DoChenRollingBearing

Yellow Jacket

...

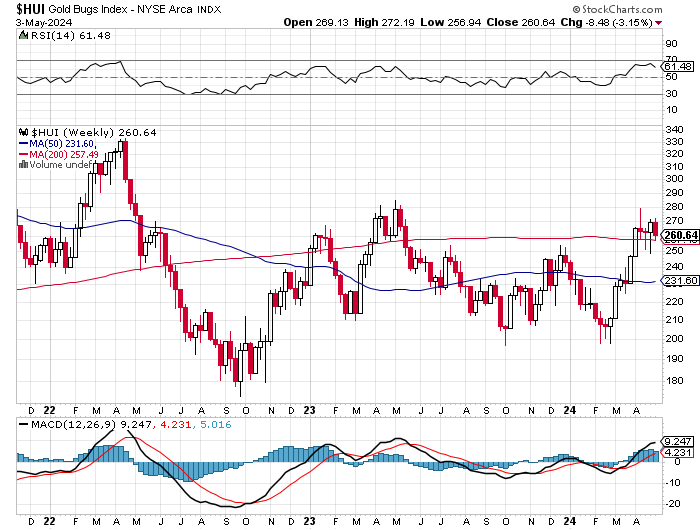

Hey, I am not a chart technician (perhaps the opposite, as the below chart is so bearish looking), but the question arises WHEN is a good time to buy the gold miners? This is (was supposed to be) a three year chart of the HUI (symbol $HUI at stockcharts.com):

(Bah! I was hoping the image would come through.)

Link to image:

http://stockcharts.com/c-sc/sc?s=$HUI&p=W&b=5&g=0&i=t52052886356&r=1414726363368

(Bah, again!)

Three thoughts come to me though:

1) The break-even cost of production is very roughly $1200 / oz, so buying may be risky, big time.

2) FOFOA says to buy the gold, not the miners (risk of expropriation or heavy taxation).

3) I have never bought gold miners before, and I read that many gold mine operators are incompetent. <-- I would be interested in any views on this.

Hey, I am not a chart technician (perhaps the opposite, as the below chart is so bearish looking), but the question arises WHEN is a good time to buy the gold miners? This is (was supposed to be) a three year chart of the HUI (symbol $HUI at stockcharts.com):

(Bah! I was hoping the image would come through.)

Link to image:

http://stockcharts.com/c-sc/sc?s=$HUI&p=W&b=5&g=0&i=t52052886356&r=1414726363368

(Bah, again!)

Three thoughts come to me though:

1) The break-even cost of production is very roughly $1200 / oz, so buying may be risky, big time.

2) FOFOA says to buy the gold, not the miners (risk of expropriation or heavy taxation).

3) I have never bought gold miners before, and I read that many gold mine operators are incompetent. <-- I would be interested in any views on this.

Last edited: