In the hours after Friday's Supreme Court ruling that struck down his attempt to forgive large amounts of federal student debt, President Joe Biden promised two new actions to ease borrowers' burdens. The president's next steps and his rhetoric suggest that little has changed in his flawed logic regarding student loan forgiveness—which has always seemed to have been more about electoral politics than serious policymaking, despite the huge price tag.

Going forward, Biden's student loan plan will include the two steps announced Friday and one lingering element from his earlier proposal that wasn't part of the Supreme Court's review.

First, Biden has invoked a different federal statute in another attempt to unilaterally forgive some student debt. Under powers contained in the Higher Education Act of 1965, Biden intends to direct Secretary of Education Miguel Cardona to "compromise, waive, or release loans under certain circumstances." That will be a federal ruling process, and those tend to take a while—the White House says the first step is a virtual public hearing on July 18—and it is unclear how much debt could be forgiven this way, who would benefit, or what the cost to taxpayers will be.

In the meantime, federal student loan payments will come due again in October after being paused since the COVID-19 emergency was declared in March 2020. But borrowers will be able to ease back into paying what they owe: Biden also announced Friday a 12-month "on-ramp" process during which missed payments will not accrue penalties and won't result in delinquent borrowers having their credit scores dinged.

When they do restart, those monthly payments will be lower than before the pandemic for many borrowers. That's due to the third part of Biden's plan, which caps monthly payments at 5 percent of a borrower's discretionary income—which the Department of Education defines as income that exceeds 150 percent of the federal poverty guidelines. In practice, that means a single borrower with no children starts making payments on income that exceeds $20,400. Additionally, outstanding loan balances will be forgiven after 10 years for those who borrowed $12,000 or less, with a maximum payment period of 20 years no matter how much was borrowed.

That part of the plan isn't new, but the Department of Education finalized those rules on Friday just after the Supreme Court's ruling. "It will cut monthly payments to zero dollars for millions of low-income borrowers, save all other borrowers at least $1,000 per year," Cardona promised.

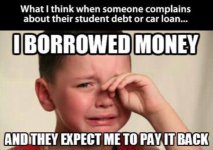

The consequences of capping monthly payments and also capping the length of time a loan can be in repayment should be fairly obvious: A lot of loans will never get paid back in full. "On average, borrowers (current and future) might only expect to repay approximately $0.50 for each dollar they borrow," the Brookings Institution concluded in an analysis last year.

That's going to create some major perverse incentives in the already screwed-up student loan marketplace. Brookings warns that Biden's income-based repayment plan will result in "tuition inflation" and "increased borrowing," particularly by students in pursuit of "low value, low earning" degrees.

...