Potemkin

Predaceous Stink Bug

- Messages

- 213

- Reaction score

- 1

- Points

- 0

I'm not at all discouraged by the previous gold crash. Even the bargain-hunting pushed gold above 1,300 $ and I allow myself to hope for it to climb above 1,500 $ again.

To me, the signals, the signs are becoming clearer... this was a profit-taking short-selling dip. Perhaps the silence before the storm as someone wrote on a blog that I read a short while ago...

If we take account of a few key facts, indeed - precious metals are still very good investments:

http://www.primevalues.org/market-watch/why-still-believe-value-pms.htm

If I was a Cypriot, I'd like to have silver or gold in my hands...

Knowing that the Fed is keeping interest rates "tied down" until 2015,... makes me believe they are going to let go of the inflation after that. That's when we'll all be glad to have bought gold and silver!

Also, there might be a rally coming right now:

http://www.bullionbaron.com/2013/02/more-on-capitulation-in-gold-silver.html?m=1

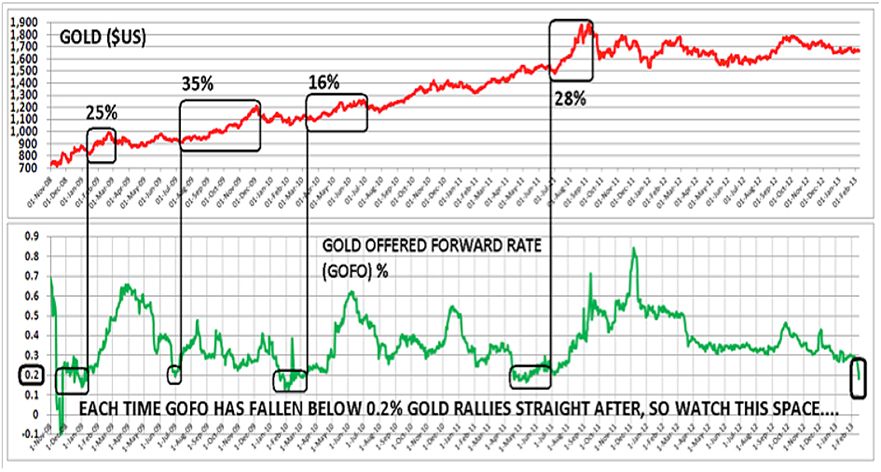

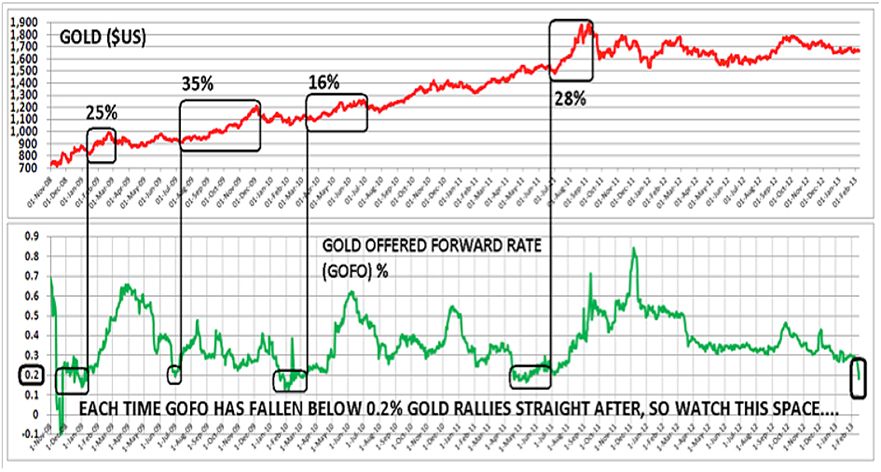

The Gold GOFO just turned negative. Although I'm still learning about PM's... a bug, but no expert - I admit - From what I understand this could signal the next bull run:

It's strange that we're all worried about precious metals' prices in dollars. Why not worry about the worth of dollars?

It's deceiving to believe that this crash destroyed the REAL worth of these metals.

This "GOFO" might be a signal to "go for" it, so I'm into investing again

What I find interesting now is platinum: it didn't crash. Unlike gold and silver. Probably because there are no platinum ETF's.

It's great to own a bit of platinum now.

If the "gold era" were over (as the media, Roubini and others are saying), then why are platinum, palladium still holding on so well? Because the crash was artificial.

I don't think I have any doubt about investing in precious metals any more, no matter what the news are saying...

Following the agonizing news in the media and watching gold price fall for months... fearing my stack like for my kids, I now feel like I finally "found god" and believe in the price recovery.

Cheers :beer:

To me, the signals, the signs are becoming clearer... this was a profit-taking short-selling dip. Perhaps the silence before the storm as someone wrote on a blog that I read a short while ago...

If we take account of a few key facts, indeed - precious metals are still very good investments:

http://www.primevalues.org/market-watch/why-still-believe-value-pms.htm

If I was a Cypriot, I'd like to have silver or gold in my hands...

Knowing that the Fed is keeping interest rates "tied down" until 2015,... makes me believe they are going to let go of the inflation after that. That's when we'll all be glad to have bought gold and silver!

Also, there might be a rally coming right now:

http://www.bullionbaron.com/2013/02/more-on-capitulation-in-gold-silver.html?m=1

The Gold GOFO just turned negative. Although I'm still learning about PM's... a bug, but no expert - I admit - From what I understand this could signal the next bull run:

It's strange that we're all worried about precious metals' prices in dollars. Why not worry about the worth of dollars?

It's deceiving to believe that this crash destroyed the REAL worth of these metals.

This "GOFO" might be a signal to "go for" it, so I'm into investing again

What I find interesting now is platinum: it didn't crash. Unlike gold and silver. Probably because there are no platinum ETF's.

It's great to own a bit of platinum now.

If the "gold era" were over (as the media, Roubini and others are saying), then why are platinum, palladium still holding on so well? Because the crash was artificial.

I don't think I have any doubt about investing in precious metals any more, no matter what the news are saying...

Following the agonizing news in the media and watching gold price fall for months... fearing my stack like for my kids, I now feel like I finally "found god" and believe in the price recovery.

Cheers :beer: