You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

China's banks offering precious metals wallets

- Thread starter Voodoo

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more. You can visit the forum page to see the list of forum nodes (categories/rooms) for topics.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

FYI - that China speculation was published early January. Doesn't look like the speculation had any legs.

This is new news.

Here is the JPM head's trip to China.

JPMorgan's Dimon to visit mainland China for first time in four years

Jamie Dimon, the chief executive of JPMorgan Chase & Co, travels to mainland China this month for the first time in four years, sources said, the latest in a series of visits by top foreign financial executives since the lifting of tough COVID-19 curbs.

Here is the Tweet from Today.

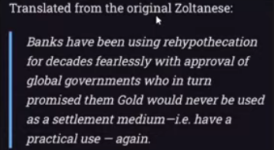

Yes, Zoltan had predicted that this was coming but is NOW happening.

I cannot find any corroboration that China is now offering gold backed savings accounts. If it were real news, you would think you might find it mentioned in some news media somewhere instead of just an unsourced claim from someone on twitter.

I cannot find any corroboration that China is now offering gold backed savings accounts. If it were real news, you would think you might find it mentioned in some news media somewhere instead of just an unsourced claim from someone on twitter.

It is China after all. I don't think this exact product is a good thing at all. But if even the bad guys are going to Gold backing CBDC's then we are 100% going in that direction. Give it a few more days to simmer to see if there are a few articles.

Cigarlover

Ground Beetle

- Messages

- 673

- Reaction score

- 855

- Points

- 213

Gold backed CBDC. Does this mean I can trade in my cbdc for gold? If not then it is backed by nothing. It's really just a way for governments to print endlessly and make up the numbers as they go along.

I found this on Twitter:... Give it a few more days to simmer to see if there are a few articles.

No links the article displayed in the image and search engines can't find it. Beijing Business Daily is all Chinese (no English) and I can't read or navigate that site, so the story is coming 3rd hand at best through unverifiable translation. I'd like to see a report without any hype that explains the news clearly.

I searched around a good bit and found this:

...

1. Precious Metal Wallet

The Precious Metal Wallet business refers to the one-stop precious metal service introduced by Bank of Communications that integrates the functions of buying, selling, depositing, accumulating of precious metal shares, and the shares can be converted into fixed-term gold investment products or physical precious metals. The main functions include: a. real-time transaction and accumulation investment plan: the customer acquires the precious metal shares of Bank of Communications based on physical precious metals through real-time transaction or accumulation investment plan; b. Precious metal investment with maturity income: The customer may purchase or convert the precious metal shares into a variety of fixed-term precious metal investment products, and the maturity income is reflected by increased shares; and c. Physical conversion: The customer may convert the precious metal shares into physical precious metals and other related products provided by Bank of Communications.

Best I can tell, the bank is offering clients the ability to buy shares of an unallocated pool and to take physical possession through some undisclosed process. It does not appear to have anything to do with a CBDC or crypto token.

Bai Xiaojun responded to my comment on twitter with a link to the source report for this story which is a Chinese news site that does not have an English version. I copy/pasted the story he referenced into Google translate though:

Source:

As the global risk aversion sentiment heats up, the international gold price has recently hit a new high. Against this background, banks have stepped up their promotion of gold and other precious metal accumulation products. Recently, the Bank of Communications sent a text message to investors, introducing a precious metal wallet business of the bank covering the accumulation, trading and conversion of precious metals. Bank branches such as China Construction Bank and Postal Savings Bank of China have also released public account promotion documents about gold accumulation. Prior to this, out of risk prevention and compliance considerations, many banks successively tightened up agency personal precious metal business and account precious metal business including paper gold. Now that the gold price is recovering, is it a good choice to invest in precious metal accumulation products?

Banks promote precious metal products

Recently, some investors received a text message from the Bank of Communications, introducing a precious metal wallet business of the bank. "A new way to invest in gold! Precious metal wallets start from 1 gram and accumulate a lot. T+0 transactions are easy and convenient, and there are various types of physical objects. Log in to the Bank of Communications App homepage and search for 'precious metal wallets' to sign up and buy directly."

It is understood that the precious metal wallet of the Bank of Communications covers gold transaction-based services such as accumulation, trading, and conversion. On May 7, a reporter from the Beijing Business Daily consulted the customer service personnel of the Bank of Communications and learned that the precious metal wallet has been launched before. It is through precious metal trading or precious metal accumulation plans to obtain the precious metal shares of the Bank of Communications based on physical precious metal assets. The precious metal shares held by customers provide conversion value-added services. Investors can convert precious metal shares into physical precious metal products, precious metal investment products and other related products within a specified time, such as gold jewelry, gold bars, etc., or they can choose to continue to hold shares .

A reporter from Beijing Business Daily found that in June 2022, the Bank of Communications had announced that it would upgrade its regular gold investment business to a precious metal wallet business. 2 The account will be changed to real-time account. In addition, the Bank of Communications has also restricted the upper limit of the single fixed investment amount of the precious metal wallet, which is 20 million yuan. If the original gold fixed investment amount exceeds the upper limit, the precious metal wallet will use the upper limit of 20 million yuan as the fixed investment amount, while the previous gold fixed investment has no upper limit. Require.

At present, precious metal wallets mainly cover two types of products: demand gold for real-time transactions and fixed-term deposits. Among them, demand gold is the most popular product. The product starts at 1 gram, supports fixed investment, and mainly relies on the rise of gold to obtain income. According to the gold price of spot gold displayed on the precious metal wallet interface of the Bank of Communications App, the current gold price is at the highest point in ten years. As of May 5, the real-time gold price of spot gold has reached 454.66 yuan/gram, an increase of 2.61% in the past week.

The accumulation of precious metals is mainly gold. It is understood that the minimum business unit of gold accumulation products is 1 gram, which supports customers to withdraw physical gold or sell gold to obtain corresponding monetary funds. Since the long-term accumulation of gold can effectively stabilize the impact of gold price fluctuations, investors can earn income from price fluctuations and resist risks through asset diversification. Gold accumulation has become the choice of many investors during the volatility of the gold market.

A reporter from Beijing Business Daily noticed that in addition to Bank of Communications, branches of banks such as China Construction Bank and Postal Savings Bank of China have also released promotional texts about gold accumulation, and the Inner Mongolia Autonomous Region Branch of China Construction Bank released a reward activity for participating in gold accumulation and exchanging welfare "CC beans" , Postal Savings Bank Qingdao Branch introduced the function of gold accumulation and the specific handling process.

Talking about the reasons why banks have recently promoted the accumulation of precious metal products, Zhou Maohua, an analyst at the financial market department of Everbright Bank, believes that for ordinary investors, precious metal accumulation has a low investment threshold, which helps reduce the risk of one-time purchases of precious metals and smooth market fluctuations , investors can obtain relatively stable income, and at the same time, trading operations are more flexible. Recently, as the price of gold continues to rise, the market's enthusiasm for gold investment has increased, so banks are actively promoting related businesses.

Prudent investment is still required under the tide of panic buying

In 2022, affected by the price fluctuations of precious metals, banks such as Industrial Bank, Huaxia Bank, and China Everbright Bank have all tightened up their personal precious metal trading business on behalf of the Shanghai Gold Exchange. The account precious metal business included in the account is restricted or suspended.

Talking about the reasons for the tightening of precious metal-related businesses at that time, Zhou Maohua pointed out that some banks previously tightened their personal precious metal trading business or account precious metal business mainly to prevent potential risks and protect the legitimate rights and interests of investors. At that time, the precious metals market was facing a complex environment and increased volatility. For investors, market predictability decreased and potential risks increased. Regulatory authorities attached great importance to the implementation of investor suitability management by financial institutions.

Until 2023, due to the combination of multiple factors, the global risk aversion sentiment has heated up, and the price of gold has repeatedly surged. The most recent round occurred on May 4. London spot gold once soared to US$2,079.37 per ounce, breaking through the highest point of US$2,074.71 per ounce in August 2020. However, the price of gold then fell back, and as of the close on May 6, it fell to $2016.37 per ounce.

Regarding the reasons for the recent rise in gold prices, Zhou Maohua said that the recent gold prices have been driven by factors such as the global economic recession, the end of the Fed's interest rate hike cycle, and geopolitical conflicts. In addition, some central banks' increased gold purchases have also boosted the enthusiasm for gold investment to a certain extent.

According to news from the World Gold Council on May 5, in the first quarter, the demand for gold from global central banks increased significantly. Central banks in many countries are still keen to buy gold, increasing the global official gold reserves by 228 tons. Looking forward to 2023, the investment demand for gold will become the protagonist.

Regarding the trend of gold prices in 2023, Wang Hongying, president of the China (Hong Kong) Financial Derivatives Investment Research Institute, believes that in the long run, the price of gold will rise steadily and continue to break through new highs. It is a relative consensus on the expectation of further easing of liquidity in the future.

Under the trend of gold price recovery, is it a good choice to invest in gold and other precious metal accumulation products? Wang Hongying said that for institutional investors, long-term holding of gold and other precious metal products will be an important trading strategy; for individual investors, short-term gold prices are still at historical highs, and a small amount of light positions should be taken when investing in gold 1. The idea of prudent investment should not be aggressive, especially chasing high investment will bring the risk of short-term price correction.

Zhou Maohua also believes that in the case of fluctuations in the price of gold, gold accumulation investment is safer than one-time investment, and gold accumulation is suitable for long-term investment. At present, gold is at a relatively high level in history, and there are still many uncertain factors affecting the trend of gold. From the perspective of stable investment, investors need to grasp the rhythm of accumulation.

Source:

The man I consider the most informed on Gold in the world seems to confirm this news. Andrew Maguire brings it up at the 24 min mark.