BREAKING: 50% of COMEX Eligible Gold is still not Eligible as deliverable supply, says COMEX operator CME on 9 December 2024.

Deliverable supply of gold according to COMEX and CME = Registered + 50% of Eligible

Which means that there is far less gold than imagined in Comex vaults to meet gold futures contracts deliveries.

CME’s latest letter to the CFTC, dated 9 December 2024 (after the NY-LN spread had already started to blow out), says that:

“Deliverable supply is calculated as the sum of total reported registered gold with total reported eligible gold, after taking a 50% discount for eligible gold.”

Which means that , based on the latest CME Gold Stocks report of 28th March, instead of 22.75 mn ozs of registered and 20.59 mn ozs of eligible (for a total of 43.34 mn ozs (434,300 contracts)) being available for delivery against CME’s gold futures contracts, as many in MSM claim, there are actually 22.75 mn ozs of registered and 10.29 mn ozs of eligible (for a total of 33.04 mn ozs (330,000 contracts)) of available deliverable supply.

Which is 25% less than just adding registered and eligible together.

Watch for the shorts to spin this one.

See CME letter to CFTC, pages 9-11 of pdf

https://cftc.gov/sites/default/files/filings/ptc/24/12/ptc12092410790.pdf

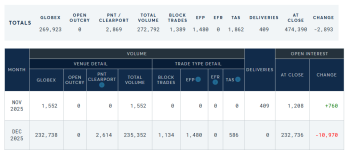

Screenshot below is CME on 9th Dec 2024.