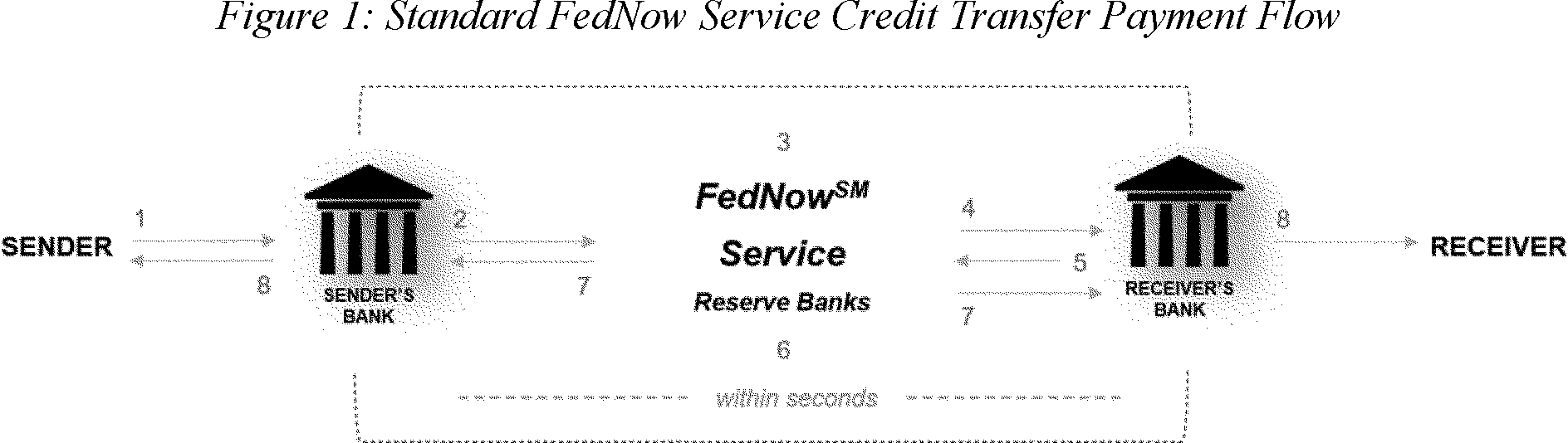

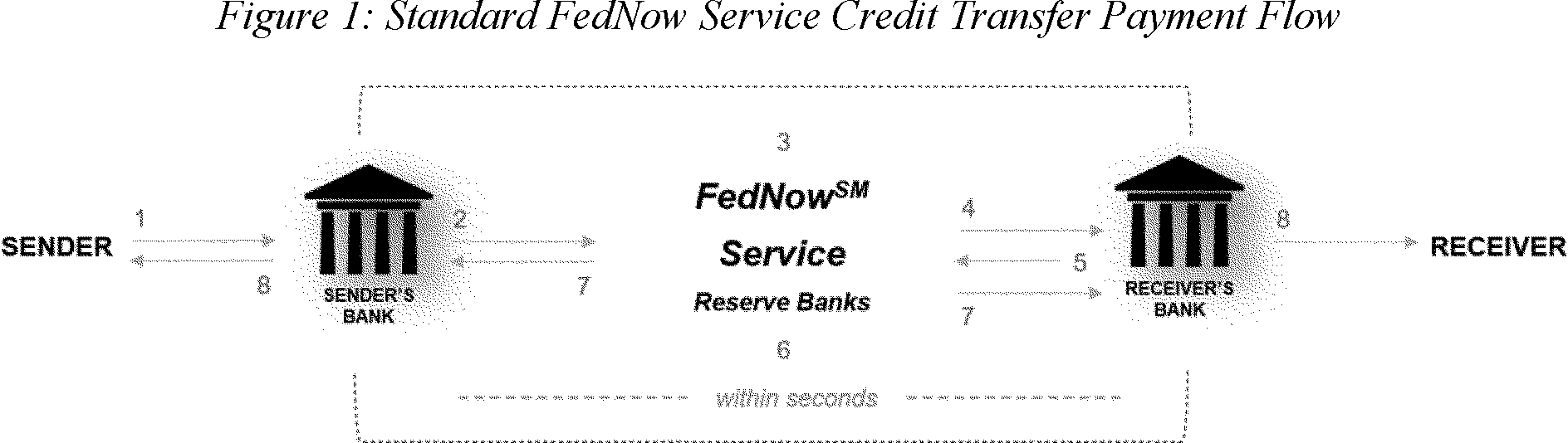

... An instant payment facilitated by the FedNow Service begins when a sender (that is, an individual or business) initiates a payment using a service provided by their bank, such as a banking application accessed on a computer, tablet, or mobile device.[13] After the sender's bank receives this request, it will send a message through the FedNow Service to the receiver's bank, with information about the payment.[14] Upon receipt of this message, the receiver's bank will indicate whether it intends to accept the payment. If it intends to accept the payment, the receiver's bank will send a positive confirmation back, and upon receipt the FedNow Service will transfer the funds between the Federal Reserve accounts associated with the banks. Each bank will debit and credit their customer's account accordingly. The entire process is intended to take place in a matter of seconds, so the receiver will have funds available to use in near real time. Completed payments will be final, meaning they are irrevocable.[15]

...

Because instant payment services such as the FedNow Service process and settle each payment separately and continuously on a 24x7x365 basis, participants will need adequate funds or available credit (liquidity) in their accounts at all times in order to settle each payment. In some circumstances, banks with account balances beyond their current needs may supply liquidity to those facing a shortfall. Typically, banks can use a service like the Fedwire® Funds Service to conduct such liquidity transfers. However, when those services are closed, participants in the FedNow Service or the existing private-sector service may need an alternative method to transfer liquidity.

...

- In step 1, a sender (that is, an individual or business) initiates a payment by sending a payment message to its bank through an end-user interface outside the FedNow Service.[39] The sender's bank is responsible for screening the payment according to its internal processes and requirements.[40]

- In step 2, the sender's bank submits a payment message to the FedNow Service.

- In step 3, the FedNow Service validates the payment message, for example, by verifying that the message meets message format specifications.

- In step 4, the FedNow Service sends the contents of the payment message to the receiver's bank to seek confirmation that the receiver's bank intends to accept the payment message. At this point, the receiver's bank will have the opportunity to confirm or deny that it maintains the specified account.

- In step 5, the receiver's bank sends a positive response to the FedNow Service, confirming that it intends to accept the payment message.[41] Steps 4 and 5 are intended to reduce the number of misdirected payments and resulting exception cases that can occur in high-volume systems.

- In step 6, the FedNow Service debits and credits the designated master accounts of the sender's and receiver's banks (or their correspondent banks), respectively.

- In step 7, the FedNow Service sends a payment message forward to the receiver's bank with an advice of credit and in parallel sends an acknowledgement to the sender's bank notifying it that settlement is complete.[42]

- In step 8, the receiver's bank credits the receiver's account.[43] As a condition of the FedNow Service, the receiver's bank must agree to make funds available to the receiver almost immediately after step 7. This crediting to the receiver's account as well as the debiting of the sender's account by their respective banks happens outside the FedNow Service.[44]

...