Q1 2013 US Silver Eagle Sales Beats All Records

All the numbers are bot in yet but look at the detail in the link !

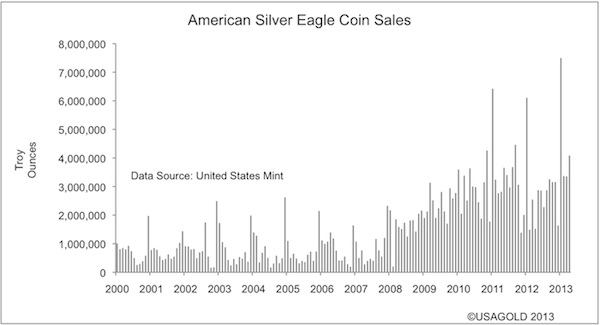

Only a week ago, we wrote how the physical silver investment demand is historically high. We got to that conclusion based on the physical holdings of all silver ETF’s combined, as well as the 2013 US Silver Eagle coin sales.

This is the table we published exactly one week ago. It shows the Q1 sales of each year since 2008. Obviously, March 2013 was not complete at that moment in time.

Today’s US Mint figures show an astonishing increase of almost a million ounces over the past week. March 2013 stands now at 3,356,500 silver ounces sold. Replace the latest figure in the above table with the most actual one, and it becomes clear how this is the best first quarter ever (the figures before 2008 were consistently lower).

Now we did an easy but interesting exercise. The first quarter of 2013 saw sales of 14,2 million ounces of US Silver Eagles. We compared this Q1 2013 figure with the total of each year since this giant gold & silver bull market started in 2001. The comparison needs no additional comment (but readers should feel free though to comment in the section below).

•

Q1 2013 equals 42% of total 2012 US Mint sales of Silver Eagles

•Q1 2013 equals 35% of total 2011 US Mint sales of Silver Eagles

•Q1 2013 equals 41% of total 2010 US Mint sales of Silver Eagles

•Q1 2013 equals 49% of total 2009 US Mint sales of Silver Eagles

•Q1 2013 equals 72% of total 2008 US Mint sales of Silver Eagles

•Q1 2013 is already 40% higher than total 2007 US Mint sales of Silver Eagles

•Q1 2013 is already 42% higher than total 2006 US Mint sales of Silver Eagles

•Q1 2013 is already 69% higher than total 2005 US Mint sales of Silver Eagles

•Q1 2013 is already 47% higher than total 2004 US Mint sales of Silver Eagles

•Q1 2013 is already 56% higher than total 2003 US Mint sales of Silver Eagles

•Q1 2013 is already 41% higher than total 2002 US Mint sales of Silver Eagles

•Q1 2013 is already 61% higher than total 2001 US Mint sales of Silver Eagles

http://goldsilverworlds.com/gold-silver-general/q1-2013-us-silver-eagle-sales-beats-all-records/ :wave: