- Messages

- 19,189

- Reaction score

- 11,503

- Points

- 288

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

The best explanation I have heard yet. It was Nicks fault.

She's definitely easy on the eyes. She's also very good at what she does. Always seems to ask intelligent questions and keeps the interviews on track.Came for the commentary, stayed for the hottie.

"On February 5, 2026, six groups of accounts under actual control exceeded the daily trading volume limit for relevant contracts , reaching the exchange's processing standard. The aforementioned clients' trading activities violated Article 16 of the " Shanghai Futures Exchange Abnormal Trading Behavior Management Measures ," and the exchange decided to take regulatory measures to restrict the opening of positions by the relevant clients in the corresponding contracts."

...

One last point is people talk about this like there is only so much silver available and once it's gone it's gone. I think they forget the 850 million ounces comes out of the ground every year.

Yes, that's the primary reason this bull run started in the first place. After 5 years of this, stores of metal were dropping, and the up cycle started. As prices rose "new" supply in the form of stored investment metal (and other recycle sources) came in to partially offset the shortage. But much of the investment metal is held in strong hands and much of that will not sell until silver hits 150, etc. As the price continues to go up, more silver will come out into the open for purchase, but I suspect the price vs additional recycle will see diminishing returns, and eventually a point will be reached where demand cannot be met. As that point comes closer, industrial users, seeing that train coming at them. will be frantically searching for less expensive alternatives, and for some needs, they will find a work-around. Those industrial needs with an alternative will exit the silver market. For other needs, at least in the near-term, there will be no practical alternative, so silver prices will go up until demand balances supply. At least in theory.Industrial demand alone is purportedly 900M ozt / year right now.

... This market needs to settle down and consolidate.

I cant find anything on last years demand. 2024 was 680 million. 900 million would be a substantial increase over 2024. I can certainly see that happening if industry started stockpiling it as a critical metal.Industrial demand alone is purportedly 900M ozt / year right now.

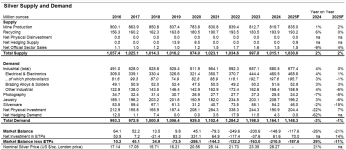

From the table above:I cant find anything on last years demand. 2024 was 680 million. 900 million would be a substantial increase over 2024. I can certainly see that happening if industry started stockpiling it as a critical metal.

The silver institute did have 2025 numbers already. They say 677 million for industrial.

View attachment 18351

As I understand it, the refiners are primarily backed up with remelting and re-pouring (not refining, not recycle) various sizes of 0.999 stock (coins, rounds, small bars) into 1000 oz COMEX and LBDA good delivery bars.Kieth Nuemeyer doesn't think the Is even puts out real data anymore. How could 2025 recycling numbers be the same as 2024 but the refiners are backed up as long as they are? That alone doesn't make sense.

From Business Focus HK (had to use translate)The primary suspected actor: Bian Ximing (also referenced in reports as a veteran Chinese commodity trader). Through his associated brokerage Zhongcai Futures Co., he built what appears to be the largest net short position on SHFE silver—reportedly around 450 tons (equivalent to roughly 30,000 lots or a massive portion of available physical).

Not going to accelerate anything if there is nothing available to purchase.

I suspect that the deficit will lessen this year because of the higher prices and more people selling. The refiners are maxed out so there will be a lot more silver coming into the market as they catch up over the coming months. In addition, if investor demand was 200 million ounces when silver was 20 it takes a whole lot more money at current prices to continue that 200 million ounce demand. It may be happening but indications are that in the US the sellers really came out when prices got over 100.

One last point is people talk about this like there is only so much silver available and once it's gone it's gone. I think they forget the 850 million ounces comes out of the ground every year.