Fresh on the heels of an announced oil cut by Russia, OPEC follows up with cuts across the board.

Surprise OPEC Announcement

The initial cut is 1.1 million barrels then increases to 1.6 million barrels by August.

In a move that is sure to rattle president Biden, OPEC+ Makes Surprise 1 Million-Barrel Oil Production Cut

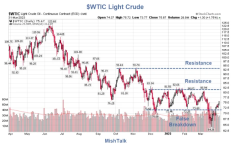

$WTIC Light Crude Daily

Daily Technicals

On the daily chart, the breakdown below $70 now looks like a head fake. Price is back in the a technical channel whose bottom is $70-$73 and the top $80-83 or so.

Strong resistance is at the $83 level and above that $94.

Technically speaking, I expect a run to the $90-$94 level.

Political and Economic Complications

A strong move higher in the price of crude, especially in the surprise manner that it will happen will complicate US Mideast policy and exacerbate the struggles at the Fed to get inflation under control.

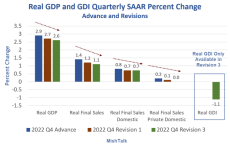

Real Income Was Negative in 2022 Q4, Big Negative Revisions to GDP

Meanwhile please note Real Income Was Negative in 2022 Q4, Big Negative Revisions to GDP.

Rising inflation lessens real income, which was negative in Q4. I commented "Don't discount the possibility that a recession started in 2022 Q4. That's the message from the BEA's revised GDP numbers."

On March 29, I noted Money Supply Is Headed for 6th Month of Contraction

Other Deposit Liabilities, the best measure of money supply, is headed for a 6th consecutive decline, every month starting October.

What's the Real Risk Now, Is it Inflation or Deflation?/

Given the obvious inflationary forces, that may seem like a silly question, but please consider this video discussion: What's the Real Risk Now, Is it Inflation or Deflation?

The short answer is Credit Freezes Are Highly Deflationary. See the above link for details and discussion.

Stagflation? Then What?

Rising oil price and higher inflation are a recipe for stagflation. But a credit crunch is a recipe for deflation.

Ultimately, I expect the latter will win. This too complicates matters for the Fed.

By the way, I expect this decision by Saudi Arabia is at least as much political as it is economic (e.g. slowing demand).

What would you do in the face of a president who vows to end the use of your primary asset?

mishtalk.com

mishtalk.com

Surprise OPEC Announcement

The initial cut is 1.1 million barrels then increases to 1.6 million barrels by August.

In a move that is sure to rattle president Biden, OPEC+ Makes Surprise 1 Million-Barrel Oil Production Cut

OPEC+ announced a surprise oil production cut that will exceed 1 million barrels a day, abandoning previous assurances that it would hold supply steady to maintain a stable market.

That’s a significant reduction for a market where — despite the recent price fluctuations — supply was looking tight for the latter part of the year. Oil futures weren’t trading when the cut was announced on Sunday, but the inevitable price reaction could add to inflationary pressures across the world, forcing central banks to keep interest rates higher for longer and amplifying the risk of recession.

In October last year, when OPEC+ made a surprise production cut of about 2 million barrels day just weeks before the US midterm elections, Biden vowed there would be “consequences” for Saudi Arabia. But the administration did not follow through after and the White House has recently praised several Saudi initiatives, including its decision to supply Ukraine with $400 million in energy and financial assistance.

All fourteen traders and analysts polled last week by Bloomberg predicted no change. They were taking their lead from Saudi Energy Minister Prince Abdulaziz bin Salman, who had said last month that the current OPEC+ production targets are “here to stay for the rest of the year, period.”

$WTIC Light Crude Daily

Daily Technicals

On the daily chart, the breakdown below $70 now looks like a head fake. Price is back in the a technical channel whose bottom is $70-$73 and the top $80-83 or so.

Strong resistance is at the $83 level and above that $94.

Technically speaking, I expect a run to the $90-$94 level.

Political and Economic Complications

A strong move higher in the price of crude, especially in the surprise manner that it will happen will complicate US Mideast policy and exacerbate the struggles at the Fed to get inflation under control.

Real Income Was Negative in 2022 Q4, Big Negative Revisions to GDP

Meanwhile please note Real Income Was Negative in 2022 Q4, Big Negative Revisions to GDP.

Rising inflation lessens real income, which was negative in Q4. I commented "Don't discount the possibility that a recession started in 2022 Q4. That's the message from the BEA's revised GDP numbers."

On March 29, I noted Money Supply Is Headed for 6th Month of Contraction

Other Deposit Liabilities, the best measure of money supply, is headed for a 6th consecutive decline, every month starting October.

What's the Real Risk Now, Is it Inflation or Deflation?/

Given the obvious inflationary forces, that may seem like a silly question, but please consider this video discussion: What's the Real Risk Now, Is it Inflation or Deflation?

The short answer is Credit Freezes Are Highly Deflationary. See the above link for details and discussion.

Stagflation? Then What?

Rising oil price and higher inflation are a recipe for stagflation. But a credit crunch is a recipe for deflation.

Ultimately, I expect the latter will win. This too complicates matters for the Fed.

By the way, I expect this decision by Saudi Arabia is at least as much political as it is economic (e.g. slowing demand).

What would you do in the face of a president who vows to end the use of your primary asset?

Expect Higher Gasoline Prices as OPEC Makes a Surprise Cut in Supply

Surprise OPEC AnnouncementThe initial cut is 1.1 million barrels then increases to 1.6 million barrels by August. In a move that is sure to rattle president Biden, OPEC+ Makes Surprise 1 Milli…