- Messages

- 9,998

- Reaction score

- 7,790

- Points

- 238

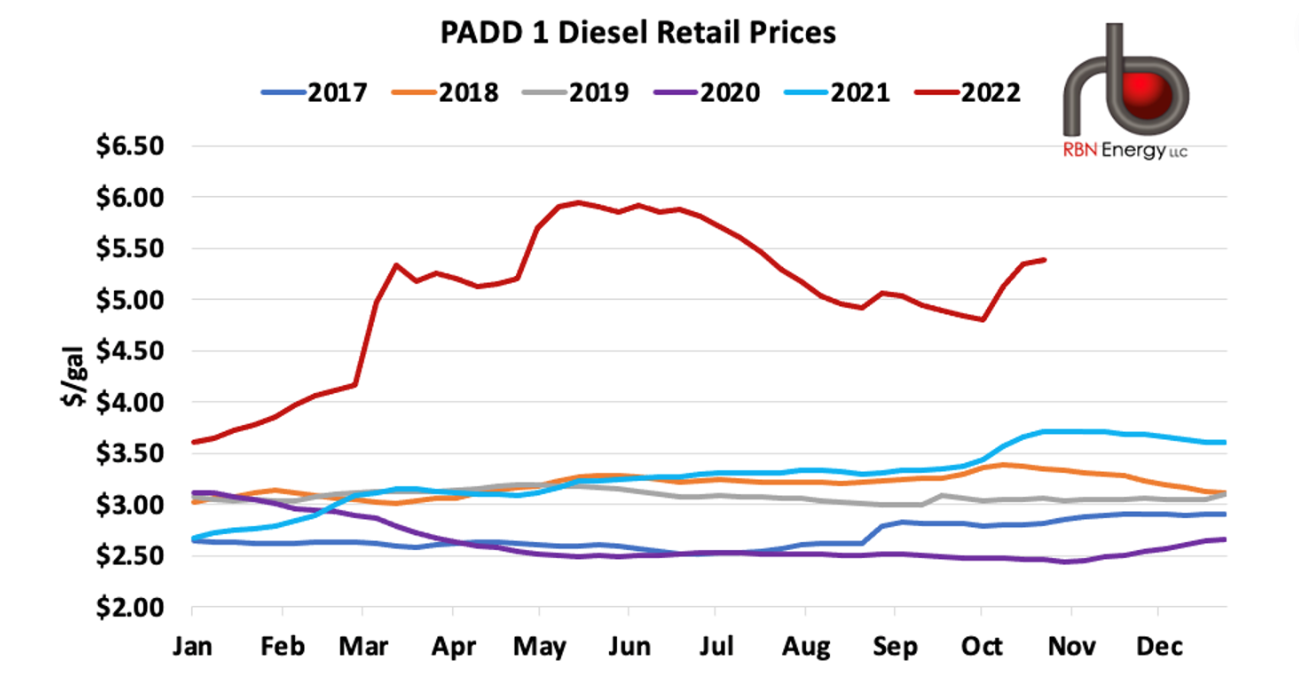

Supply Alert – October 25, 2022

October 25, 2022 Alan ApthorpEast Coast fuel markets are facing diesel supply constraints due to market economics and tight inventories.

Poor pipeline shipping economics and historically low diesel inventories are combining to cause shortages in various markets throughout the Southeast. These have been occurring sporadically, with areas like Tennessee seeing particularly acute challenges.

Back in May 2022, diesel prices rose by $1/gal and supply dried up throughout the Southeast. Over the past few weeks, market volatility has begun to echo the challenges seen in April 2022, as we covered in FUELSNews on Oct 11 and Oct 14. Like before, markets are now seeing extremely high prices in the Northeast along with supply outages along the Southeast.

In many areas, actual fuel prices are currently 30-80 cents higher than the posted market average, because supply is tight. Usually the “low rack” posters can sell many loads of fuel before running out of supply; now, they only have one or two loads. That means fuel suppliers have to pull from higher cost options, at a time when low-high spreads are much wider than normal. At times, carriers are having to visit multiple terminals to find supply, which delays deliveries and strains local trucking capacity.

Because conditions are rapidly devolving and market economics are changing significantly each day, Mansfield is moving to Alert Level 4 to address market volatility. Mansfield is also moving the Southeast to Code Red, requesting 72 hour notice for deliveries when possible to ensure fuel and freight can be secured at economical levels.

Supply Alert - October 25, 2022 - Mansfield Energy Corp

East Coast fuel markets are facing diesel supply constraints due to market economics and tight inventories. Poor pipeline shipping economics and historically low diesel inventories are combining to cause shortages in various markets throughout the Southeast. These have been occurring...