the three-month and six-month periods ended December 31, 2017.

Highlights and future plans are as follows I’ll also update what future they manage to accomplish. These plans are the plans they made in March 12, 2018.

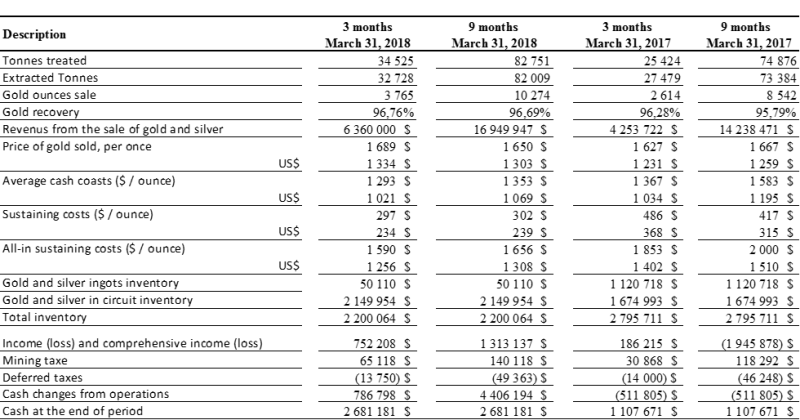

Abcourt manages to sold 4,225 ounces of gold at an average price of CAN $1,627 (US $1,281) in the second quarter with revenues of $6,873,133

Sale for the semester ended December 31, 2017, of 6,509 ounces of gold at an average price of CAN $1,627 (US $1,289) for a total revenue of $10,589,947;

They also manage to have a net income for the quarter of $784,748 and for the semester of $510,929. Their gross profit for the quarter of $1,023,283 and for the semester of $886,014. Abcourt also managed to have a substantial increase in tonnes treated at Sleeping Giant mill, an increase of 42% over the previous quarter. And their average production cash costs (1) for the quarter was CAN $1,293 (US $1,018) per ounce, a decrease of 5% over the same quarter of the previous year which was CAN $1,358 (US $1,020) per ounce. In 2017, important maintenance costs to the Sleeping Giant mill resulted in an upward impact on the average production cash costs (1);

• All-in sustaining costs (1) of CAN $1,526 (US $1,202) per ounce, a decrease of 15% over the all-in sustaining costs (1) for the year 2017 which was CAN $1,810 (US $1,387) per ounce;

• Abcourt reaches its production costs reduction objectives. The operating cash-flow of the company was $1,187,150 for the six-month period ended December 31, 2017. Their Cash balance at the end of the quarter was CAN $3,346,810 including the net proceed of $995,212 related to a private financing completed on December 21, 2017 and in amounts receivables of $1,160,723 mainly from the sale of gold;

• A surface drilling program was started in September on the Elder property. Several good intersections were cut. This program was continued to the end of December. Additional exploration and definition drilling is planned for 2018;

• In 2018, about 8000 meters of drilling is planned on the Aldermac, Discovery and Dormex properties;

The focus of Abcourt is on increasing the Elder production to 12,000 tonnes per month. The new work schedule introduced at the end of November 2017 increased the working hours per month and will help reach our production goal;

• Abcourt maintains its goal to increase the overall profitability of the Company with a close control on Elder mine and Sleeping Giant mill production costs and by improving the Elder mine production grade

Abcourt price stock right now 10/29/2020 $0.18 CAD.

February 15, 2018, The surface drilling at Elder Mine found and has intersected an excellent value in gold. Mr. Renaud Hinse, President and Chief Executive Officer of Abcourt Mines Inc. is pleased to announce that excellent results were obtained in a recent surface drilling program at the Elder mine. Forty-four holes were drilled, for a total of 7,288 meters. At the Elder mine, the No.1 vein is the main vein. It extends over a strike distance of about 650 meters, from surface to the bottom of the mine. The dip is 22 degrees to the South. It is accompanied by vein #3 and #6 with the same strike and dip. There are also veins No.2 and No.2A, from the 4th level to surface, with the same strike and a dip of 40 degrees S and vein No.4 with a North-South direction and a dip of 22 degrees to the East.

March 12, 2018, Abcourt announces their excellent operation and financial results for Elder Mine for the the three-moth and six-month periods that ended December 31,2017

Mont-St-Hilaire, Québec, Canada, March 12, 2018

Mr. Renaud Hinse, President and Chief Executive Officer of Abcourt Mines Inc. is pleased to announce excellent operating and financial results for the Elder mine for the three-month and six-month periods ended December 31, 2017.

Highlights and future plans are as follows I’ll also update what future they manage to accomplish. These plans are the plans they made in March 12, 2018.

Abcourt manages to sold 4,225 ounces of gold at an average price of CAN $1,627 (US $1,281) in the second quarter with revenues of $6,873,133

Sale for the semester ended December 31, 2017, of 6,509 ounces of gold at an average price of CAN $1,627 (US $1,289) for a total revenue of $10,589,947;

They also manage to have a net income for the quarter of $784,748 and for the semester of $510,929. Their gross profit for the quarter of $1,023,283 and for the semester of $886,014. Abcourt also managed to have a substantial increase in tonnes treated at Sleeping Giant mill, an increase of 42% over the previous quarter. And their average production cash costs (1) for the quarter was CAN $1,293 (US $1,018) per ounce, a decrease of 5% over the same quarter of the previous year which was CAN $1,358 (US $1,020) per ounce. In 2017, important maintenance costs to the Sleeping Giant mill resulted in an upward impact on the average production cash costs (1);

• All-in sustaining costs (1) of CAN $1,526 (US $1,202) per ounce, a decrease of 15% over the all-in sustaining costs (1) for the year 2017 which was CAN $1,810 (US $1,387) per ounce;

• Abcourt reaches its production costs reduction objectives. The operating cash-flow of the company was $1,187,150 for the six-month period ended December 31, 2017. Their Cash balance at the end of the quarter was CAN $3,346,810 including the net proceed of $995,212 related to a private financing completed on December 21, 2017 and in amounts receivables of $1,160,723 mainly from the sale of gold;

• A surface drilling program was started in September on the Elder property. Several good intersections were cut. This program was continued to the end of December. Additional exploration and definition drilling is planned for 2018;

• In 2018, about 8000 meters of drilling is planned on the Aldermac, Discovery and Dormex properties;

The focus of Abcourt is on increasing the Elder production to 12,000 tonnes per month. The new work schedule introduced at the end of November 2017 increased the working hours per month and will help reach our production goal;

• Abcourt maintains its goal to increase the overall profitability of the Company with a close control on Elder mine and Sleeping Giant mill production costs and by improving the Elder mine production grade