You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2025 Lunatic Fringe - Market and Trade Chat

- Thread starter pmbug

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

The Trump administration is reportedly in talks with a New York-based investment firm to set up a $5 billion fund to boost mining of critical minerals.

According to a Bloomberg report citing people familiar with the matter, the U.S. International Development Finance Corp. is exploring a joint venture with Orion Resource Partners.

...

https://www.msn.com/en-us/politics/...ominance-remains-a-concern-report/ar-AA1MF5Xp

Looks like @oriental_ghost

has finished his trip and is back to posting China market updates.

Silver closed ~$43.44 in China is London spot it currently $41.82. That's a $1.62 difference (~3.9% over London spot).

SFE silver vault has lost ~21 metric tons since Wed of last week. SGE silver vault gained a tiny 4.1 metric tons last week.

~~~

Fed expected to cut rates 25bps today. Markets may overreact if they cut more or less than expected.

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

1946-1964-Silver-Roosevelt-Dime-Value

1946-1964 Roosevelt Dime $0.10

1946-1964-Silver-Roosevelt-Dime-Value - $3.0208

That means gas is about 10c a gallon!!

1946-1964 Roosevelt Dime $0.10

1946-1964-Silver-Roosevelt-Dime-Value - $3.0208

That means gas is about 10c a gallon!!

A $1.1bn gold exchange-traded commodity (ETC) distributed by Tabula Investment Management has been all but emptied of assets this month amid heavy outflows.

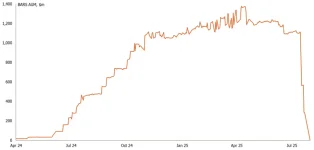

The SMO Physical Gold ETC (BARS), formed in partnership with responsible sourcing firm Single Mine Origin (SMO), enjoyed strong early traction after launch with the pitch of ‘mine to vault’ traceability resonating with gold hungry, ESG-focused investors.

BARS is managed by Zipa Investment Management, a Cayman-based entity which was established to launch and issue the product.

After peaking at just shy of $1.4bn in assets under management (AUM) in April, the fund has been rocked by large redemptions shedding around 99.5% of assets since 30 July, as the below chart shows.

It is now all but empty and houses just $5.6m in assets, per Trackinsight figures.

...

More:

So someone was tipped off that that ETF was a scam. Clearly wasn't much retail money in it either.

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

Same for GLD and SLV...So someone was tipped off that that ETF was a scam. Clearly wasn't much retail money in it either.

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

FOMC Meeting Just Changed My Entire Predictions For Gold and Bitcoin - Gerald Celente

Fed announces first rate cut in nine months, signals more reductions to come as gold and bitcoin continue to soar to fresh highs.In today’s episode, Gerald Celente delivers his trademark firebrand take on the two assets everyone’s watching: Bitcoin and gold. He hails gold as the one true constant—a timeless fortress standing tall while paper currencies wither under waves of inflation and policy chaos. To Celente, gold isn’t just a safe haven; it’s financial survival, a rock-solid shield against the engineered fragility of modern markets.

But he doesn’t stop there. Celente shifts gears to Bitcoin, the volatile digital renegade he describes as thrilling yet dangerously untethered. He calls it the modern gold rush, where fortunes rise like rockets and crash just as fast. While gold offers the security of centuries, Bitcoin offers adrenaline-fueled risk—and in Celente’s words, only those with “steel in their veins” should dare to ride it.

FOMC Meeting Just Changed My Entire Predictions For Gold and Bitcoin - Gerald Celente

12

I had largest one day windfall in my lifetime today after getting waxed on the FED cut. The people who sold on Monday are buying back in at a higher price today.

I held instead of trading in and out Ithen found that avoiding a whipsaw in a bull market is just as important as minimizing losses. I been trimming low performers and reinvesting into the leaders and BAM!

I held instead of trading in and out Ithen found that avoiding a whipsaw in a bull market is just as important as minimizing losses. I been trimming low performers and reinvesting into the leaders and BAM!

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

Ruh roe... the risky practice of betting on POG!

It’s like the sky is falling. The whole area of Shuibei is in chaos, with 20 dealers running away in one day. Gold prices are rising rapidly, and the risks in the industry are climbing just as fast.

China’s Largest Gold Wholesale Market Crashes, With Dozens of Gold Suppliers Fleeing the Same Day

Sep 16, 2025 #chinaobserverIt’s like the sky is falling. The whole area of Shuibei is in chaos, with 20 dealers running away in one day. Gold prices are rising rapidly, and the risks in the industry are climbing just as fast.

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

according to Clive's charts... we're heading down....

Knowing that the last admin cooked the books and their 'employment increases' were 'government' employees. They also massaged the numbers to look good only to revise them downward 3 months later. Sinclair called it "Management of Perspective Economics'.

Armstrong says the world is going into recession, but the US will have a better go of it.

The S&P 500, Nasdaq and Dow all posted weekly gains of 1%+ into Fri Sep 19, aided by easing expectations and AI-led leadership.

The dollar eased.

Gold extended gains on a weaker dollar. Silver surged.

31

Knowing that the last admin cooked the books and their 'employment increases' were 'government' employees. They also massaged the numbers to look good only to revise them downward 3 months later. Sinclair called it "Management of Perspective Economics'.

Armstrong says the world is going into recession, but the US will have a better go of it.

Sunday September 21 2025 Weekly financial news for the last 8 days. Fed cut rates. Unemployment up

The FOMC lowered the funds rate by 25 bps mid-week and signalled scope for further cuts as labor indicators soften; stocks finished the week at fresh records.The S&P 500, Nasdaq and Dow all posted weekly gains of 1%+ into Fri Sep 19, aided by easing expectations and AI-led leadership.

The dollar eased.

Gold extended gains on a weaker dollar. Silver surged.

31

Last edited:

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

They took the gold and fled.

- Messages

- 1,821

- Reaction score

- 2,151

- Points

- 283

Dragging the miners with them too.

I love the miners!Dragging the miners with them too.

pmbug said:Gold is up and silver is just barely, slightly up from yesterday's close in overnight trading in China. Silver is still at a premium to LBMA spot / COMEX futures and gold is still at a discount to same.

The SGE silver vault reports a modest net outflow across last week. SGE silver vault has largely been draining it's stock since the beginning of August in spite of silver trading on the SGE at a premium to the West.

When the USG officially labels Ag a strategic metal there will be a pop, a pause and then an explosion. Same thing happened with gold when it became a Tier 1 asset. Gold usually leads, but silver at some point outperforms.

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

You're lying to me!!"there is no 999 white gold"

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

Tues Sept 23, 2025 Stock Market report for today and yesterday. Stocks at new record high. Gold too.

Wall Street RecordsNvidia and anti-trust rules

Alibaba’s Qwen

Trump tariffs effect on inflation

UK Inflation

Gold Silver platinum palladium

Trump Tariffs effect on Inflation

Bitcoin & Ethereum

China’s trade surplus

32

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

Not sure where to put it but FCX had a big mine accident and why copper prices are up today.

www.zerohedge.com

www.zerohedge.com

I had to dig deep but that mine did also produce silver. Looks like the last 3 months was 1.1 million ounces (I don't know if that was total or there ~49% ownership). Still if its down 3 months that's another million ounces of no silver.

"A Black Swan Event": Copper Prices Soar After FCX Declares Force Majeure At World's 2nd Largest Mine | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

I had to dig deep but that mine did also produce silver. Looks like the last 3 months was 1.1 million ounces (I don't know if that was total or there ~49% ownership). Still if its down 3 months that's another million ounces of no silver.

- Status

- Not open for further replies.