The Silver Institute - Press Release said:Posted on 11 08, 2023

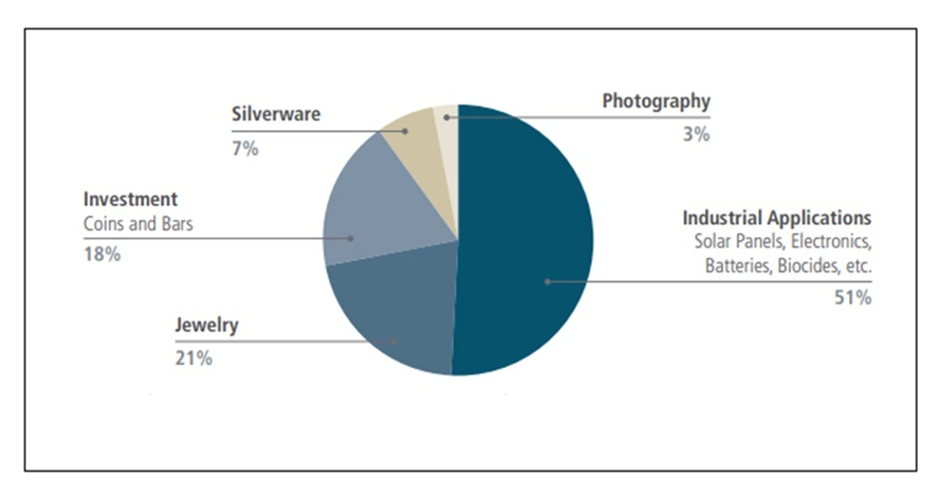

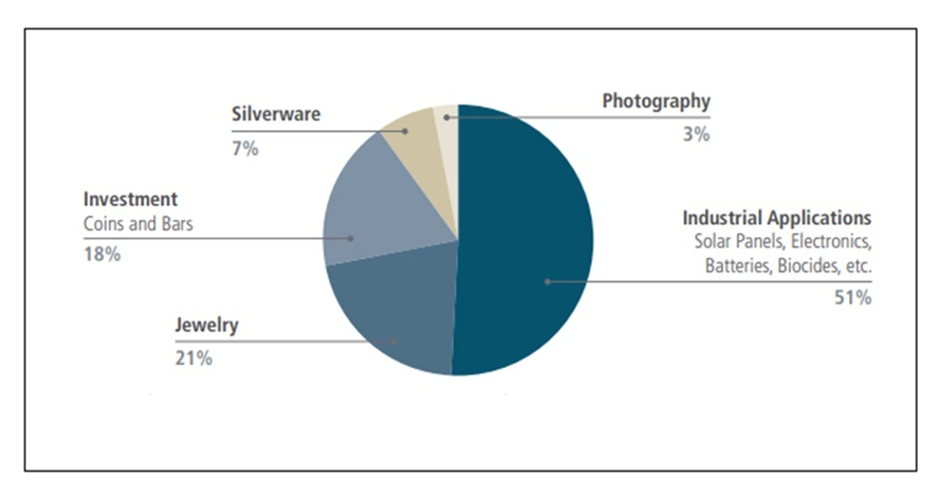

(Washington, D.C. – November 8, 2023) Three key sectors of global silver demand – industrial, jewelry and silverware – are significant drivers for annual silver consumption and accounted for nearly three-quarters of the world’s demand for silver in 2022. This stands in contrast to investment demand for silver, which was a sturdy 27 percent of overall silver demand last year. New research indicates that silver industrial demand is forecast to increase 46 percent through 2033, while jewelry and silverware demand is projected to rise 34 and 30 percent, respectively, according to Oxford Economics, a leading independent economic advisory and consultancy firm based in London.

Their report, “Fabrication Demand Drivers for Silver in the Industrial, Jewelry and Silverware Sectors Through 2033,” was commissioned by the Silver Institute to examine and forecast the growth rates of key sectors of global silver manufacturing demand, and to gain insight into how demand will change over the next decade. The consultancy found that the combined output of silver industrial, jewelry and silverware fabricators is forecast to increase 42 percent, effectively double the growth rate over the previous decade, 2014-2023.

The report finds that a few critical industries that use silver are forecast to experience strong output over the next decade, which is most likely to occur in Asia, particularly China. The report indicates that the forecasted increase in demand reflects the rapid growth in the output of the electrical and electronics applications industry, which is expected to grow by 55 percent over the decade. Silver’s use in solar energy and electric vehicles will help lead this category forward. The report also looks at the evolving demand for silver in brazing alloys, which alone consumed 9 percent of global industrial demand in 2022.

Oxford Economics forecasts that India will lead jewelry demand over the next ten years, but the report indicates that it may lose some of its silver jewelry dominance to China, as that country’s economic situation strengthens. Silverware demand is to continue to be led by India, but perhaps with a lower market share than it recorded in 2022.

The report also addresses why long-term forecasting is essential, and examines potential risks, such as structural changes like thrifting or possible global economic challenges.

To download the complimentary report, please click here.

...

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Demand Drivers (and vault totals)

- Thread starter pmbug

- Start date

- Featured

-

- Tags

- physical demand

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

The Silver Institute - Press Release said:Global Silver Industrial Demand Forecast to Achieve New High in 2023

Posted on 11 16, 2023

Silver Market Expected to Register Another Sizeable Structural Deficit

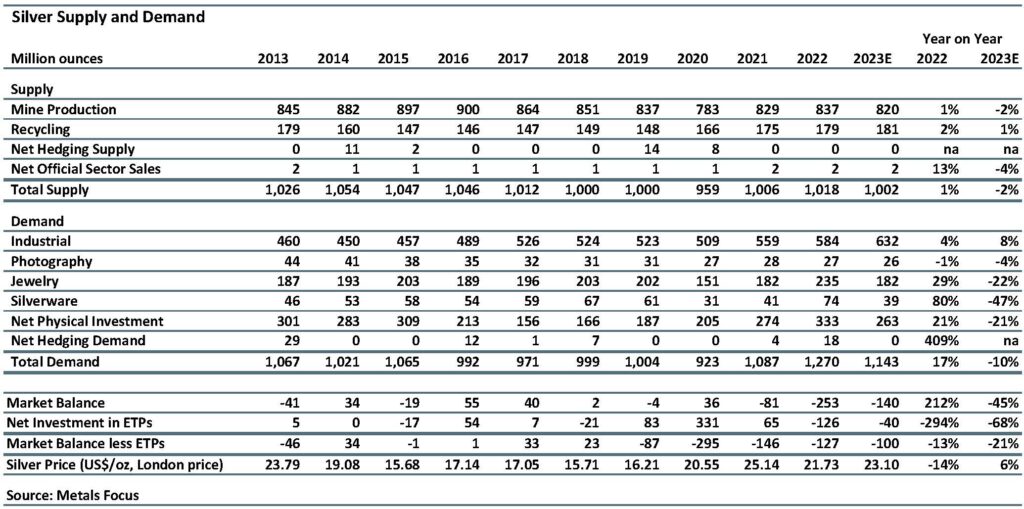

(November 15, 2023 – New York) – Silver Industrial demand is expected to grow 8% to a record 632 million ounces (Moz) this year. Key drivers behind this performance include investment in photovoltaics, power grid and 5G networks, growth in consumer electronics, and rising vehicle output. These key findings were reported by Philip Newman, Managing Director at Metals Focus, and Sarah Tomlinson, Director of Mine Supply, during the Silver Institute’s Annual Silver Industry Dinner in New York tonight, featuring historical supply and demand statistics and estimates for 2023. Other key highlights from their presentation include:

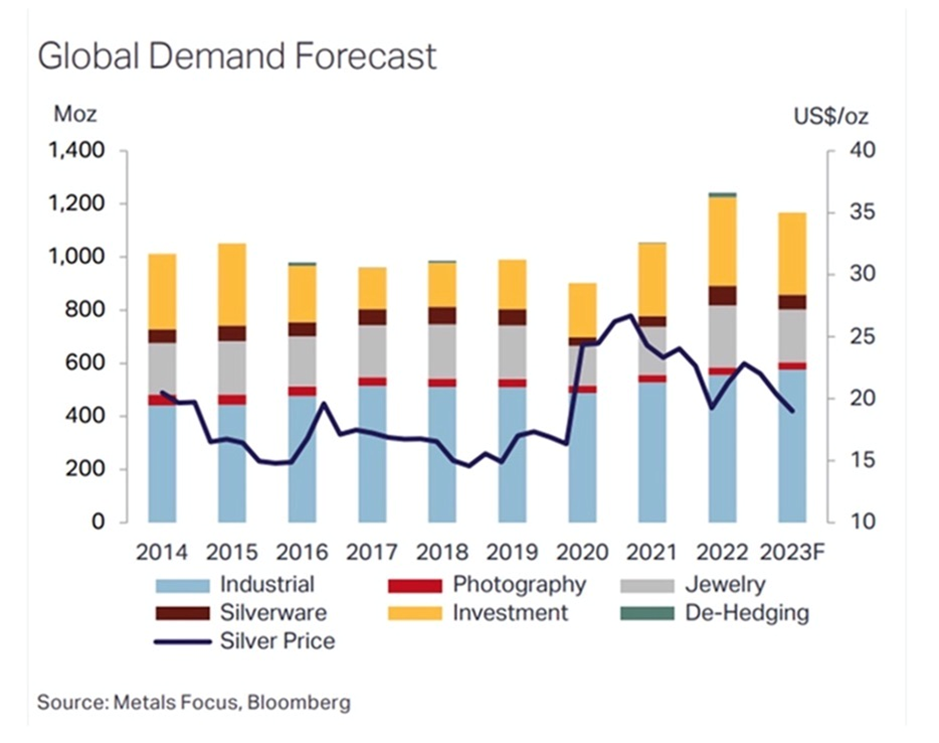

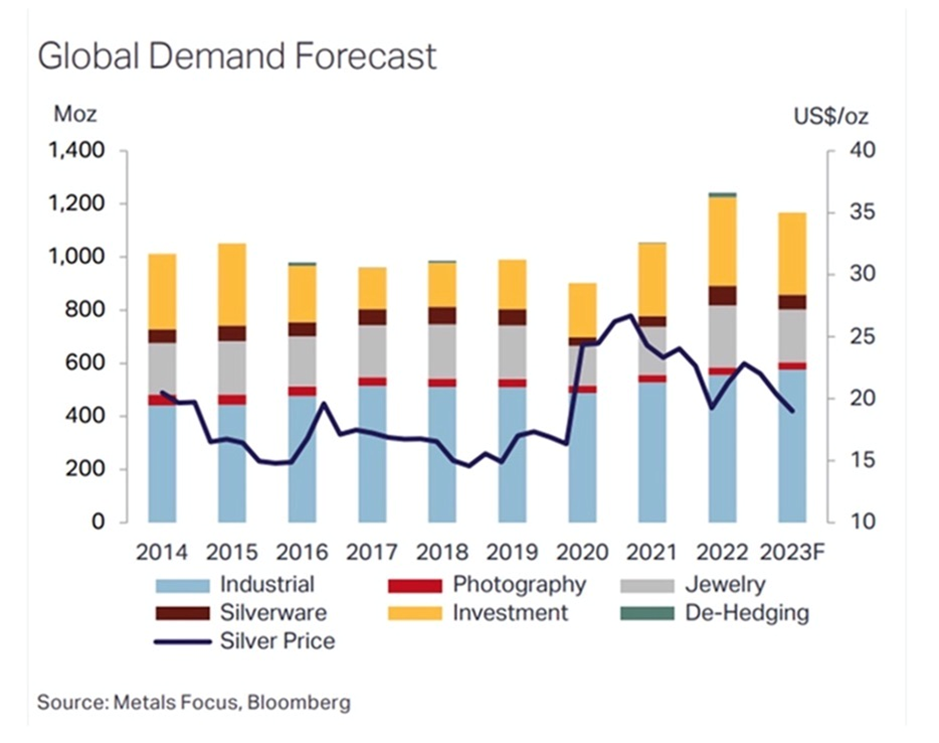

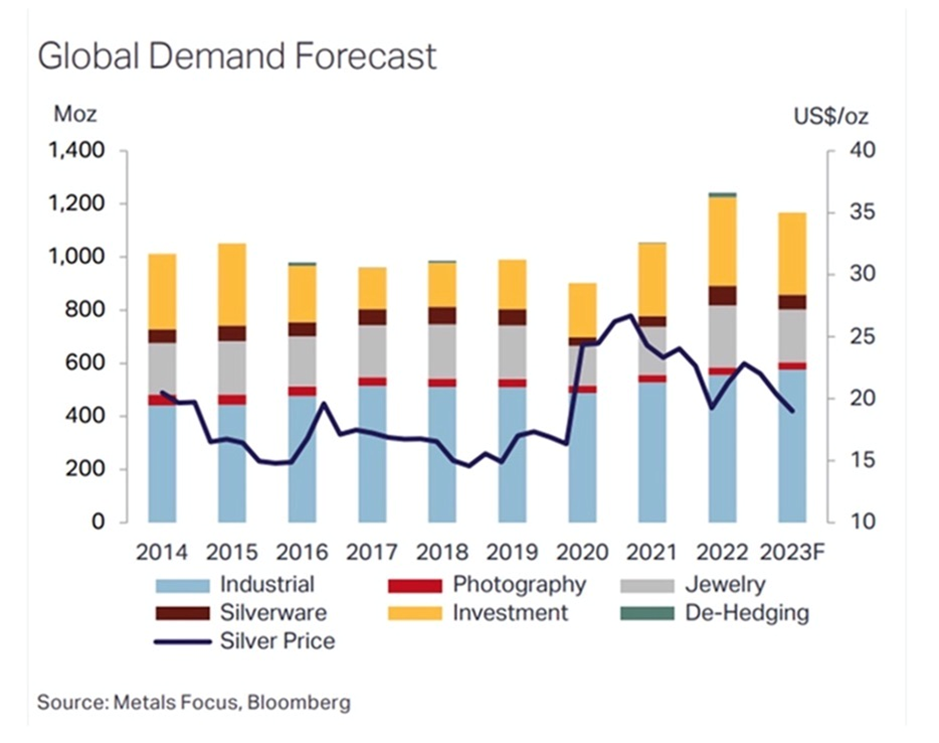

- Globally, total silver demand is forecast to ease by 10% to reach 1.14 billion ounces in 2023. Gains in industrial applications will be offset by losses in all other key segments. Despite the fall, total demand remains elevated by historical standards, making the 2023 figure the second highest in Metals Focus’ data series.

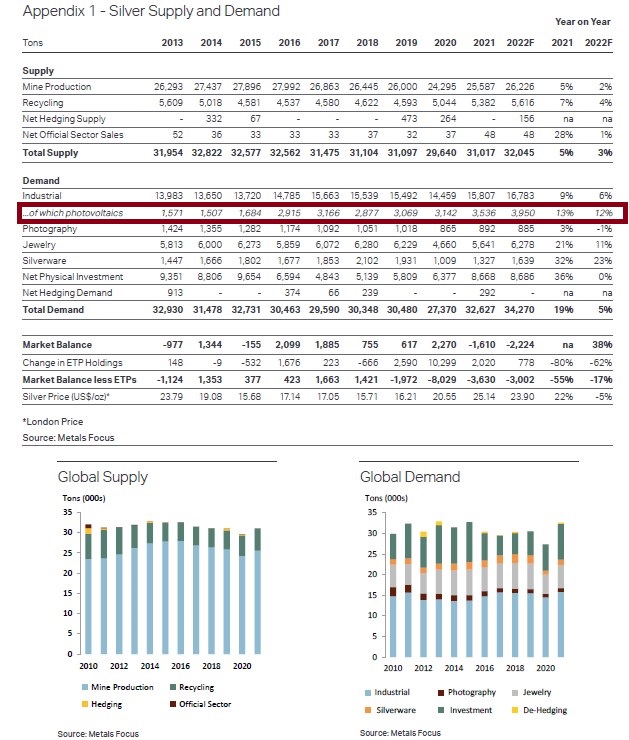

- Industrial demand in 2023 will achieve a new annual high. As noted above, key drivers in this growth are being driven by a strong green economy, including investment in photovoltaics (PV), power grids and 5G networks, as well as increased use of automotive electronics and supporting infrastructure. Improvements in (PV) were particularly noticeable as the increase in cell production exceeded silver thrifting, which helped drive electronics and electrical demand higher.

- Silver jewelry and silverware demand is set to fall by 22% and 47%, respectively, to 182 Moz and 39 Moz this year. For both, losses are led by India, where full-year demand is expected to normalize after a surge in 2022. Excluding India, global jewelry demand is expected to edge slightly higher in 2023, while silverware will fall by a notably smaller 12%.

- Physical investment in 2023 is projected to fall by 21% to a three-year low of 263 Moz. While most markets have seen weaker volumes, losses have been concentrated in India and Germany. In India, record high local prices both deterred new investor purchases and led to profit taking, resulting in a 46% decline. In Germany, investor sentiment was hit hard by the VAT hike to some silver coins at the start of 2023. US investment has also turned lower, but only modestly, thanks to buoyant safe haven demand following the regional banking crisis. The resilience of the US market helps explain why the global total stays historically high.

- Exchange-traded products are forecast to record net outflows for the second year in a row. As was the case in 2022, the bulk of year-to-date redemptions reflect continued monetary tightening and its consequential boost to yields, especially in real terms. However, the decline in holdings is expected to be more restrained at 40 Moz in 2023, roughly a third of 2022’s record outflows.

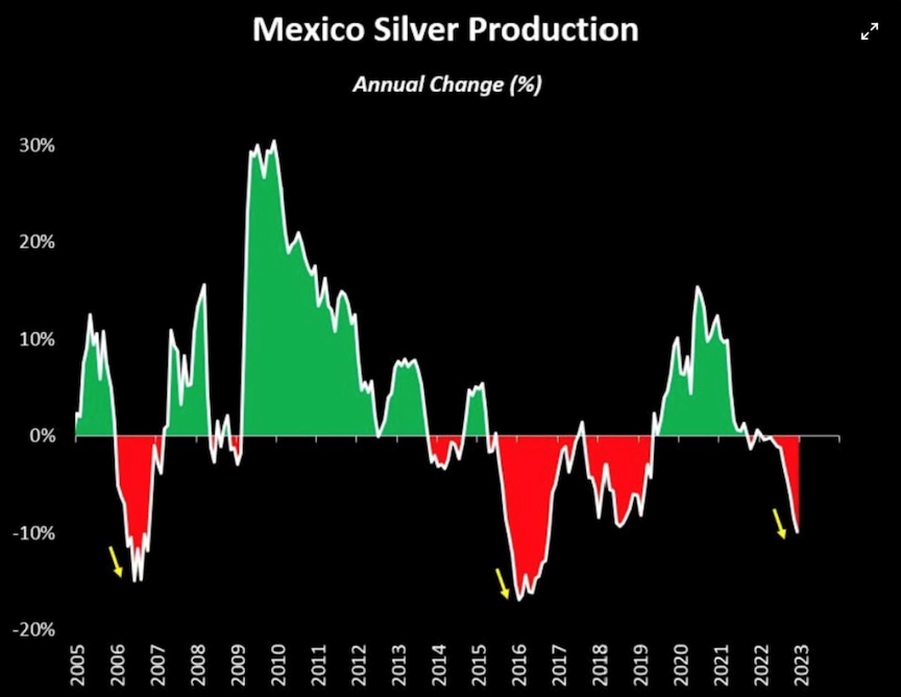

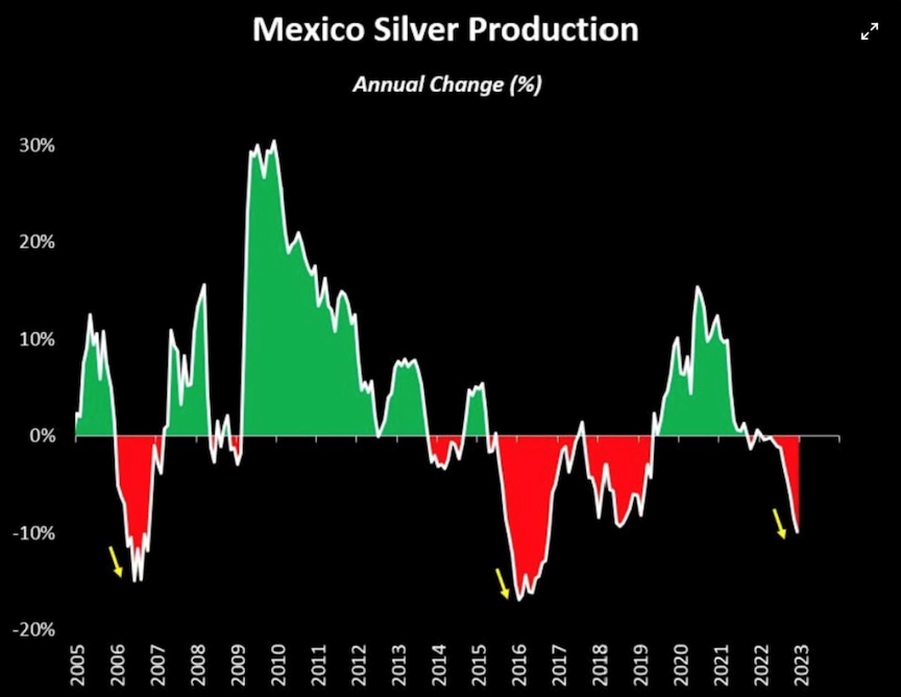

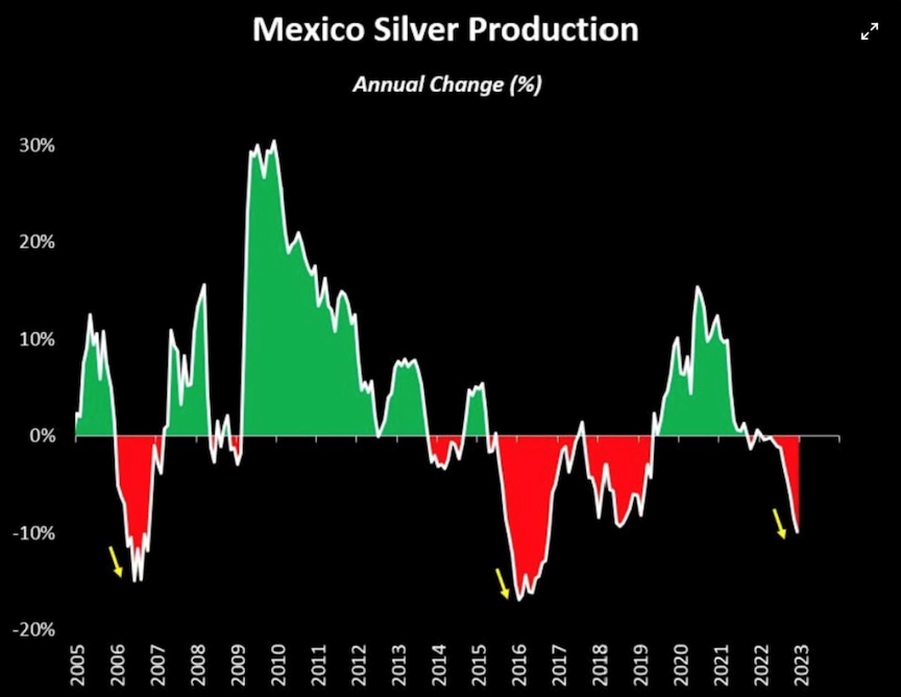

- In 2023, global mined silver production is expected to fall by 2% year-on-year to 820 Moz, driven by lower output from operations in Mexico and Peru. Production from Mexico is expected to fall by 16 Moz due to the impact of the suspension of operations at Peñasquito in Q2 and Q3 in response to the labor strike. Even so, overall production from primary silver mines will still rise this year, driven by the expected ramp-up at the Juanicipio mine. Output from lead/zinc mines will also increase as Udokan in Russia comes on-stream. A decrease in by-product credits, an increase in sustaining capital spending and inflation of input costs will all lead to double-digit year-on-year growth in AISC.

- Overall, despite weaker demand and a slight drop in total supply, the global silver market is forecast to see another sizeable physical deficit in 2023, marking the third consecutive year of an annual deficit. At 140 Moz, this will be 45% lower than 2022’s all-time high, but this is still elevated by historical standards. Just as important, Metals Focus believes the deficit will persist in the silver market for the foreseeable future.

- Metals Focus expects the average silver price to increase by 6% year-on-year to $23.10 this year. Through November 7, prices have grown by 8% year-on-year. Going forward, Metals Focus are firmly in the ‘higher for longer’ camp, as far as US interest rate expectations are concerned. This backdrop is not favorable for zero-yielding assets such as silver. The white metal’s investment appeal will also be hurt by poor confidence in industrial commodities due to a slowing Chinese economy. With this in mind, Metals Focus maintains a cautious outlook for the silver price for now and for much of 2024.

Global Silver Industrial Demand Forecast to Achieve New High in 2023 |

- Messages

- 27,067

- Reaction score

- 4,839

- Points

- 288

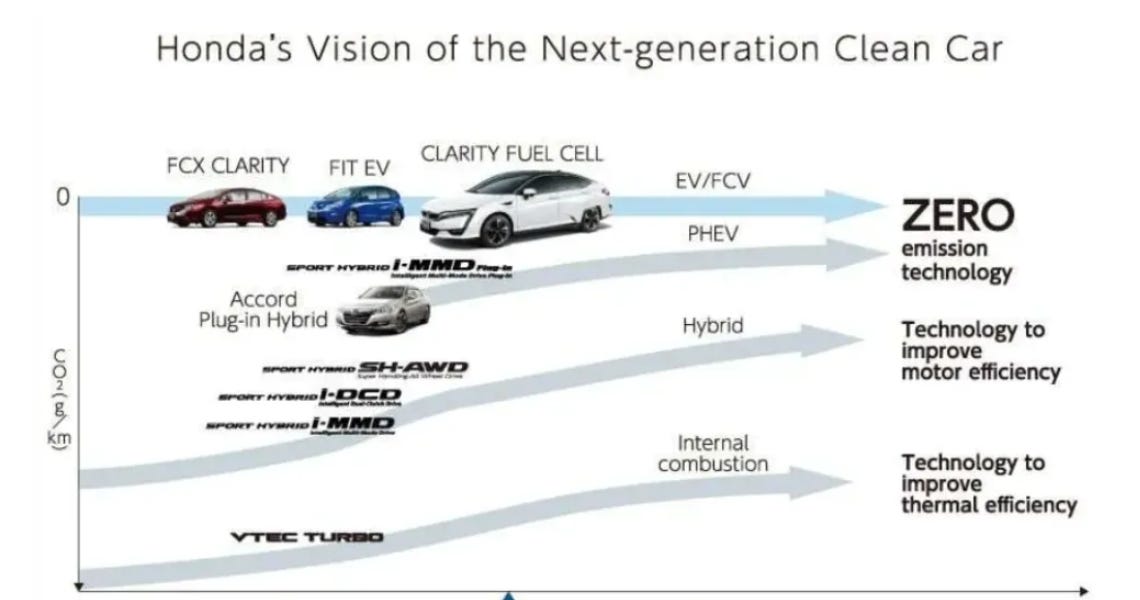

GAME-CHANGER! Silver Revolutionizes Fuel Cell Technology, Paving the Way for Fuel Cell Car Supremacy

By Jon Forrest LittleWhat is this News Article About?

Silver kicks Platinum out of the Fuel Cell Manufacturing Process Making Fuel Cell Cars Cost Competitive with EVs. Moreover, Fuel Cell Cars Perform Much Better than EVs.

A Brief look Back at Turning Points Considering Energy Transitions

There have been turning points in history when a new fuel source improved the villagers' lives.

The Industrial Revolution marked a significant shift from wood to coal as the primary energy source during the late 18th century. Coal's higher energy density and availability fueled the growth of steam-powered engines, revolutionizing industries and transportation in the 19th century.

Click the link to read the rest:

GAME-CHANGER! Silver Revolutionizes Fuel Cell Technology, Paving the Way for Fuel Cell Car Supremacy

Inexpensive silver is now replacing costly platinum in fuel cell technology. Fuel cell vehicles will CRUSH electric vehicle sales because of cheaper costs and much better performance.

I don't like when articles fail to cite sources. Anyway, I found the source for that claim:

www6.slac.stanford.edu

www6.slac.stanford.edu

... thanks to fundamental research stemming from the Department of Energy's SLAC National Accelerator Laboratory, Stanford University, and the Toyota Research Institute (TRI), that was recently translated to practice in a fuel cell device via a collaboration between Stanford and Technion Israel Institute of Technology.

...

... by substituting cheaper silver for some of the PGMs used in previous catalysts, they could achieve an equally effective fuel cell with a much lower price tag –and now that they have a proven method of developing catalysts, they can start testing more ambitious ideas. “We could try going entirely PGM-free,” said Jaramillo. ...

Researchers aim to make cheaper fuel cells a reality

The team reduced the amount of expensive platinum group metals needed to make an effective cell and found a new way to test future fuel cell innovations.

Umm, that thin-film still used PALLADIUM. So I guess they haven't noticed that was more expensive than Pt lately. Palladium does have some very unique properties with hydrogen. But this really isn't that much of a breakthrough. Nor much detail.

That news is only a couple of weeks old. It will take some time for industry to adopt the tech (and they will if it works and has significantly favorable economics). I don't know what the demand for the fuel cell market will be by the time this reaches critical mass adoption, but I have to think it's going to drive a bit of industrial silver demand while diminishing some demand for platinum.

...

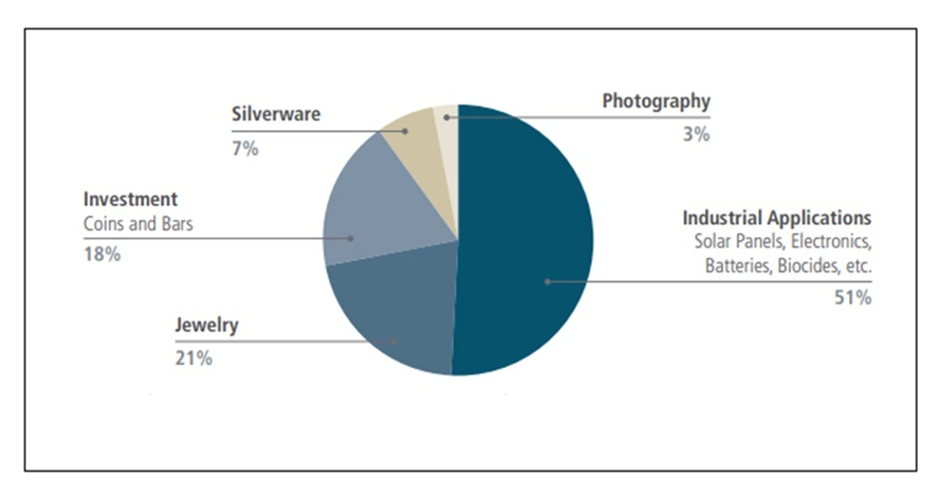

Apart from monetary easing, the green energy transition and artificial intelligence could be excellent demand stimuli for silver. After all, tech and industrial applications account for more than half of global silver demand.

For example, according to scientists at the University of New South Wales, solar manufacturers will likely need more than 20% of the current yearly silver supply by 2027. By 2050, solar panel production will consume almost 85-98% of the current global silver reserves.

However, artificial intelligence will require vast supplies of precious metals. According to Metals Focus, there will be a higher demand for chips powering AI technology. But in order to produce chips, precious metals are required. The demand for these stayed somewhat low due to the fact there was low global economic activity. For example, the demand for gold in the technology and industrial sector was down 3% year-on-year in the third quarter.

Due to the evolution of AI, however, this trend could change in the coming year, not just for gold, but also for silver. According to Metals Focus, shipping growth for artificial intelligence servers and switches will increase by double digits over the next several years to stay in line with the evolution of AI algorithms. Demand is also expected to increase for silver-palladium Ag-Pd multi-layer ceramic capacitors (MLCCs) in high-power components.

...

Silver May Surge To $100 Thanks To AI (NYSEARCA:SLV)

Silver prices could reach triple-digit valuations as the Fed considers easing monetary policies. Check here what investors should do with the precious metal.

BoA seems to think that fuel cell news is significant:

Silver prices will benefit from the growing demand for EVs and solar panels in 2024, and could also get a boost from a potential rebound in industrial demand, according to metals strategists at Bank of America.

In their recently published Metals and Mining Outlook for 2024, the BofA analysts said that several of the key factors that supported prices this year in an otherwise weak macro environment should also carry over into 2024.

...

Silver prices will see steady support from EV, solar in 2024, could spike with industrial rebound - Bank of America

(Kitco News) - Silver prices will benefit from the growing demand for EVs and solar panels in 2024, and could also get a boost from a potential rebound in industrial demand, according to metals strategists at Bank of America.

www.kitco.com

Ronan Manly - BullionStar said:There has been a significant imbalance in the physical silver market for the last 3 years with annual silver demand exceeding annual silver supply.

This is a problem since when silver demand is greater than silver supply, the extra demand (deficit) must be met by eating into the world’s finite and limited above-ground silver stockpiles.

This silver deficit has been so persistent and systemic that it is being described by the Silver Institute as a ‘structural deficit’ i.e. a prolonged deficit that is due to underlying ‘structural’ factors (technological advances and a sharply growing industrial demand), in an environment where supply (mine production and recycling) is unable to adjust upwards to keep pace with demand.

...

Given continued growth in silver demand across industrial / technology and investment sectors – with demand outpacing supply – coupled with falling mining output and seemingly unresponsive / inflexible supply from recycling, it is certain that the continued deficits in the silver market will continue to eat up above ground stockpiles

Structural silver deficits should in theory mean that the price of silver should rise significantly during 2024. This is Economics 101 on supply and demand.

...

More (very long and interesting):

Surging Silver Demand to Intensify Structural Deficit

The silver market is in a multiyear deficit with demand exceeding supply.

tl;dr: there is not enough supply to meet current demand for very long

Last edited:

This post may contain affiliate links for which PM Bug gold and silver discussion forum may be compensated.

Silver prices could be headed for an “explosive” rise in 2024 if global supplies continue to fall short of demand, and the Federal Reserve makes good on its plans to pivot to interest rate cuts in the coming months, according to metal-markets analysts.

...

“The window for buying silver in the low- to mid-$20s is ending,” said Peter Spina, president of silver news and information provider SilverSeek.com.

...

Global supply of silver, meanwhile, is expected to fall short of demand this year, for a third year in a row.

The “fundamentals for the silver market are extremely bullish,” Spina said, particularly with a structural deficit continuing for silver.

The report from the Silver Institute showed that global industrial demand for silver is expected to grow by 8% to a record 632 million ounces this year, buoyed by investment in photovoltaics — used in solar technology — power grid and 5G networks, growth in consumer electronics, and rising vehicle output.

The report showed 2023 global silver supply estimated at about 1 billion ounces, while total demand is seen at a larger 1.143 billion ounces. Metals Focus said it believes the deficit will “persist in the silver market for the foreseeable future.”

...

He expects silver prices to “re-challenge” $30 an ounce within the coming months, “if not sooner.”

Watch gold prices for the initial direction, he said. “If the gold price is moving to record price highs in the coming weeks, silver is in the perfect set-up to test $30, with a likely breakout to $50 [and ounce] coming in 2024.”

https://www.msn.com/en-us/money/mar...sed-for-an-explosive-move-in-2024/ar-AA1lz3AS

Cigarlover

Yellow Jacket

- Messages

- 1,483

- Reaction score

- 1,718

- Points

- 283

Global supplies are not falling short of demand though. Mining and recycling are falling short of demand but above ground stockpiles are plentiful. Somewhere between 2 and 56 billion ounces depending on who you want to believe and what they include in their metrics. London, NY and JPM alone are probably close to 2 billion. How many are in private investors hands? It's all available at the right price.Silver prices could be headed for an “explosive” rise in 2024 if global supplies continue to fall short of demand

... Mining and recycling are falling short of demand ...

I'm pretty sure that is what they meant (even if they used "supply" where they should have used "production"). Ronan Manly did a better job of breaking this down in the report mentioned in post #9. He (Ronan Manly) also points out that the above ground supply is not as plentiful as the Silver Institute/Metals Focus is reporting (because a significant percentage of vaulted silver is held by ETFs and not available to the industrial market).

- Messages

- 27,067

- Reaction score

- 4,839

- Points

- 288

2023: The Dawn of the Silver Boom

By: Chen Lin, chenpicks.comDecember 2023

2023 saw another year of the huge supply-demand deficit in silver, despite heavy investment selling. The most significant demand increase came from solar panels. In 2021, the Silver Institute and Metal Focus group were looking at PV (solar panel) using 110 million oz, growing at 12-13% per year. But in November 2023, the Silver Institute and Metal Focus group revised the 2023 estimate to about 200 million oz! In other words, in the past two years, over 100 million oz of silver was taken by the PV industry “unexpectedly”!

Read the rest:

2023: The Dawn of the Silver Boom

Historically, silver tends to do well in the later stage of a gold rally and usually hits a new high. That means silver will likely test the 50-dollar mark and is likely to exceed it.

Cigarlover

Yellow Jacket

- Messages

- 1,483

- Reaction score

- 1,718

- Points

- 283

How Much Silver Is Above Ground? |

Lets take a look at silver. Silver Institute hires GFMS to publish the World Silver Survey, which includes statistics on supply and demand. CPM Group Publishes

cpmgroup.com

cpmgroup.com

Above-ground silver stocks are an order of magnitude higher than what is widely assumed.

In total, there were an estimated 1.6 million metric tonnes of physical silver above ground by late 2018. This amount is 20 times higher than what The Silver Institute discloses as “identifiable above-ground stocks,” which is what’s widely assumed to be the total above-ground stock. The huge discrepancy is important to analyze, as it reveals silver’s true stock to flow ratio and supply and demand dynamics. Misunderstanding these dynamics would mean failing to understand the price of silver.

Potential impact on silver demand:

More:

www.zerohedge.com

www.zerohedge.com

The solar industry in California is facing significant headwinds following the implementation of a new policy in April, which reduced incentives that had encouraged homeowners to install solar systems.

Bloomberg reports the California Solar & Storage Association has found about 63% of its 400 solar installer members have reported cash flow issues because the new policy crushed consumer demand.

Since last April, sales of rooftop solar systems across the state have crashed 85% in the most recent months of 2023 compared to similar periods one year before, according to solar firm Ohm Analytics.

On Wednesday, California Solar and Storage Association Executive Director Bernadette Del Chiaro told an audience at the Intersolar North America conference in San Diego that 25 to 30 solar companies have already closed shop or abandoned the state.

...

More:

"Worried About Next Two Months": Solar Firms Running Out Of Cash In California | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

- Messages

- 471

- Reaction score

- 305

- Points

- 168

Keith Neumeyer says he doesn't believe in the estimates of the Silver Insitute and their consultant firms.

I think he even stopped sponsoring them.

That said,

Historical and forecast solar capacity by region, 2006-2025.

Above-ground silver

Silver is interesting in that there is the same amount of investable silver above ground as there is gold, because 60% of silver goes into industrial uses and 80% of that end up in landfills. Just 40% is used for investing.

Looking at mined silver versus gold, if we take the 60% of silver used for industrial purposes and subtract the 80% that gets thrown into landfills, silver should be more valuable yet the current silver to gold price ratio is 88:1.

Richard (Rick) Mills (don't know him)

silverseek.com

silverseek.com

I think he even stopped sponsoring them.

That said,

Historical and forecast solar capacity by region, 2006-2025.

Above-ground silver

Silver is interesting in that there is the same amount of investable silver above ground as there is gold, because 60% of silver goes into industrial uses and 80% of that end up in landfills. Just 40% is used for investing.

Looking at mined silver versus gold, if we take the 60% of silver used for industrial purposes and subtract the 80% that gets thrown into landfills, silver should be more valuable yet the current silver to gold price ratio is 88:1.

Richard (Rick) Mills (don't know him)

Mexico Could Run out of Silver by 2026, Worsening Supply Deficit

Mexico has regularly outputted 5,600 tons of white metal over the past 10 years, but has seen its reserves dwindle to just 37,000 tons. If mining continues at the current pace, Mexico’s silver reserves will be exhausted by the end of 2026...

that article puts together most of the info i have been trying to accumulate, it had been a couple of years since i did a fundamentals checkup on silver thank you sirKeith Neumeyer says he doesn't believe in the estimates of the Silver Insitute and their consultant firms.

I think he even stopped sponsoring them.

That said,

Historical and forecast solar capacity by region, 2006-2025.

Above-ground silver

Silver is interesting in that there is the same amount of investable silver above ground as there is gold, because 60% of silver goes into industrial uses and 80% of that end up in landfills. Just 40% is used for investing.

Looking at mined silver versus gold, if we take the 60% of silver used for industrial purposes and subtract the 80% that gets thrown into landfills, silver should be more valuable yet the current silver to gold price ratio is 88:1.

Richard (Rick) Mills (don't know him)

Mexico Could Run out of Silver by 2026, Worsening Supply Deficit

Mexico has regularly outputted 5,600 tons of white metal over the past 10 years, but has seen its reserves dwindle to just 37,000 tons. If mining continues at the current pace, Mexico’s silver reserves will be exhausted by the end of 2026...silverseek.com

- Messages

- 471

- Reaction score

- 305

- Points

- 168

that article puts together most of the info i have been trying to accumulate, it had been a couple of years since i did a fundamentals checkup on silver thank you sir

Who said Mother Nature didn't provide a role for Flies on the Walls : )

This "bal silver mine production is projected to fall 2% this year to about 820 million ounces, compared to forecasted demand of 1.2 billion ounces. "

and This in the next paragraph.... Does not compute... The Silver Institute forecasts a 140Moz silver deficit this yea

and This in the next paragraph.... Does not compute... The Silver Institute forecasts a 140Moz silver deficit this yea

as i read that he is quoting information from different sources including some interpretations along the way, and while they do not match they agree in the fundamental direction of changeThis "bal silver mine production is projected to fall 2% this year to about 820 million ounces, compared to forecasted demand of 1.2 billion ounces. "

and This in the next paragraph.... Does not compute... The Silver Institute forecasts a 140Moz silver deficit this yea

his whole article is just a collection of accumulated information from various sources as i read it .......he draws a conclusion at the end ...... i havent checked his fact sources but at this point i assume they are truthfull

- Messages

- 471

- Reaction score

- 305

- Points

- 168

Above-ground silver stocks are an order of magnitude higher than what is widely assumed.

60% of silver goes into industrial uses and 80% of that end up in landfills.

Just 40% is used for investing.

if we take the 60% of silver used for industrial purposes and subtract the 80% that gets thrown into landfills, silver should be more valuable (than gold)

@Cigarlover @Ttazzman

would you agree with Mr. Richard Mills?

i am not sure if i "agree" with Mills ............i enjoy his research and information provided and take it with a skeptical eye.......he speculates on mine closures and nationalization which is purely "speculation" and has a component of political nature and only time will provide the answer....

his research does point to lower MINE production going forward, and silver is really quite hard to predict mine supply since much of it is mined as a byproduct metal and much of that is driven by the worlds overall production of products requiring other metals......his information also

silver has generally seen a world wide reduction of stockpiles of silver over many years ....and a lot of silver has moved into private hands for investment which could be considered a stockpile that is available as prices increase

as prices increase primary silver mine production should increase as less profitable deposits become economically feasible and if demand exceeds supply prices will increase till the market can draw from the investment stockpiles to balance supply and demand

just as a discussion point ....byproduct silver supply cost is much lower than primary silver mine supply and a driver to keep silver costs lower and i see byproduct silver production as a major component to keeping silver pricing low

all my opinions ....and rambling, but i am not a writer ...

- Messages

- 471

- Reaction score

- 305

- Points

- 168

Thanks @Ttazzman

I knew I can count on you

I was more interested in the above ground stockpiles point rather than about future mining output.

Common sense suggests that there is more silver than gold above ground, because more silver gets mined than gold.

But then there is the distinction, silver gets industrially used and wasted, gold doesn't - better: gold's wasted percentage is by far much lower than silver's.

Hence there are these projections that actually there is more gold than silver above ground.

I was wondering whether such an idea would be worth of being considered.

I knew I can count on you

I was more interested in the above ground stockpiles point rather than about future mining output.

Common sense suggests that there is more silver than gold above ground, because more silver gets mined than gold.

But then there is the distinction, silver gets industrially used and wasted, gold doesn't - better: gold's wasted percentage is by far much lower than silver's.

Hence there are these projections that actually there is more gold than silver above ground.

I was wondering whether such an idea would be worth of being considered.

This "bal silver mine production is projected to fall 2% this year to about 820 million ounces, compared to forecasted demand of 1.2 billion ounces. "

and This in the next paragraph.... Does not compute... The Silver Institute forecasts a 140Moz silver deficit this yea

I suppose there is one factor in there that could account for the difference. That would be silver recycling.

However, one thing almost no one discusses is from what is this silver being recycled? It used to be blamed on photography but that can't be much anymore. What exactly are they recycling and how much of that stock is left to recycle?

I went back and revisited Ronan Manley's report (cited in post #9) to compare his numbers against the latest data.

Latest from the LBMA is:

www.lbma.org.uk

www.lbma.org.uk

SLV report for 26 January claims 343,504,554.9 ounces (9,738.19 tonnes) vaulted in London. That's a pretty significant drop from the 16,028 tonnes reported on 14 December. That leaves a total of 16,892.81 tonnes (63%) of silver in the London vaults not owned by ETFs.

Ronan reported that as of 14 December, COMEX registered silver was 45.5moz and eligible was 223.02moz for a total of 268moz.

That would yield roughly 165moz in COMEX vaults not owned by ETFs.

Comex data from Friday:

The 26 January SLV report claims 103,176,253 oz vaulted in New York COMEX vault - a very slight increase over the December report.

That yields roughly ~173moz in COMEX vaults not owned by ETFs - a slight (8moz or ~227 tonnes) increase over the December numbers that Ronan published.

SFE has dropped from 1041 tonnes in mid December to to ~897 tonnes as of today.

LBMA

Ronan Manley said:...

But, as of the end of November, of this 26,284 tonnes, 16,028 tonnes (61%) was held in silver-backed ETFs which hold their silver in London, which leaves only 10,256 tonnes (39%) of silver in the London vaults not owned by ETFs.

...

Latest from the LBMA is:

...

As at end December 2023, ...

There were also 26,631 tonnes of silver (a 1.3% increase on previous month), ...

London Vault Data

Over US$430 billion of precious metal bullion is held in London vaults.

SLV report for 26 January claims 343,504,554.9 ounces (9,738.19 tonnes) vaulted in London. That's a pretty significant drop from the 16,028 tonnes reported on 14 December. That leaves a total of 16,892.81 tonnes (63%) of silver in the London vaults not owned by ETFs.

COMEX

Ronan reported that as of 14 December, COMEX registered silver was 45.5moz and eligible was 223.02moz for a total of 268moz.

Ronan Manley said:... 103.17 million ozs of SLV’s silver (3209 tonnes) is held in the JP Morgan vault in New York and this needs to be excluded from Eligible. ...

That would yield roughly 165moz in COMEX vaults not owned by ETFs.

Comex data from Friday:

The 26 January SLV report claims 103,176,253 oz vaulted in New York COMEX vault - a very slight increase over the December report.

That yields roughly ~173moz in COMEX vaults not owned by ETFs - a slight (8moz or ~227 tonnes) increase over the December numbers that Ronan published.

SGE/SFE

Ronan Manley said:...

A similar depletion in silver stockpiles is also evident on China’s other main silver trading venue, the Shanghai Futures Exchange (SHFE), where silver inventories have been on a downward trend all through 2023, falling from around 2200 tonnes at the beginning of 2023, to 1041 tonnes (33 million ozs) in mid December

...

SFE has dropped from 1041 tonnes in mid December to to ~897 tonnes as of today.

I don't believe a word from almost any of those organizations. They have demonstratively shown they are there to rig/control prices.

that is why i like to keep a birds eye view of things and their general trend direction.... while reported details and statistics are worth looking at they can be parsed by the agenda of the reporter.......just like our interpretation of those reports can be viewed thru rose colored glasses .......I don't believe a word from almost any of those organizations. They have demonstratively shown they are there to rig/control prices.

Thanks @Ttazzman

I knew I can count on you

I was more interested in the above ground stockpiles point rather than about future mining output.

Common sense suggests that there is more silver than gold above ground, because more silver gets mined than gold.

But then there is the distinction, silver gets industrially used and wasted, gold doesn't - better: gold's wasted percentage is by far much lower than silver's.

Hence there are these projections that actually there is more gold than silver above ground.

I was wondering whether such an idea would be worth of being considered.

a interesting statistic would be what percentage of newly mined silver is currently expected to be lost forever, this could lead us to understand how much silver is "stockpiled" in for example solar panels and how feasible and when will solar panels expire and start being recycled into the supply chain (this is something i am trying to get a understanding of now) as solar panels could be a huge above ground "stockpile" of silver that may start to come into the supply chain in a few years offsetting mine supply losses ..........just like photographic silver did in the past...

Cigarlover

Yellow Jacket

- Messages

- 1,483

- Reaction score

- 1,718

- Points

- 283

In past interviews Kieth has stated that silver recycling is a losing proposition. He had looked at getting into it.

Obviously prices need to be higher to make recycling worthwhile. They use about 20 grams per panel and there's a shitload of panels out there right now.

They have also been saying for years that silver is in deficit. 120 million ounces at least per annum. Thats not a small amount. 10-15% of worldwide production.

I know the bankers get blamed for keeping the prices artificially low but in reality they are just doing the bidding of their corporate customers. Tesla, Apple and the solar panel manufacturers use huge amounts of silver and it's one of their costs they they can manipulate and keep low. Silver is a 20 billion dollar market. A rounding error for Apple so it's nothing to manipulate the price lower.

Input costs will continue to climb with higher labor and fuel costs. At some point this will lead to higher silver prices or mines will have to shut down. Of course if mines shut down then we also get higher prices for silver.

Right now we have Chinas economy slowing and the US is right behind them. Probably the reason for the weakness in silver right now but where was the strength in the silver price over the last several years when solar panels and EV;s were flying off the shelves? That never made sense to me other than price manipulation. But if the government can green light bitcoin which in my opinion has 0 value, and allow speculation in a 0 value asset, imagine what they will allow with silver.

Investment demand I the wildcard in all of this. If people around the world bought even 1 ounce of silver annually this pricing would be much different. With 900 million ounces of production and 7 billion ounces of demand, it wouldn't take long to see prices equal to or exceeding gold. Of course that's a pipe dream since not even Americans will buy 1 ounce a year. Most dont even know it exists.

Obviously prices need to be higher to make recycling worthwhile. They use about 20 grams per panel and there's a shitload of panels out there right now.

They have also been saying for years that silver is in deficit. 120 million ounces at least per annum. Thats not a small amount. 10-15% of worldwide production.

I know the bankers get blamed for keeping the prices artificially low but in reality they are just doing the bidding of their corporate customers. Tesla, Apple and the solar panel manufacturers use huge amounts of silver and it's one of their costs they they can manipulate and keep low. Silver is a 20 billion dollar market. A rounding error for Apple so it's nothing to manipulate the price lower.

Input costs will continue to climb with higher labor and fuel costs. At some point this will lead to higher silver prices or mines will have to shut down. Of course if mines shut down then we also get higher prices for silver.

Right now we have Chinas economy slowing and the US is right behind them. Probably the reason for the weakness in silver right now but where was the strength in the silver price over the last several years when solar panels and EV;s were flying off the shelves? That never made sense to me other than price manipulation. But if the government can green light bitcoin which in my opinion has 0 value, and allow speculation in a 0 value asset, imagine what they will allow with silver.

Investment demand I the wildcard in all of this. If people around the world bought even 1 ounce of silver annually this pricing would be much different. With 900 million ounces of production and 7 billion ounces of demand, it wouldn't take long to see prices equal to or exceeding gold. Of course that's a pipe dream since not even Americans will buy 1 ounce a year. Most dont even know it exists.

- Messages

- 471

- Reaction score

- 305

- Points

- 168

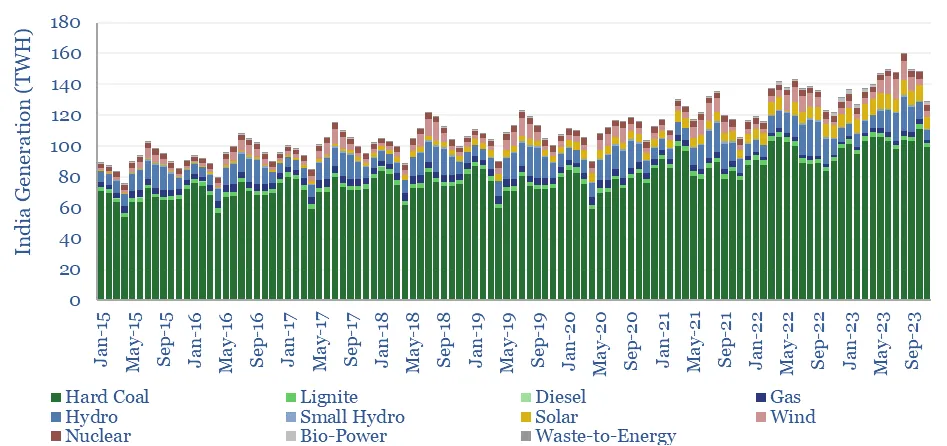

Silver Solar Use in India

48 GW x 500,000 ounces = 24 Million Ounces

4x higher from 2023 levels (to meet their NetZero targets)

India is now the largest country in the world by population, with 1.4bn people (18% of the global total), $3.5 trn of GDP, and GDP per capita of $2,500 pp pa.

However, India only uses 6% of total global energy, 6% of total global electricity and emits 6% of global CO2.

What implications for energy markets and energy transition as India grows?

And could India’s energy demand move global energy markets in the late 2020s as China’s moved global energy markets in the mid-2000s?

According to my friend Mr. Chen Lin of ChenPicks (considered the leading expert in analyzing Silver loading in Solar panels) 1 GW = 500,000 ounces of silver

India did add 12GW of solar in 2023, but the growth rate would need to be 4x higher just to cause coal power to flat-line in absolute terms.

Pixy Math: 12GW x 4x Higher = 48GW (500,000) = 24,000,000 ounces of silver (24 Million ounces of Silver)

Silver Solar Use in India. 48 GW x 500,000 ounces = 24 Million Ounces

4x higher from 2023 levels (to meet their NetZero targets.)

The Silver Institute published an update:

www.silverinstitute.org

www.silverinstitute.org

Global Silver Demand Forecasted to Rise to 1.2 Billion Ounces in 2024

If Achieved, It Would Be Second Highest Level on Record

(Washington, D.C. – January 30, 2024) Global silver demand is forecast to reach 1.2 billion ounces in 2024, which, if achieved would be the second-highest level recorded. Stronger industrial offtake is a principal catalyst for the rising global demand for the white metal, and the sector should hit a new annual high this year.

For the short term, as an early start to U.S. interest rate cuts appears less likely, investment in much of the precious metals complex could be under pressure. Concerns about a slowing Chinese economy could also present a headwind to silver institutional investment. By contrast, the economic backdrop is expected to turn more favorable to silver investment in the second half of 2024, when the U.S. Fed is anticipated to begin cutting interest rates.

With that backdrop, the Silver Institute offers its thoughts on the 2024 silver market, noting that Metals Focus, the distinguished global precious metals research consultancy based in London, contributed to this analysis. The firm will research and produce the Silver Institute’s annual report on the international silver market, World Silver Survey 2024, which will be released on April 17.

Silver Demand

Global silver demand is expected to rise 1 percent, pushed higher by the continued strength of industrial end-uses and a recovery in jewelry and silverware demand.

Silver industrial fabrication is forecast to post a 4 percent rise in 2024 to a record 690 million ounces (Moz), building on the all-time highs achieved last year. In line with the trend in recent years, the photovoltaics (P.V.) and automotive industries will remain key drivers of growth this year.

Taking each in turn, global P.V. installations significantly exceeded initial market expectations in 2023, with new capacity additions forecast to reach another record high this year. Silver offtake should also benefit from the technological breakthrough that has brought new, higher-efficiency N-type solar cells (with higher silver loadings) into mass production. In the automotive industry, greater use of electronic components and investment in battery charging infrastructure will continue supporting silver offtake.

After a challenging 2023, a projected recovery in consumer electronics will provide an additional lift to the silver industrial market. Despite uncertain economic conditions in some key markets, the deployment of AI-related applications has seen several consumer electronic brands prepare to introduce new products, which should favor silver.

Jewelry demand is expected to record a 6 percent rise, and India will contribute the bulk of gains this year. This follows a sharp pull back in 2022 when Indian demand weakened after a post-COVID surge in 2021. On top of a return to more “normal” levels, a positive economic backdrop and consumers getting used to high rupee silver prices should also underpin growth this year. In the U.S. and Europe, soft consumer sentiment may continue to weigh on jewelry consumption, but retailers’ stock replenishment will likely mitigate the impact on fabrication. In line with the jewelry sector, as demand normalizes, a recovery in India will lift global silverware fabrication by 9 percent.

By contrast, silver physical investment is projected to decrease by 6 percent to a four-year low, with losses dominated by the U.S. Solid economic growth and further gains in the U.S. stock market will be key drivers behind this weaker investor interest across all precious metal coins and bars. In India and Europe, a modest recovery is expected this year, compared with a depressed 2023 total. In the former, as Indian investors become accustomed to high rupee prices, bargain hunting is expected on price dips. Even with a recovery, Europe’s total volumes will remain near multi-year lows.

Silver Supply

Total global silver supply is forecast to grow by 3 percent in 2024 to an eight-year high of 1.02 billion ounces, entirely led by a recovery in mine output.

Silver mine production in 2024 is projected to rise 4 percent to 843 Moz, the highest level since 2018. This growth is, to a large extent, reliant on undisrupted operations at Newmont’s Peñasquito gold mine in Mexico, the commissioning of Polymetal’s Prognoz silver mine in Russia, the start-up of Gold Field’s Salares Norte gold mine in Chile, and the continued ramp-up of operations at Coeur’s Rochester expansion project in the U.S.

By-product silver output from base metal mines is forecast to decrease as community and government disputes led to some mine closures in 2023, particularly in South America. Furthermore, there is an impending risk to silver output from zinc mines that may continue to face mine suspensions due to weak zinc prices.

In contrast, silver recycling is expected to edge lower, with volumes likely to drop by 3 percent to a three-year low. Lower jewelry and silverware scrap supply will account for most of this year’s losses. Photographic scrap is also expected to weaken due to structural factors, leaving industrial recycling the only area anticipated to record modestly higher volumes.

The silver market is forecast to remain in a deficit (total supply less demand) in 2024, marking the fourth consecutive year of a structural market deficit. Although this year’s deficit is expected to ease by 9 percent to 176 Moz (194 Moz in 2023), it will still be exceptionally high by historical standards.

Silver Investment

Early 2024 has seen financial markets scale back their expectations of U.S. rate cuts, with many investors having believed this would start as soon as March. The consequential boost to the U.S. dollar and yields has created fresh headwinds to precious metal investment.

Even so, market expectations of U.S. interest rate cuts are still a little more dovish compared with the Fed’s more hawkish position. In the coming months, as the market gradually adopts a more hawkish stance, this will weigh on gold and silver investment. During this time, investor interest in silver could also be hampered by a still lackluster recovery in China.

Nonetheless, this weaker investment is likely to be temporary, and silver’s positive fundamentals should encourage decent bargain hunting. Once the Fed starts to cut rates, most likely in mid-2024, silver investment should begin to recover.

More importantly, with inflation on course to retreat towards the U.S. authorities’ official long-term target, the Fed is expected to signal further and accelerated easing next year. The impact of falling real yields and pressure on the U.S. dollar should also favor fresh silver and gold investment.

...

Global Silver Demand Forecasted to Rise to 1.2 Billion Ounces in 2024 |

In past interviews Kieth has stated that silver recycling is a losing proposition. He had looked at getting into it.

Obviously prices need to be higher to make recycling worthwhile. They use about 20 grams per panel and there's a shitload of panels out there right now.

They have also been saying for years that silver is in deficit. 120 million ounces at least per annum. Thats not a small amount. 10-15% of worldwide production.

I know the bankers get blamed for keeping the prices artificially low but in reality they are just doing the bidding of their corporate customers. Tesla, Apple and the solar panel manufacturers use huge amounts of silver and it's one of their costs they they can manipulate and keep low. Silver is a 20 billion dollar market. A rounding error for Apple so it's nothing to manipulate the price lower.

Input costs will continue to climb with higher labor and fuel costs. At some point this will lead to higher silver prices or mines will have to shut down. Of course if mines shut down then we also get higher prices for silver.

Right now we have Chinas economy slowing and the US is right behind them. Probably the reason for the weakness in silver right now but where was the strength in the silver price over the last several years when solar panels and EV;s were flying off the shelves? That never made sense to me other than price manipulation. But if the government can green light bitcoin which in my opinion has 0 value, and allow speculation in a 0 value asset, imagine what they will allow with silver.

Investment demand I the wildcard in all of this. If people around the world bought even 1 ounce of silver annually this pricing would be much different. With 900 million ounces of production and 7 billion ounces of demand, it wouldn't take long to see prices equal to or exceeding gold. Of course that's a pipe dream since not even Americans will buy 1 ounce a year. Most dont even know it exists.

Everyone uses money, maybe we should take exception for calling it investment demand. Everyone demands money and could always use some more.

- Messages

- 27,067

- Reaction score

- 4,839

- Points

- 288

Silver: The New Oil of the Photovoltaic Era

Feb 8, 2024Gregor Gregersen founder and CEO of Silver Bullion continues the discussion from part 1 on the demand for silver. Gregor lends his insight on the renewable energy space where silver looks to be "the new oil" of the photovoltaic era. Gregor will give you those numbers and reasons why here, in part 2 of the silver industrial demand for photovoltaics. 12 minutes long.

Part 1 here: https://www.youtube.com/watch?v=srqcJ....

Silver plays a pivotal role in the evolving industrial market. Read our newest report on the rising solar photovoltaic (PV) demand for silver here: https://www.silverbullion.com.sg/Arti...

- Messages

- 471

- Reaction score

- 305

- Points

- 168

'Silver is the new gold' as Egyptians try to protect savings

CAIRO, Feb 8 (Reuters) - Egyptian women traditionally receive a gold jewellery set, or "shabka", on their engagement. But as surging prices and a weakening currency have driven up demand for the precious metal, some are getting silver instead.

The trend is a measure of an economic crisis in which inflation has been running at more than 30% and the central bank has allowed the currency to weaken 50% against the dollar, with more devaluation expected.

"Silver is the new gold," said a salesman at a Cairo silver store who only gave his first name, Abanob.

(Egypt = 110M people)

Silver is increasingly becoming an industrial and an electrical metal, says Matt Watson, founder of Precious Metals Commodity Management LLC.

On Wednesday, Watson recorded an episode of Green Rush with guest Phillips Baker. Baker is president & CEO of Hecla Mining, the largest silver producer in the United States, and chairman of The Silver Institute.

Baker agreed that silver is less a monetary metal, like gold, than it used to be.

Nearly a third of the global silver supply, about 300,000 ounces, is now used for solar power. Other industrial applications include automotive, solder and brazing alloys, and water purification.

...

"We're looking at about 40 years' worth of material here," he said. "This is going to be hard to catch up to this demand and I can see us burning down our reserves very rapidly."

Watson and Baker diverged over the amount of silver demanded by solar.

Watson predicts solar demand will peak within the next decade, noting where high rates of solar installation have occurred, such as California, electricity has become more expensive.

"It's really going to become a question of how much solar do we need?" he asked.

Baker called Watson out on his peak solar demand thesis.

"Everybody who has said we're reaching a peak has been wrong. It's continued to grow," Baker said, emphasizing he is struck by the amount of additional silver being demanded by new applications.

Solar plus automotive, which adds another 200,000 ounces — EVs use more silver than gas-powered vehicles — comes to nearly half the amount of silver currently being mined.

"I can't see any scenario where this is going to drop, the demands seem to be built in as far as I could tell," Watson concluded.

"Photovoltaics are the central bank of silver," Baker summarized. "You have this base of demand that is going to continue to push the silver price."

...