You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

IRS clarifies requirements for 1099b reporting for gold and silver

- Thread starter pmbug

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

Viking

Yellow Jacket

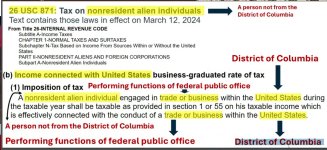

Most brokers are committing fraud when they send in a 1099b.

- Messages

- 506

- Reaction score

- 423

- Points

- 238

Thank you, that is interesting. Could you expand on that? I have bought and sold over the decades. And I will again. I would welcome more discussion on this.Most brokers are committing fraud when they send in a 1099b.

Viking

Yellow Jacket

This is for the 1099-S, real estate brokers. But the wording is the same as far as I read.Thank you, that is interesting. Could you expand on that? I have bought and sold over the decades. And I will again. I would welcome more discussion on this.

Attachments

Viking

Yellow Jacket

If you want to learn more about taxation:

Tinyurl.com/LiveTaxFree

Tinyurl.com/LiveTaxFree

Viking

Yellow Jacket

Here he goes into broker for real estate:

More videos:

More videos:

Late to the party; but the first post was exactly what I needed to hear/learn.