You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2026 Lunatic Fringe - Market and Trade Chat

- Thread starter pmbug

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

Re: March26 open interest / delivery risk:

TFMetals said:Here's a "controversial" take from someone who has dedicated 15 years of his life working to end the fractional reserve and digital derivative precious metal pricing scheme:

COMEX silver will not default on February 26 or anytime during March.

But, China! Yes, I know all about it. More than most of you reading this. But understand that the CME makes it very difficult to stand for physical delivery in size.

And what parties do you expect to stand for this exchange-breaking delivery? The CTA algos? The Swap Dealers? How about the Producer/Merchants? Yes, there will be some bullion bank Customer deliveries but 50,000 contracts worth? That's very, very unlikely when the record seen in March 2025 was 16,149.

Yes, dwindling physical supply is stressing the pricing scheme that relies upon leverage and, one day soon, the scheme will collapse under its own unallocated weight.

But that collapse will not begin on COMEX and it won't start on 2/26/26.

(please bookmark this post and revisit it in three weeks to see if I'm correct)

- Messages

- 641

- Reaction score

- 550

- Points

- 268

I don't know how to read the chart properly, but it seems that buying options to buy gold at $20K should be extremely cheap, maybe even as a bet just for the entertainment value. Like when I bought Worldcom at twenty cents.

Unobtanium

Big Eyed Bug

- Messages

- 465

- Reaction score

- 27

- Points

- 153

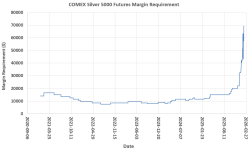

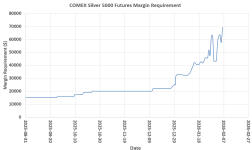

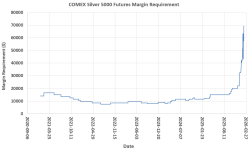

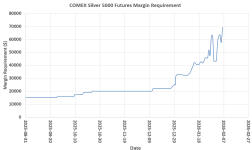

SAIP, but I put together this chart to show how violently the CME has recently raised the silver futures margin in recent weeks, compared to the past five years.

If we blow up just between Aug 2025 until present, we can see the rapid changes in the past few weeks.

On Jan 13, 2026, the CME change the margin from fixed values to a rate that gets multiplied by the current silver price and by the #contracts (5000) to get the margin requirement for any given day. Therefore the margin requirements are now changing daily based on rate and silver price. Thus the large swings in silver margin requirement since Jan 13. Since Jan 13, the rate has already been increased four times from 9% to 11% to 15% to 18%.

If the rate stays at 18%, when the silver price gets back up to $112/oz, then the margin req will be about $100k.

If we blow up just between Aug 2025 until present, we can see the rapid changes in the past few weeks.

On Jan 13, 2026, the CME change the margin from fixed values to a rate that gets multiplied by the current silver price and by the #contracts (5000) to get the margin requirement for any given day. Therefore the margin requirements are now changing daily based on rate and silver price. Thus the large swings in silver margin requirement since Jan 13. Since Jan 13, the rate has already been increased four times from 9% to 11% to 15% to 18%.

If the rate stays at 18%, when the silver price gets back up to $112/oz, then the margin req will be about $100k.

It looks pretty much the same...that's how you know its a real strong bull market.

- Messages

- 19,284

- Reaction score

- 11,524

- Points

- 288

Clive's bedtime stories – should be required reading for every family...

Chapter 1

Little Trot and Old John grow vegetables in their garden. They sell the vegetables in the market. Then they take their money and put it in the bank. They are saving their money to buy a bigger house.

Mr Ledger, the bank manager, lends their money to the goblins. The goblins are lazy. They don't work. They just borrow money from the bank and spend it on food. The bank manager, Mr Ledger, tells the goblins that they will have give the money back one day. He hopes they will repay the loans. But he is worried that they might not pay. But he lends them more money anyway.

The goblins just laugh as they borrow more and more money. They have no intention of repaying their loan, ever.

One day Little Trot and Old John have saved enough money to buy a new house. So they go to the bank to get their money.

"Oh No!" says Mr Ledger. "I don't have your money. I lent it all to the goblins".

"What?" cries Little Trot, "But that's our money. I gave it to YOU! I want it back"

Mr Ledger goes to see the goblins to ask them to repay the loan. But the goblins just laugh. "We don't have any money", they say. We spent it on vegetables.

Poor Little Trot. His money is all gone.

"Don't worry" says Old John. "We'll work even harder to earnj money. But this time we'll be smarter. We won't put it all in the bank. We will save our money in lots of different ways"

Little Trot does not understand. So Old John explains. "We'll put just a little in the bank. With the rest we are going to buy gold, property and businesses"

In this story, you can help your children understand words like:

• SAVE = Keep money safe for later, not spend it now

• BORROW = Get money you must give back later

• LEND = Give money to someone who must return it

• DEBT = Money you borrowed and must pay back

• INTEREST = Extra money you pay as a "thank you" for borrowing

• PROFIT = Money left over after paying for everything

Investing Lesson: Little Trot learns about saving. But he should never have put it all in the bank!

This video is for adults to explain investing to their children. Our first lesson is about saving in the bank. Your bank does not keep ypour money in a shoebox waiting for you to come and get it.Chapter 1

Little Trot and Old John grow vegetables in their garden. They sell the vegetables in the market. Then they take their money and put it in the bank. They are saving their money to buy a bigger house.

Mr Ledger, the bank manager, lends their money to the goblins. The goblins are lazy. They don't work. They just borrow money from the bank and spend it on food. The bank manager, Mr Ledger, tells the goblins that they will have give the money back one day. He hopes they will repay the loans. But he is worried that they might not pay. But he lends them more money anyway.

The goblins just laugh as they borrow more and more money. They have no intention of repaying their loan, ever.

One day Little Trot and Old John have saved enough money to buy a new house. So they go to the bank to get their money.

"Oh No!" says Mr Ledger. "I don't have your money. I lent it all to the goblins".

"What?" cries Little Trot, "But that's our money. I gave it to YOU! I want it back"

Mr Ledger goes to see the goblins to ask them to repay the loan. But the goblins just laugh. "We don't have any money", they say. We spent it on vegetables.

Poor Little Trot. His money is all gone.

"Don't worry" says Old John. "We'll work even harder to earnj money. But this time we'll be smarter. We won't put it all in the bank. We will save our money in lots of different ways"

Little Trot does not understand. So Old John explains. "We'll put just a little in the bank. With the rest we are going to buy gold, property and businesses"

In this story, you can help your children understand words like:

• SAVE = Keep money safe for later, not spend it now

• BORROW = Get money you must give back later

• LEND = Give money to someone who must return it

• DEBT = Money you borrowed and must pay back

• INTEREST = Extra money you pay as a "thank you" for borrowing

• PROFIT = Money left over after paying for everything

Last edited:

Viking

Yellow Jacket

- Messages

- 19,284

- Reaction score

- 11,524

- Points

- 288

I'm thinking the correction was a good thing... coitus interruptus if you will?Tuesday night McSlammy right on time. It was worse an hour ago.

It was parabolic.

Sure they forced it to rise to create the excitement that causes newbies to rush right in where wise men never go...

But in the long run... now it will do a slow burn back to the high which will provide much needed support to the campaign.

March madness (shortages) will keep them from slamming silver further down...

Not saying they couldn't try it again, but the house is playing with borrowed money.

- Messages

- 19,284

- Reaction score

- 11,524

- Points

- 288

The Solari Report | Catherine Austin Fitts - no nonsense analysis...

This week, I am joined by Carlos Alegría (CEO) and Edward “Ed” Dowd (founding partner) of Phinance Technologies. As macroeconomic consultants, their core expertise is a high-integrity, data-driven focus on the underlying forces that tend to remain “invisible and neglected by most market participants.”

Phinance has just released a major report on China’s economic outlook for 2026, as well as a major report on the U.S. economic outlook. In this discussion, we take a serious look at the economic risks that China will be forced to confront in the coming year and beyond.

Our discussion focuses on three areas:

Both of my guests bring a wealth of credentials permitting a nuanced and informed discussion of China’s economic realities. Alegría, originally trained as a physicist before turning to quantitative finance, has dual PhDs in optoelectronics and finance. While working at a large London-based hedge fund at the onset of the 2008 Financial Crisis, he was shocked to realize that almost no one saw it coming. He is author of the 2017 book, Economic Cycles, Debt, and Demographics.

During the height of the Covid injection rollout, Dowd earned our deep appreciation for his powerful “Cause Unknown” book, his integrity, and his clarity in giving voice to the “died suddenly” phenomenon—and its economic implications. Before cofounding Phinance with Alegría, he had a lengthy career on Wall Street, including as a portfolio manager at BlackRock.

This is an interview that helps adjust the picture that most Western financial professionals have about China, by, as Alegría puts it on the Phinance website, “separating information (signal) from noise.”

For those who manage a family office, institutional assets, or family savings, and are likely affected by what happens in China and by the Trump administration’s trade policies, these Phinance reports offer valuable intelligence.

5m

This Chart Is One of Those OMG Moments When You Understand That China Isn't Going to Overtake the US

"China’s Real Economic Risks with Carlos Alegría and Ed Dowd"This week, I am joined by Carlos Alegría (CEO) and Edward “Ed” Dowd (founding partner) of Phinance Technologies. As macroeconomic consultants, their core expertise is a high-integrity, data-driven focus on the underlying forces that tend to remain “invisible and neglected by most market participants.”

Phinance has just released a major report on China’s economic outlook for 2026, as well as a major report on the U.S. economic outlook. In this discussion, we take a serious look at the economic risks that China will be forced to confront in the coming year and beyond.

Our discussion focuses on three areas:

Demographics: In the aftermath of the One Child Policy, China’s population is shrinking—and that has significant economic implications.

GDP and Debt: Relative to the U.S., China’s GDP has declined. In 2025, China managed to achieve a 5% growth rate through strong exports, but to keep it going, they will need to continue to “export, export, export”—with ramifications for the economies being flooded with China’s cheap goods. China has also doubled its money supply.

Real Estate: China’s real estate problem is getting worse, not better. When the bubble bursts, Alegría and Dowd have serious concerns about a possible worldwide real estate contagion.

Both of my guests bring a wealth of credentials permitting a nuanced and informed discussion of China’s economic realities. Alegría, originally trained as a physicist before turning to quantitative finance, has dual PhDs in optoelectronics and finance. While working at a large London-based hedge fund at the onset of the 2008 Financial Crisis, he was shocked to realize that almost no one saw it coming. He is author of the 2017 book, Economic Cycles, Debt, and Demographics.

During the height of the Covid injection rollout, Dowd earned our deep appreciation for his powerful “Cause Unknown” book, his integrity, and his clarity in giving voice to the “died suddenly” phenomenon—and its economic implications. Before cofounding Phinance with Alegría, he had a lengthy career on Wall Street, including as a portfolio manager at BlackRock.

This is an interview that helps adjust the picture that most Western financial professionals have about China, by, as Alegría puts it on the Phinance website, “separating information (signal) from noise.”

For those who manage a family office, institutional assets, or family savings, and are likely affected by what happens in China and by the Trump administration’s trade policies, these Phinance reports offer valuable intelligence.

5m

$20K INTO $5M!

www.kitco.com

www.kitco.com

Silver’s parabolic rally a 'seven sigma event’ where ‘YOLO traders’ turned $20,000 into $5 million – RJO Futures’ Pavilonis

The Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.

- Messages

- 1,827

- Reaction score

- 2,158

- Points

- 283

I thought everyone was doing that on here. The next move will be 5 mil into 1 1/4 billion. After that we meet up in the Caribbean and party on our mega yachts.$20K INTO $5M!

Silver’s parabolic rally a 'seven sigma event’ where ‘YOLO traders’ turned $20,000 into $5 million – RJO Futures’ Pavilonis

The Kitco News Team brings you the latest news, videos, analysis and opinions regarding Precious Metals, Crypto, Mining, World Markets and Global Economy.www.kitco.com

Viking

Yellow Jacket

Sooner.I did some rolling and got smoked when they pulled the rug. Still holding for the rebound by the summer?

- Messages

- 19,284

- Reaction score

- 11,524

- Points

- 288

I'm not "playing" the futures game.

It's way over my head....

I'm just happy holding silver rounds and junk silver and a few miners.

I bought a small bag of Rosies about 20 years ago. I forget the price, but I'm happy they're selling for around $6 each!

I should count them up and see how many there are.

It's way over my head....

I'm just happy holding silver rounds and junk silver and a few miners.

I bought a small bag of Rosies about 20 years ago. I forget the price, but I'm happy they're selling for around $6 each!

I should count them up and see how many there are.

... After that we meet up in the Caribbean and party on our mega yachts.

Wait - you think a bunch of precious metals stackers could all make it to the Caribbean on boats?

Think of the bonanza it would be for future treasure hunters! Dozens of sunken mega yachts filled with gold and silver just waiting for intrepid divers to find the wrecks!Wait - you think a bunch of precious metals stackers could all make it to the Caribbean on boats?

Xiaojun Bai said:SHFE's gold bulls continue to increase their holdings in various months contracts, and suppress short positions by more than three times. The market has reached a consensus that gold will surpass $10000 in the near future!

I don't remember if it has been mentioned here, but China's markets are closed next week for a holiday. I expect silver is likely going to get slammed and then miraculously recover on Friday (next week). Might be a good BTFD opportunity.

- Messages

- 19,284

- Reaction score

- 11,524

- Points

- 288

Reason Armstrong's prediction for lower silver is in the works....I don't remember if it has been mentioned here, but China's markets are closed next week for a holiday. I expect silver is likely going to get slammed and then miraculously recover on Friday (next week). Might be a good BTFD opportunity.