Gold continued its trend lower Tuesday, but falling prices are boosting demand out of India and China, according to analysts. ...

...

... lower prices are working in favor of the retail buyer in Asia, which suggests there could be a price floor in gold's recent selloff, said Commerzbank analyst Carsten Fritsch.

This is visible by looking at rising premiums in India and China. "Gold traders in India responded by demanding a premium of $2 per troy ounce on the official local price. The week before they had been forced to grant a discount of $18 per troy ounce. The higher demand is meeting with reduced supply after gold imports were postponed in anticipation of a possible cut in import tax that did not then materialise," Fritsch noted.

...

In China, premiums were also raised by local sellers, Fritsch added. "Traders in China raised their price premium to $16-27 per troy ounce from $12-15 in the previous week. Jewellery retailers there are replenishing their stocks following the New Year festivities," he said Tuesday.

The rising demand points to how price-sensitive gold buyers are in the world's top two gold-consuming nations.

What this means for the global price of gold is that the overall move down could be limited, Fritsch pointed out. "Though this does not mean that they are able to drive prices significantly up, they can preclude or at least slow any further price fall," he said.

...

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Asian demand puts floor on gold price

- Thread starter pmbug

- Start date

-

- Tags

- physical demand

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more. You can visit the forum page to see the list of forum nodes (categories/rooms) for topics.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Messages

- 256

- Reaction score

- 190

- Points

- 113

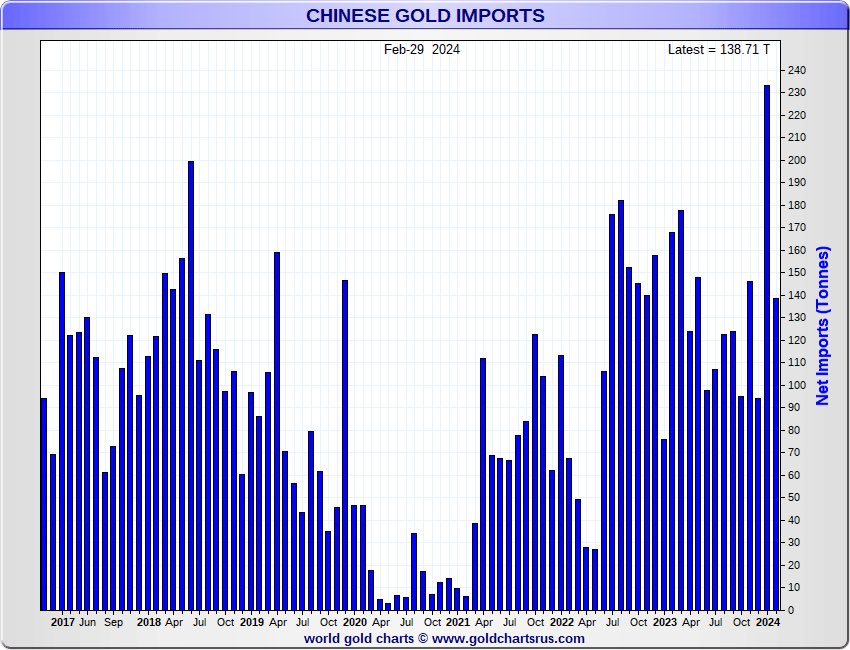

China’s gold imports surge to record high as appetite increases, middle class seek wealth security

- China imported a record high 1,447 tonnes of gold for non-monetary use last year, with the value increasing ninefold from three years ago to US$90 billion

- China’s middle class are seen to be attempting to preserve their dwindling fortunes caused by the property market crisis and slumping stock market

China’s appetite for gold rose to record high levels last year, as investors sought to secure their assets and limit uncertainties caused by a weak yuan, an ongoing property slump and fears over a stock market rout.

Imports of gold for non-monetary use – products including gold jewellery – rose to 1,447 tonnes last year, breaking the previous record of 1,427 tonnes in 2018, according to the General Administration of Customs.

The weight marked a sevenfold increase from 2020, while the US$90 billion value represented an almost ninefold increase from three years ago.

Domestic sales in China also hit 1,090 tonnes of gold last year, according to the China Gold Association, with gold jewellery consumption increasing by 7.97 per cent year on year and purchases of gold bars and coins increasing by 15.7 per cent.

With limited access to overseas assets, China’s middle class are seen to be attempting to preserve their fortunes, which have dwindled amid the slumping property market.

“Facing the property and stock market slump, global geopolitical instability, and the fall of the Chinese yuan’s exchange rate, gold purchasing is currently the best way for Chinese residents to preserve their wealth,” said Peng Peng, executive chairman of the Guangdong Society of Reform.

China’s wealth-preservation society ups appetite for gold with record imports

China imported a record high 1,447 tonnes of gold for non-monetary use last year, with the middle class attempting to preserve their dwindling fortunes caused by the property market crisis and slumping stock market.

2 points

a) gold bars and coins are considered non-monetary...

b) these statistics don't consider imports of gold for monetary use

those are intresting coins.....very large diameter but seem very thin ....when i handle one i feel like it would be easy to bend ....i am a fan of 1 ducats and in the past they provided extra ordinary value in gold coins, ducat pic for fun LOLI was looking at a few 4-ducat restrikes @ 3% above spot.

Attachments

- Messages

- 9,998

- Reaction score

- 7,790

- Points

- 238

He'll thank you later!Brother-in-law was about to pull the trigger on $10k worth of silver from one of those silver houses. They wanted nearly $40 an ounce. Talked him into going with five Maple Leaves from Apmex instead.

- Messages

- 3,057

- Reaction score

- 3,340

- Points

- 248

He'll thank you later!

He was talking to someone at Rosiland Capital. He was ready to send them the money. Personally, I was willing to let him do it because he's an idiot liberal democrat, but I had my sister (who is not) to think of.

- Messages

- 256

- Reaction score

- 190

- Points

- 113

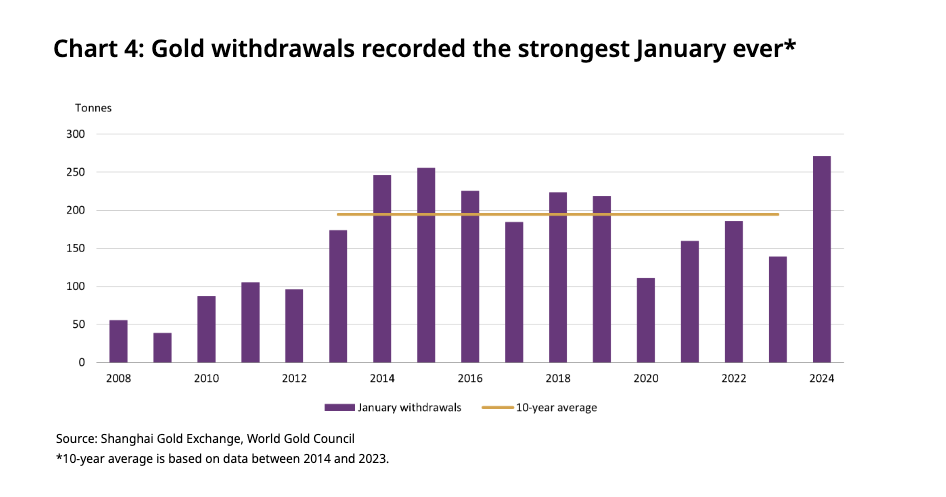

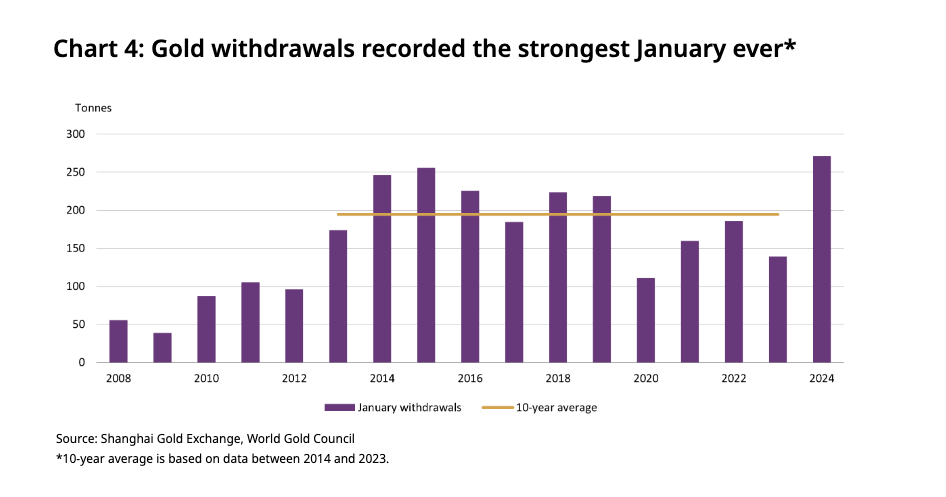

Chinese Wholesale Gold Demand Sets January Record

Chinese gold demand kicked off 2024 with a bang.Wholesale gold demand set a record in January. Meanwhile, assets under management by Chinese gold ETFs reached an all-time high.

China ranks as the world’s top gold consumer, and Chinese demand has a significant impact on the global gold market.

Gold withdrawals from the Shanghai Gold Exchange (SGE) hit 271 tons in January, the highest level on record. It was a 95 percent increase compared to a tepid 2023 and a 65 percent increase month-on-month.

Withdraws from the SGE represent wholesale gold demand in China.

Chinese Wholesale Gold Demand Sets January Record

Due to strong demand coupled with a stable gold price, assets under management by Chinese-based gold ETFs rose by $113 million to $4 billion in January. An all-time high.

- Messages

- 256

- Reaction score

- 190

- Points

- 113

China's Jan gold imports via HK gallop to 6-year highs on festive spirit

China's monthly net gold imports via Hong Kong surged 51 per cent in January to their highest since mid-2018, official data showed on Tuesday, as customers amassed the precious metal in preparation for the Lunar New Year festival.The Hong Kong data may not provide a complete picture of Chinese purchases, as gold is also imported via Shanghai and Beijing.

The People's Bank of China controls the amount of gold entering the country via quotas to commercial banks.

China's Jan gold imports via HK gallop to 6-year highs on festive spirit

:China's monthly net gold imports via Hong Kong surged 51 per cent in January to their highest since mid-2018, official data showed on Tuesday, as customers amassed the precious metal in preparation for the Lunar New Year festival."As local assets including equities and properties saw weak...

I admit I'm a little confused...

First, one thing are imports and another one are withdrawals (e.g. from Shanghai. S. previous post). Record imports doesn't mean record withdrawals... or does it?

Second, record imports via HK doesn't mean record imports into China, as "gold is also imported via Shanghai and Beijing". Right?

- Messages

- 256

- Reaction score

- 190

- Points

- 113

If all the gold in Ft. Knox is there then it's at most a 3 year supply. If othwrs wise up about gold then it's about one year's supply.

If the gold in Fr. Knox is not for sale it's 0 years supply

At least six Chinese banks have raised investment thresholds for their gold savings accounts, in an attempt to warn retail investors of potential risks amid a price rally and growing demand for the safe-haven asset.

Starting Friday the Agricultural Bank of China Ltd. increased the minimum investment to 550 yuan ($76) from 500 yuan for one of its gold deposit products, according to a March 22 notice.

...

I think Chinese people are aware that Chinese economy (and Yuan) have significant downside risks. They want gold.