...

On a different tangent...there is this so called notion that in the past several years there has been a SURPLUS OF SILVER. The GFMS- World Silver Survey is the one that comes up with these figures. The reason why we have had a so called LARGER SURPLUS is due to taking COIN & MEDAL out of the Fabrication figures. The coin & medal figure is included in the total fabrication number, but they have decided to take it out.

GFMS Calculation for Deficit-Surplus Silver:

Mine Production +Scrap - Fabrication (plus Coin & Medals) = Deficit-Surplus

Here is the 2010 figures:

735.9 mil + 215 mil - 878 + 101.3 = 174.2 million surplus

---------------------------------------------------------------

GMFS believes that coin & medal count as new bullion demand. So the higher the amount of silver that goes into COIN & MEDAL acutally adds to the so called surplus. Silly isn't it? Most of this coin production is from Govt mints making Eagles, Maples, Philharmonics, Pandas, Kookaburras and etc. Most people who own these are not going to sell them for melt.

So, 101.3 million ounces worth of coin and medal in 2010 accounted for 58% of the so called surplus. This year in the 2011 Interim Silver Market Report, GFMS says that coin & medal demand will increase 25 million. That would give us a ballpark of about 126 million ounces to coin & medals. This will be added to increase the surplus in 2011.

Also, the Scrap silver which comes from recycling industrial silver is part of the Supply. Why does GFMS not take this out as it is also a form of bullion... scrap maybe, but supply that does come back into the market. Interesting...

GFMS STATES GLOBAL SILVER PRODUCTION WILL RISE IN 2011

I had an email exchange with Oliver Heathman, metals analyst at GFMS and they believe global silver production with increase 30 million ounces in 2011 or 4% above last year. In my research I thought we would see a decline in 2011 and I have posted a few comments here to that effect. Australia, Peru, Chile and the United States will come in lower, but Mexico, Russia, and China are higher.

GFMS's 2010 Interim Silver Market Report showed a higher global silver production in 2010 than its final report. I believe they will be wrong by at least 15 million. Anyhow, I wrote that article

Peak Silver Revisited: Impacts of a Global Depression, Declining Ore Grades & a Falling EROI, where I believe we are going to see a peak in silver soon.

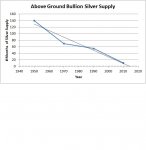

Anyhow, this so called surplus is really a joke when you figure just how little silver the world owns.

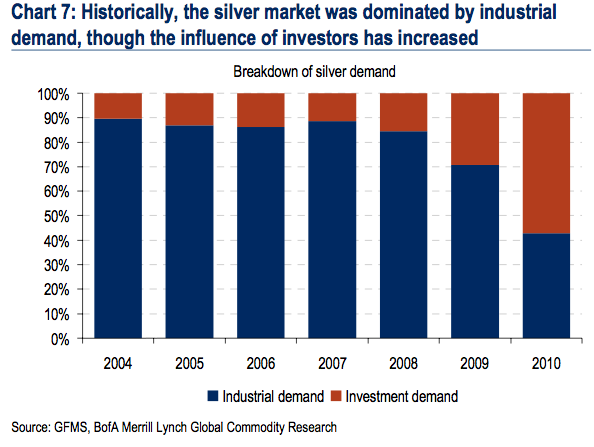

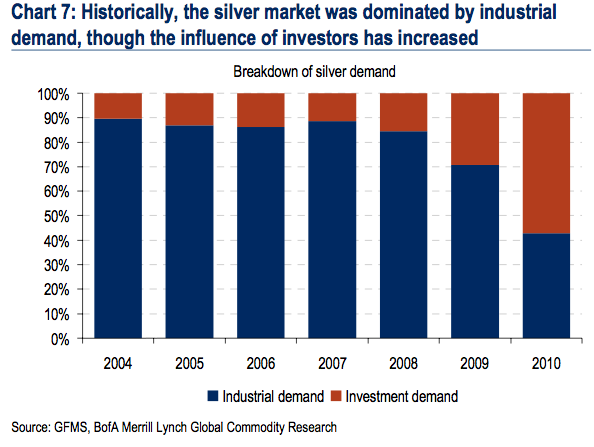

Lastly, when we had a deficit in silver, we also had LOW SILVER PRICES. As this so called silver surplus went higher, so did the price of silver. REASON? It was investment demand that pushed the price higher, not industrial demand. This will be the very reason why we see much higher silver prices when the system implodes.