- Messages

- 37,063

- Reaction score

- 6,374

- Points

- 288

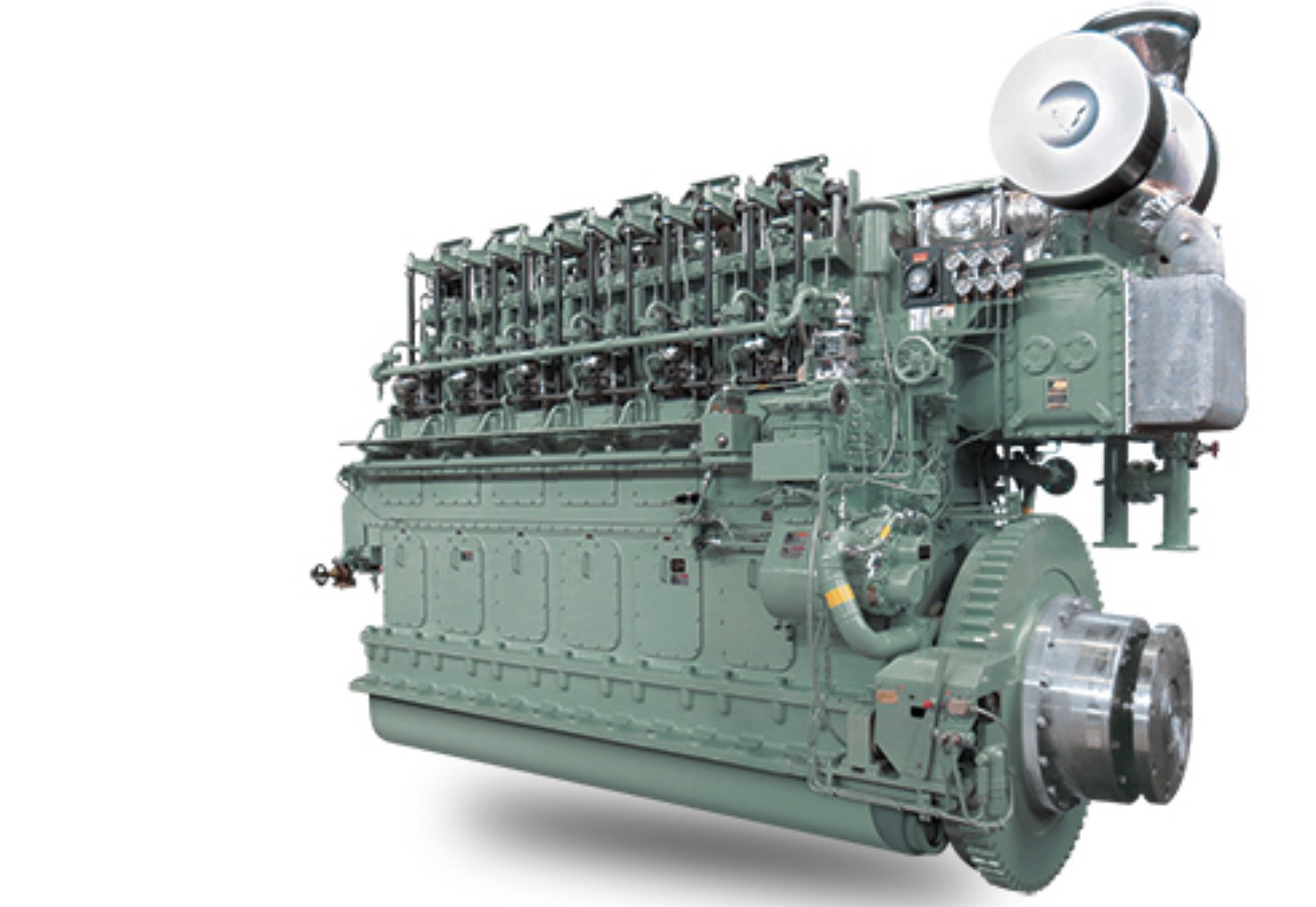

Oregon’s Port of Portland to Suspend Container Operations as Losses Grow

Oregon’s only ocean seaport, the Port of Portland, informed shippers yesterday that it plans to suspend container operations as of October 1. Like ma...