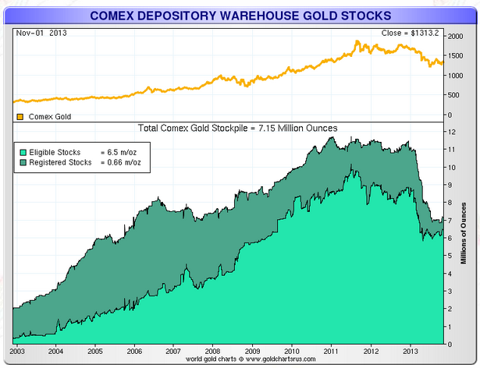

Last week was turning out to be the quietest week in months in terms of COMEX gold inventories, until we had a large registered gold transfer that was reported late on Friday. This transfer took COMEX gold registered stocks to a new all-time low at just above 650,000 total registered gold ounces.

...

...

Total COMEX gold stocks only declined by a minute 499 ounces for the week, which was the quietest week we've seen in quite some time. But the week was marked by a large late week transfer of 48,652 gold ounces from registered gold inventory (deliverable) to eligible gold inventory (non-deliverable). This took total COMEX registered gold stocks to a new all-time low, falling past the previous low of 665,243 ounces seen in early September.

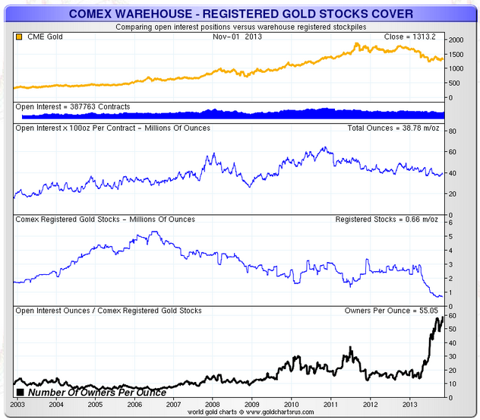

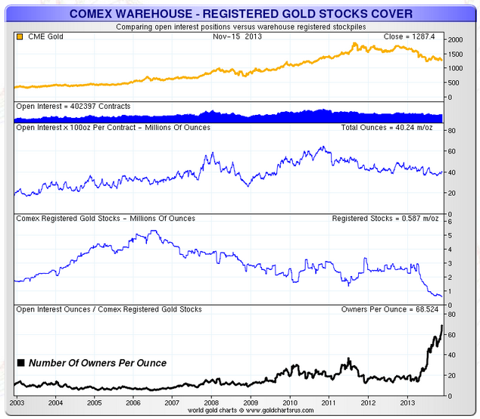

Finally, let us take a look at possibly the most important number when it comes to COMEX gold inventories - the registered gold cover ratio. We've discussed this in-depth in a previous article so please refer to that article for details, but in a nutshell it is the amount of investors owning a claim to each registered gold ounce (i.e. owner per registered gold ounce).

As investors can see, after declining a bit, owners-per-registered ounce advanced to 55 owners-per-registered ounce - which leaves us near historic record highs. In fact, before this year we've never seen above 40 owners-per-registered ounce - even during the spike in gold in 2011.

...

Additionally, we're seeing more and more owners per registered ounce in terms of the COMEX paper trading -

if a mere 2% of outstanding contracts were held until delivery, there simply wouldn't be enough gold to cover it at current registered gold levels.

...