Unbeatable

Big Eyed Bug

- Messages

- 415

- Reaction score

- 0

- Points

- 0

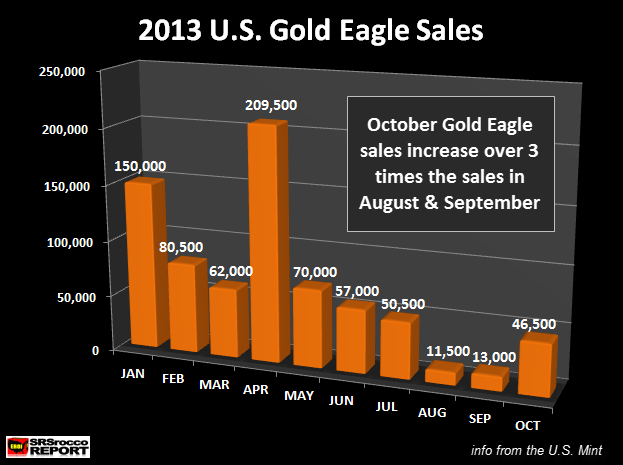

Sales total for July 4 406 500

Only 54000 away from being the biggest non-January total ever!

Only 54000 away from being the biggest non-January total ever!

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

...

Silver Eagle sales are on track to surpass the total sales for 2012 within the next 2-3 weeks. I forecast that total sales for Silver Eagles by the end of August will be 33 million oz. ...

Furthermore, Silver Eagle sales will hit a new all-time record this year by beating the past record set back in 2011 of nearly 40 million oz. I believe total Silver Eagle sales in 2013 will reach 45-47.5 million. The average monthly rate (excluding Jan) has been approximately 3.6 million ounces (Feb-July). This turns out to be 14.5 million oz for the last four months of the year. If we add 33 mil oz. + 14.5 mil oz we come up with 47.5 million oz.

On the other hand, if we take a conservative approach and attribute say a monthly 3 million oz, then the total for 2013 may be 45 million oz. Either way, its 12-19% more than 2011′s record.

...

With today’s update of 500,000 Silver Eagles sold, bringing November’s totals to exactly 1,000,000, the US Mint has just set an all-time sales record for Silver Eagles, eclipsing the previous annual record of 39,868,500 oz set in 2011.

With the US Mint alerting primary dealers last week that 2013 production will shut down on December 9th, it appears that the powers that be do not wish to allow 2013′s all time silver eagle sales record to get too far out of hand.

...

A new record was reached Nov. 12 for sales of silver American Eagles.

The U.S. Mint said total purchases had reached 40,175,000.

This surpassed the previous record high set in calendar year 2011 when 39,868,500 were sold.

Sales, of course, are not yet finished for the year. The Mint will take its last orders for 2013 coins on Dec. 9, so it is possible that another 3 million or so coins will pad the new record.

...

...

The premium charged by wholesale dealers for American Eagle coins from the U.S. Mint may rise to 17 percent from 14 percent yesterday, said Frank McGhee, the head dealer at Integrated Brokerage Services LLC in Chicago. The mint has said that weekly allocations will ease.

... Yesterday, the mint said 89 percent of this week’s quota of 3.58 million 1-ounce silver coins were sold following a halt in sales on Dec. 9 because of a lack of supply. ...

“The market is tight,” McGhee said in a telephone interview. “The drop in prices has made silver coins very attractive.”

On Jan. 8, the mint said that the quantity of coins in weekly allocations “will be much lower” than this week. Michael White, a mint spokesman, declined to comment on a specific figure. ...

...

On Monday, the U.S. Mint updated their Silver Eagle sales figures to 1,442,000 oz. Mr. White sent me an email stating that they sold 592,000 Silver Eagles on Monday and the total allocation for the week was 900,000 oz.

As you can see from the U.S. Mint figures below, they sold an additional 249,500 Silver Eagles today (Tuesday) for a total of 1,691,500 coins.

Silver Eagles Update 21114

Total Silver Eagle sales for Monday & Tuesday hit 841,500 oz. Thus, the U.S. Mint only has 58,500 Silver Eagles to sell to its Authorized Dealers for the rest of the week.

Furthermore, Silver Eagle sales continue to outpace Gold Eagle sales in a big way. For the month of February, here are the total sales of Gold & Silver Eagles to date:

Gold Eagles = 11,000 oz

Silver Eagles = 1,691,000 oz

Silver to Gold Eagle Ratio = 154/1

...

Effective Monday, June 2, 2014, the United States Mint’s American Silver Eagle bullion coins will no longer be subject to allocation. For the first time in more than sixteen months, authorized purchasers will be able to order the coins without limitations.

...

Despite the restraints on availability, year to date Silver Eagle sales have reached 21,436,500 ounces according to the latest data available on the Mint’s website. The current sales level and the removal of allocation create the possibility for another annual sales record. During 2013, the Mint had sold a record high 42,675,000 ounces.

...

In the first eight days in October, the U.S. Mint sold 2,250,000 Silver Eagles and is on track to being one of the strongest months of the year. Even though sales were strong last month, the weekly average of Silver Eagle sales in September were only 1,305,000… 42% less than the current trend in October.

...

In addition, investors are purchasing a hell of a lot more Silver Eagles than Gold Eagles:

2014 Silver Eagle Sales = 34.5 million

2014 Gold Eagle Sales = 404,000 oz

2014 Silver-Gold Eagle Ratio = 85/1

...

After the U.S. Mint updated its bullion figures on Monday, 2014 Silver Eagle sales reached a new annual record surpassing last years total by nearly 200,000. Not only was 2014 a banner year for world’s most sought after official coin, the Silver-Gold Eagle ratio also hit a new record high.

The U.S. Mint sold nearly a half million Silver Eagles over the weekend, putting the total for December at 1,317,000. This strong weekend demand pushed total annual Silver Eagle sales to 42,864,000 over last years previous record of 42,765,000. Furthermore, there are still a few more weeks remaining in the month.

As we can see from the chart above, investors purchased 82 Silver Eagles for every Gold Eagle ounce in 2014. ...

The U.S. Mint just released its FY 2014 Annual Report and the total Dollar sales of Silver Eagles surpassed Gold Eagles by a wide margin. ...

...

According to the data put out in the U.S. Mint 2014 Annual Report, total sales of Silver Eagles were $850 million compared to $693 million in Gold Eagle sales.

...

While FY 2014 Silver Eagle Dollar sales surpassed Gold Eagles, if we add Gold Buffalo sales, then total gold bullion sales were higher than silver sales. Again, according to the U.S. Mint, 178,000 Gold Buffalos were sold at a value of $234 million. If we add this to the $693 million of Gold Eagles, we get a total of $927 million for these to official gold coins.

...

The U.S. Mint said on Tuesday it temporarily sold out of its popular 2015 American Eagle silver bullion coins due to a "significant" increase in demand, the latest sign plunging prices have spurred a resurgence of retail buying.

In a statement sent to its biggest U.S. wholesalers, the Mint said its facility in West Point, New York, continues to produce coins and expects to resume sales in about two weeks.

...

The U.S. Mint's sales of American Eagle coins surged in November, with gold nearly tripling month-over-month and silver already reaching a new annual record as bullion prices fell to multi-year lows, data released on Monday showed.

The mint sold 97,000 ounces of American Eagle gold coins in November, up 185 percent from October and 62 percent higher from a year ago, after selling out of most of the 2015-dated coins as falling bullion prices attracted buyers.

...

Toward the end of this month, the mint said it had sold out of all remaining 0.1-ounce, 0.25-ounce and 1-ounce American Eagle gold bullion coins dated 2015 and would not be making any more for the calendar year.

Demand for American Eagle silver coins has also been strong, with year-to-date sales already reaching an annual record at 44.67 million ounces, breaking the full-year record of 44 million ounces in 2014.

...

A drop in silver prices this year has attracted investors seeking a bargain, prompting a temporary sellout of the 2018 American Silver Eagle bullion coins at the U.S. Mint this month.

“The sellout of Silver Eagles implies that demand for physical [silver] has recently been increasing,” says Chris Gaffney, president of World Markets at TIAA Bank. “With Silver Eagles being the most popular bullion coin available, this is a good indicator of physical demand,” he adds, and higher demand “makes sense,” given that prices are nearing multiyear lows again.

...

The mint announced on Sept. 6 that it is producing additional coins to restock its depleted inventory. “The U.S. Mint and the authorized dealer network were caught off guard as bargain-hunting physical buyers returned to the market ahead of $14” an ounce, says Peter Grant, vice president of Chicago-based Zaner Metals. He sees that as a “glimmer of stronger investment demand, but not a big deal in the overall context of the dominant downtrend.”

Through August, this year’s sales of Silver Eagles totaled 10.275 million ounces, the mint reports. The full-year figure is likely to come in well below 2017’s 18.065 million.

Edmund Moy, director of the U.S. Mint from 2006 to 2011, says the recent sellout of the 2018 coins from strong growth in demand was unusual. He adds that sellouts happened much more frequently during the financial crisis of 2007-2009 and the Great Recession, which began in late 2009. Back then, the mint had a hard time meeting surging demand, as some worried investors sought refuge in precious metals.

Moy notes that sales peaked at 47 million ounces in 2015, but that this year’s are still running above the 10 million-ounce annual totals seen before the financial crisis and Great Recession. He expects sales to end the year at 11 million or 12 million ounces.

Overall physical demand for silver—including metal used in jewelry and other commercial items and processes, as well as coins—slid to 1.018 billion ounces in 2017 from 2016’s 1.041 billion. Nonetheless, there was still was a supply deficit of 26 million ounces last year, the fifth straight annual shortfall, according to the Silver Institute.

The U.S. Mint says that increased demand was behind the Silver Eagle sellout. Moy says the “surge was likely caused by silver speculators spurred by the gold/silver ratio,” which currently stands at around 1 to 85, based on Tuesday’s settlements. That means it took about 85 ounces of silver at $14.15 to buy one ounce of gold at just over $1,202. The historical norm is 1 to 50, “which means gold is overpriced or silver is underpriced,” Moy observes. “Speculators are betting that silver is underpriced.”

...

Demand for the U.S. Mint Silver Eagles spiked again at the end of the September pushing sales nearly to three million. In a little more than a week, Silver Eagle sales jumped from 1.9 million to 2.9 million, nearly doubling from the previous month. Sales of Silver Eagles in August were only 1.5 million versus 2.9 million in September.

...

Sales of Silver Eagles continue to be strong as demand for the official coins surged in February. Moreover, as the Authorized purchases of Silver Eagles jumped by 775,000 oz this past Thursday, the U.S. Mint issued a temporary suspension of sales until inventories can be restocked. ...

...

On the physical demand side, Heraeus highlighted the significant divergence between the Perth and US Mint’s silver coin sales this year.

“Perth Mint silver coin sales remained weak, as the May sales of 796,934 oz significantly trailed previous years,” they noted. “May sales data represented a 58% decrease year-on-year and the lowest May figure in five years. Year-to-date sales reached 4.12 moz, a 51% drop year-on-year.”

...

“The US Mint sales, in contrast, appeared much more robust than in previous years,” they wrote. “During May, sales of 1.75 moz were recorded, a 9.7% year-on-year rise. Year-to-date sales reached 12.6 moz, a 52% increase year-on-year.”

...

| Year | Gold | Silver |

|---|---|---|

| 2024 (so far) | 345,000 | 20,144,000 |

| 2023 | 1,092,000 | 24,750,000 |

| 2022 | 980,000 | 16,000,000 |

| 2021 | 1,252,500 | 28,275,000 |

| 2020 | 844,000 | 30,089,500 |

| 2019 | 152,000 | 14,863,500 |

| 2018 | 245,500 | 15,700,000 |

| 2017 | 302,500 | 18,065,500 |

| 2016 | 985,000 | 37,701,500 |