vox

Predaceous Stink Bug

- Messages

- 124

- Reaction score

- 0

- Points

- 0

From the WSJ...basic premise is, well, we're fucked even more than we were in 2008.

http://online.wsj.com/article/SB10001424052702303918204577448343232424870.html?mod=WSJ_WSJ_US_News_5

Full text follows:

By the end of this year, the CBO said, cumulative federal debt will reach roughly 70% of gross domestic product—the value of all goods and services produced by the economy—the highest level since just after World War II. That's up from about 40% in 2008.

http://online.wsj.com/article/SB10001424052702303918204577448343232424870.html?mod=WSJ_WSJ_US_News_5

Full text follows:

Updated June 5, 2012, 6:01 p.m. ET

Dire CBO Report Urges Fiscal Fixes

The Congressional Budget Office released new projections of a worsening U.S. fiscal outlook, adding fuel to the election-year debate over the causes of rising government debt.

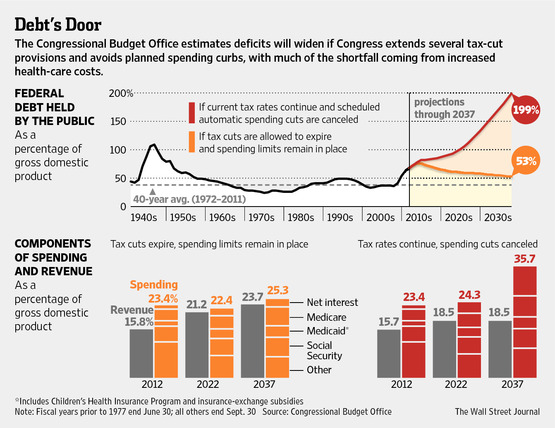

By the end of this year, the CBO said, cumulative federal debt will reach roughly 70% of gross domestic product—the value of all goods and services produced by the economy—the highest level since just after World War II. That's up from about 40% in 2008. Without changes in current policies, federal debt would reach about 200% of GDP in 25 years, the report said.

"The explosive path of federal debt…underscores the need for large and timely policy changes to put the federal government on a sustainable fiscal course," CBO director Doug Elmendorf wrote on his blog on Tuesday.

Budget watchdogs have long warned the U.S. was on an untenable fiscal path, due largely to the projected growth in spending on Medicare and other entitlement benefits as baby boomers age. Tax cuts enacted under former President George W. Bush also have contributed to the current fiscal plight.

Without changes in benefits or higher taxes—or both—the federal debt held by the public could reach 199% of GDP in 25 years, the CBO said, up from 187% in last year's projection.

The CBO said this course would likely have dire consequences for the economy, as well as forcing cuts in non-entitlement programs such as defense and social services. Without changes to stave off high debt and interest payments, U.S. GDP would be lower than otherwise over time.

The report showed that under current tax and spending policies, Social Security, Medicare and Medicaid—the three major programs that benefit older people—would amount to 16.6% of GDP in 2037, up from 10.4% now. That would tend to increase deficits dramatically and push interest costs to almost 10% of GDP in 2037, up from 1.4% now.

Republicans and Democrats blamed each other for the worsening budget outlook.

In a statement, Lanhee Chen, a top aide to Mitt Romney, the presumptive GOP presidential nominee, said the report showed President Barack Obama "has placed us on a path to fiscal ruin" by allowing debt to rise so quickly.

Obama campaign spokesman Ben LaBolt alluded to the policies of Mr. Obama's Republican predecessor, Mr. Bush, saying, "The president inherited a $1 trillion deficit as a result of two unfunded wars and tax cuts for the wealthiest." Mr. LaBolt added that Mr. Obama has "signed $2 trillion in deficit reduction into law and proposed a balanced plan to reduce the deficit by more than $4 trillion."

The political sniping also reflected the parties' sharp disagreement over several budget issues, including how to reduce the deficit, how to fuel stronger economic growth and how to handle the large tax increases and spending cuts scheduled to occur at the end of 2012.

Former President Bill Clinton, for example, appearing with Mr. Obama on Monday night, urged more short-term spending to boost the economy, and suggested Republicans were endangering growth with their zeal to cut spending.

"If you do not have economic growth, no amount of austerity will balance the budget, because you will always have revenues go down more than you can possibly cut spending," Mr. Clinton said of Republican budget plans.

Many congressional Republicans oppose more short-term spending and want more cuts. In a statement on Tuesday in response to the CBO report, House Budget Chairman Paul Ryan (R., Wis.) said Democrats' push to let the Bush tax cuts expire for high-income households and other tax increases would hurt the economy. "The president's policies call for job-crushing tax increases and harsh disruptions for beneficiaries of government programs as the debt spirals out of control. House Republicans refuse to accept this diminished future," he said.