You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2025 Lunatic Fringe - Market and Trade Chat

- Thread starter pmbug

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

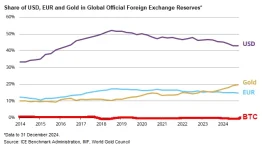

It's not a secret that USTs are not wanted and QE infinity is right around the corner. In steps gold to the rescue. This is going on for the next few years until everything resets. It might be a year into Vance's first term before the new system is fully integrated.

Yes!Gold miners are starting to decouple slightly from spot price because earnings are improving. Some say they could be the next tech stocks.

GDX

GDXJ

GDXU

SLV

SLVR

SIL

SILJ

pmbug said:Gold and silver both trade almost dead even with yesterday's close in overnight trading in China. The SFE silver vault reports a huge inflow. If the speculation that the recent blowout in EFP spread is due to tariff uncertainty in the USA (scaring actors from trying to ship metal from London to USA) is correct, I suppose it might encourage actors to ship (more?) metal to China given the ~5% premium over spot.

FWIW, ADP jobs report is shitty:

This was on the local news last night:

U.S. private sector hiring rose less than expected in August, data released Thursday shows, offering the latest indication of trouble in the labor market.

Private payrolls increased by just 54,000 in August, according to data from processing firm ADP published Thursday morning. That's below the consensus forecast of 75,000 from economists polled by Dow Jones and marks a significant slowdown from the revised gain of 106,000 seen in the prior month.

...

Jobs tied to trade, transportation and utilities saw particular weakness in August, with the group losing 17,000 roles on net, according to the ADP. Education and health services followed, recording a decline of 12,000 jobs.

But those losses were offset in part by a boom in the leisure and hospitality industry, which added 50,000 jobs in the month.

...

Thursday's ADP report adds to an already concerning picture of the labor market.

Jobless claims increased to 237,000, up 8,000 from the prior week and above estimates, per data also published Thursday morning. The Job Openings and Labor Turnover Survey registered one of its worst levels for job openings in July since 2020, according to government figures released Wednesday.

...

This was on the local news last night:

U.S. oil and gas producer ConocoPhillips will cut 20-25% of its workforce as part of a broad restructuring, a company spokesperson said on Wednesday, after five sources told Reuters that CEO Ryan Lance detailed the plans in a morning video message.

...

The company has about 13,000 employees globally, meaning between 2,600 and 3,250 employees will be affected. Most of the cuts will be made before the end of the year, ConocoPhillips spokesperson Dennis Nuss said in an email.

...

Viking

Yellow Jacket

Strategy for buying mining stocks:

Follow up to Aug 29 picture...

The Great Inversion is finally upon us. Get out while you still can. When the wealthiest top 0.00001% quietly unload their bags onto the 99.99% of retail sheep, it’s not a market, it’s a transfer. And it always marks the top.

Over the last week, 198 of the top 200 insider trades were sells. In two weeks, it was 398 of 400! The last time insider dumping hit this scale was the late 1920s, right before the Great Depression.

Unemployment is rising worldwide. Inflation is creeping back. The pressure is building exactly as it did a century ago. The worst damage will fall on stocks and crypto, both will easily to 80-90%+ of their value.

Retail hasn't really been buying, and therefore stock prices Should have declined as the Insiders get out. But we have prices that are nearly completely controlled, allowing them to get out mostly unnoticed.

Viking

Yellow Jacket

Passive investing. 401Ks, pension funds, etc. Those keep on investing.Retail hasn't really been buying, and therefore stock prices Should have declined as the Insiders get out. But we have prices that are nearly completely controlled, allowing them to get out mostly unnoticed.

Passive investing. 401Ks, pension funds, etc. Those keep on investing.

That's steady, I suppose it could show up in these "retail buying" headlines but I don't think so. Those aren't going to increase significantly.

Clive has noticed that there is a decent sized change and will be some Gold Miner rebalancing with GDX coming.

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

interesting interviewClive has noticed that there is a decent sized change and will be some Gold Miner rebalancing with GDX coming.

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

Falling Asleep at the Wheel-American Investors Fully Invested While Many Corporate Insiders Remove their Capital From the Market

September 13, 2025

more

Falling Asleep at the Wheel-American Investors Fully Invested While Many Corporate Insiders Remove their Capital From the Market

Photo Credit: Barchart 9/13/25 By Stan Szymanski This is not financial advice. For informational purposes only. If you have ever taken a long car trip to go somewhere across the United States you know that it may take you several days to get to your destination. To get there as expedientl

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

Beginning of Panic Rate Cut Cycle – Ed Dowd

Beginning of Panic Rate Cut Cycle – Ed Dowd | Greg Hunter’s USAWatchdog

By Greg Hunter’s USAWatchdog.com (Saturday Night Post) Former Wall Street money manager and financial analyst Ed Dowd of PhinanceTechnologies.com had a storied Wall Street career. He got out of Enron and Lucent long before they crashed and burned. A few of the many other more recent correct...

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

Uh...

WTF?

Well, that cuts it in half at least!

Eliminating property tax will go a long way to freedom!

In other news Gold hit $3700 today!

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

listen at 1.5x

45K! I haven't been watching the market! Last I heard it was at 35K!

• The blue-chip index crossed this psychological milestone in just trading days, marking another chapter in the longest bull run since the recovery.

• This breakthrough comes despite mixed economic signals, showing how corporate earnings and AI optimism continue to drive investor confidence.

• The milestone coincides with Trump's claims of the "strongest stock market ever" aspolitical rhetoric heats up around Fed policy.

Gold Hits All-Time Highs as Investors Brace for Fed Rate Cuts

• Spot gold reached $, per ounce, surpassing even inflation-adjusted records from , as dollar weakness and inflation hedging drive demand.

• The precious metal's surge reflects growing uncertainty about the Fed's ability to control inflation while supporting economic growth.

• JPMorgan expects gold to average $, in Q and climb toward $, by mid-

, signaling institutional confidence in the rally.

15

45K! I haven't been watching the market! Last I heard it was at 35K!

Monday Sept 15, 2025 Stockmarket repport. Stocks and Gold at Record Levels. FOMC Rate Cut Expected.

Dow Jones Smashes Through , Barrier for First Time in History• The blue-chip index crossed this psychological milestone in just trading days, marking another chapter in the longest bull run since the recovery.

• This breakthrough comes despite mixed economic signals, showing how corporate earnings and AI optimism continue to drive investor confidence.

• The milestone coincides with Trump's claims of the "strongest stock market ever" aspolitical rhetoric heats up around Fed policy.

Gold Hits All-Time Highs as Investors Brace for Fed Rate Cuts

• Spot gold reached $, per ounce, surpassing even inflation-adjusted records from , as dollar weakness and inflation hedging drive demand.

• The precious metal's surge reflects growing uncertainty about the Fed's ability to control inflation while supporting economic growth.

• JPMorgan expects gold to average $, in Q and climb toward $, by mid-

, signaling institutional confidence in the rally.

15

I don't know if this is legit or how significant a player Questrade is, but it seems like another red flag to me...

Because they ALL know that Gamestop is going to collapse the whole god damn fraud scheme's. And Questrade is likely just another POS broker that sells things and doesn't ever have any real stock.

- Status

- Not open for further replies.