I think the smart speculation has it more likely nailed than the MSM. For those saying that this is China selling bonds the facts don't seem to support that idea. What does, is likely the Basis Trade and Hedge Funds/Banks that used it are suffering badly. That and some Japanese carry trade suffering as well.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2025 Lunatic Fringe - Market and Trade Chat

- Thread starter pmbug

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

- Messages

- 1,862

- Reaction score

- 2,216

- Points

- 283

I heard it was the basis trade as well but many concerns if China does decide to dump.I think the smart speculation has it more likely nailed than the MSM. For those saying that this is China selling bonds the facts don't seem to support that idea. What does, is likely the Basis Trade and Hedge Funds/Banks that used it are suffering badly. That and some Japanese carry trade suffering as well.

Well that's a Giant Head and Shoulders top pattern.

Yep, it's not real clean due to that previous break through and bounce back but portends weakness IMO. That projects a price to ~$175. I would be soooo sad were that to happen.

pmbug said:Silver up slightly and gold up bigly from yesterday's close in overnight trading in China. SFE silver vault reports an inflow for the first time in over a week.

SGE finally released their weekly report for last week's silver vault activity and surprisingly they reported a moderate outflow. Given the very strong outflows the SFE silver vaults had been reporting daily, I was expecting the SGE to report a inflow (expecting SFE out ~> SGE in). There must be very strong demand for silver in China as SGE silver demand was greater than the SFE outflow.

Gold prices are soaring as investors flock to safe-haven assets amid escalating global trade tensions. In South Korea, where the gold rush has reached a fever pitch, daily trading volume has quadrupled, according to market data.

...

Although local prices have eased slightly from a February peak — when gold briefly neared 170,000 won per gram — investor appetite remains strong. The Korea Exchange data showed that average daily trading volume in the local market has reached 50.9 billion won this year, a 342 percent jump from the 2024 average.

...

Gold trading in Korea quadruples amid relentless global rally

Gold prices are soaring as investors flock to safe-haven assets amid escalating global trade tensions. In South Korea, where the gold rush has reached a fever pitch, daily trading volume has quadrupled, according to market data. Spot gold surged to a record $3,357 per ounce on global markets on...

I'm guessing their political instability with the martial law drama and eventual impeachment of their President might also be a factor.

FOMO rising in Asia:

thesun.my

thesun.my

As gold prices continue their upward trajectory, more Malaysians are turning to the precious metal as a hedge against inflation and a tool for wealth preservation.

...

M’sians turn to gold for wealth security as prices soar

The precious metal is one of few investments that reward fairly and one does not need course to get started, says investor

thesun.my

thesun.my

Viking

Yellow Jacket

Someone lit a fire under Gold and Bitcoin tonight.

- Messages

- 19,754

- Reaction score

- 11,700

- Points

- 288

Do you want to know why gold is driving higher so fast?

The Golden Age is already happening.

Nothing is as it appears.

“What is Basel III?”

“After the financial crisis, new banking rules known as Basel I, II and III came into effect. The regulations were created by the Basel Committee on Banking Supervision (BCBS), an offshoot of the Bank for International Settlements (BIS).

The regulations require banks to maintain proper leverage ratios and to meet certain minimal capital requirements. Tier 1 capital assets, such as cash and sovereign bonds (like US Treasuries), are considered the core measure of a bank’s financial strength from a regulator’s point of view.

Under the old Basel I and II rules, gold was rated a Tier 3 capital asset. Banks traditionally discounted a bank’s gold holdings by 50% of the market value. With gold’s value cut in half, banks had little incentive to hold gold as an asset.

As of April 1, 2019, gold bullion is a Tier 1 capital asset. Also, and this is important, under Basel III a bank’s Tier 1 capital assets must rise from the current 4% of total assets to 6%.

Because gold is now a Tier 1 capital asset, banks can operate with far less capital than when gold was classified as Tier 3. Then, banks had to hold extra capital on their books against gold holdings.”

Gold which was considered a tier 3 asset, was only counted for half its value.

That purposely discouraged banks from holding gold and helped suppress the price in order to prop up fiat currencies.

But that all changed in 2017.

“First announced in 2017, the Basel III rules apply to banks operating in the US, the European Union and Switzerland. Basel III was supposed to apply to UK banks as of Jan. 1, 2022, but according to the Bank of England, implementation has been delayed until Jan. 1, 2027.

Under the new regulations, allocated (physical) gold will be considered a Tier 1 asset and will continue to have zero risk weighting. Conversely, banks’ unallocated gold will be considered a Tier 3 asset. Unallocated gold refers to so-called “paper gold” like gold ETFs and gold futures.

In plainer English, Basel III requires the banks hold more high-quality assets to prevent liquidity crisis, reduce risky lending practices, and ensure the banks are more prepared for any kind of financial shock.”

In Trump’s first year in office, gold became a tier 1 asset and banks were required to increase their tier 1 holdings from 4% to 6%.

This is what is driving central banks around the world to massively purchase gold.

“According to the latest numbers from the World Gold Council, central banks added 1,045 tonnes to global gold reserves in 2024 — extending their buying streak to 15 consecutive years.”

“2024 was also the third consecutive year in which gold demand surpassed 1,000 tonnes, far exceeding the 473-tonne average between 2010 and 2021.”

Is Basel III setting up a new gold-backed monetary system? – Richard Mills

2025.04.18 Gold is up 25% year to date, and what a year it’s […]

Can you see what’s happening?

Can you see the SIGNAL?

The world’s financial system, which has been centralized and controlled in order to pick winners and losers, based on a fiat debt system, is being transformed before your eyes.

Gold, which had been purposely suppressed for many years in order to prop up the world’s fiat currencies, especially the dollar, is now considered real money again.

The entire system is being decentralized and banks around the world are now purchasing gold. They are also, no longer storing it in centralized locations like the U.K. and the U.S.

They are taking possession of their own gold.

And “paper” gold continues to be a tier 3 asset because it’s not real gold.

By placing physical gold in the tier 1 category as “real money,” the ability to manipulate the price using “paper” gold has ended.

That’s why gold is rallying.

Trump is FORCING the world back to a gold standard, while at the same time, transforming and decentralizing the world’s trading system that only benefited the few.

Trump is making the world great again and going back to honest money.

A Golden Age

- Messages

- 1,862

- Reaction score

- 2,216

- Points

- 283

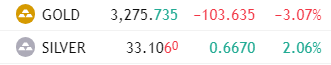

I like when every guru on the planet comes out with their foam predictions. Usually signals a top. LOL. I'm looking for 3250 temporarily and then 3000 or so. Of course any news could render any prediction worthless at this point.

- Messages

- 1,862

- Reaction score

- 2,216

- Points

- 283

Just sold my GDX and GLD puts I bought yesterday. 1st trade of the year.

- Messages

- 1,862

- Reaction score

- 2,216

- Points

- 283

Gold is almost at that 3150 level. Going to be interesting here to see if we now head back up or if we just go sideways for awhile during the summer months.

Regarding de minimus entries as highlighted in post #87:

Temu halts shipping direct from China as de minimis tariff loophole is cut off

PDD Holdings Inc.’s e-commerce sensation—similar to Shein Group Ltd. in its rapid rise with low-cost products ranging from clothing to household goods—is pivoting to a “local fulfillment” strategy. According to a statement from Temu, the platform is now actively recruiting U.S.-based sellers and...

Viking

Yellow Jacket

- Status

- Not open for further replies.