Trump Media & Technology Group to Merge with TAE Technologies, a Premier Fusion Power Company, in All-Stock Transaction Valued at More Than $6 Billion

Combined company expects to site and commence construction of the first utility-scale fusion power plant in 2026

Fusion power to blaze path toward America’s A.I. dominance and energy security

Conference call scheduled for 9 a.m. ET, December 18, 2025

Sarasota, Fla. & Foothill Ranch, Calif. – December 18, 2025 – (GLOBE NEWSWIRE) — Trump Media & Technology Group Corp. (Nasdaq, NYSE Texas: DJT) (“TMTG”) and TAE Technologies, Inc. (“TAE”) today announced the signing of a definitive merger agreement to combine in an all-stock transaction valued at more than $6 billion. Upon closing, shareholders of each company will own approximately 50% of the combined company on a fully diluted equity basis. The companies have posted supplemental slides to their respective websites, all of which can be accessed at tmtgcorp.com and tae.com.

Highlights:

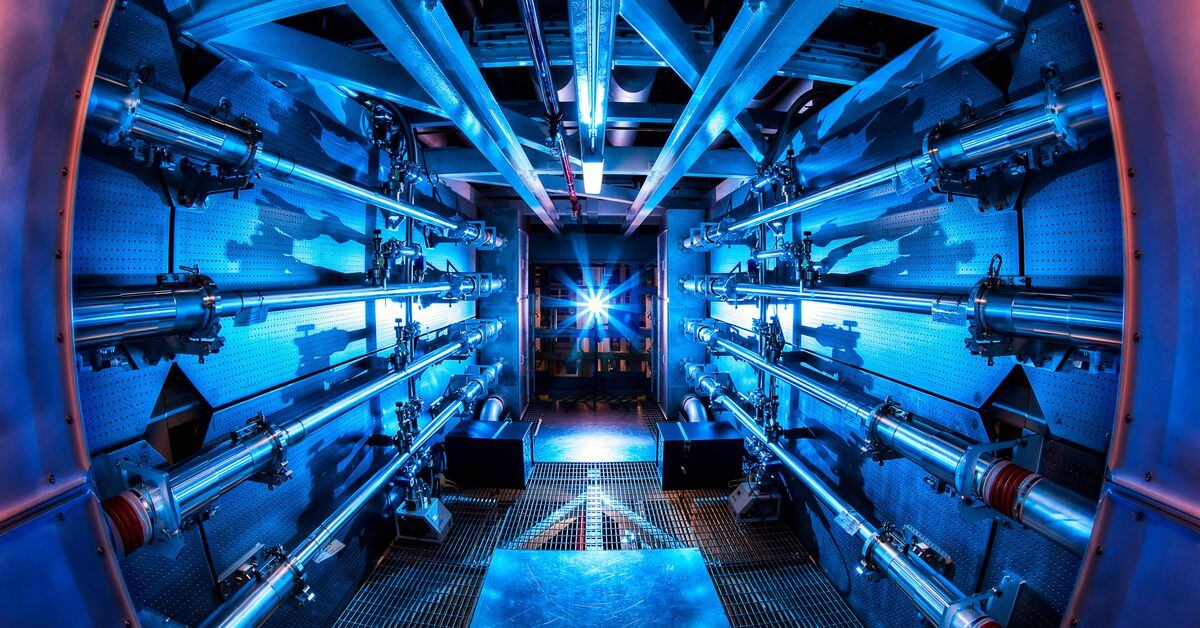

- Transaction to create one of the world’s first publicly traded fusion companies. Deal to combine TMTG’s access to significant capital and TAE’s leading fusion technology. In 2026, the combined company plans to site and begin construction on the world’s first utility-scale fusion power plant (50 MWe), subject to required approvals. Additional fusion power plants are planned and expected to be 350 – 500 MWe. Fusion power plants are expected to provide economic, abundant, and dependable electricity that would help America win the A.I. revolution and maintain its global economic dominance.

- TMTG’s balance sheet to accelerate the path to power. The transaction will combine the strength of TMTG’s strong balance sheet with TAE’s leading technologies. As part of the transaction, TMTG has agreed to provide up to $200 million of cash to TAE at signing and an additional $100 million is available upon initial filing of the Form S-4.

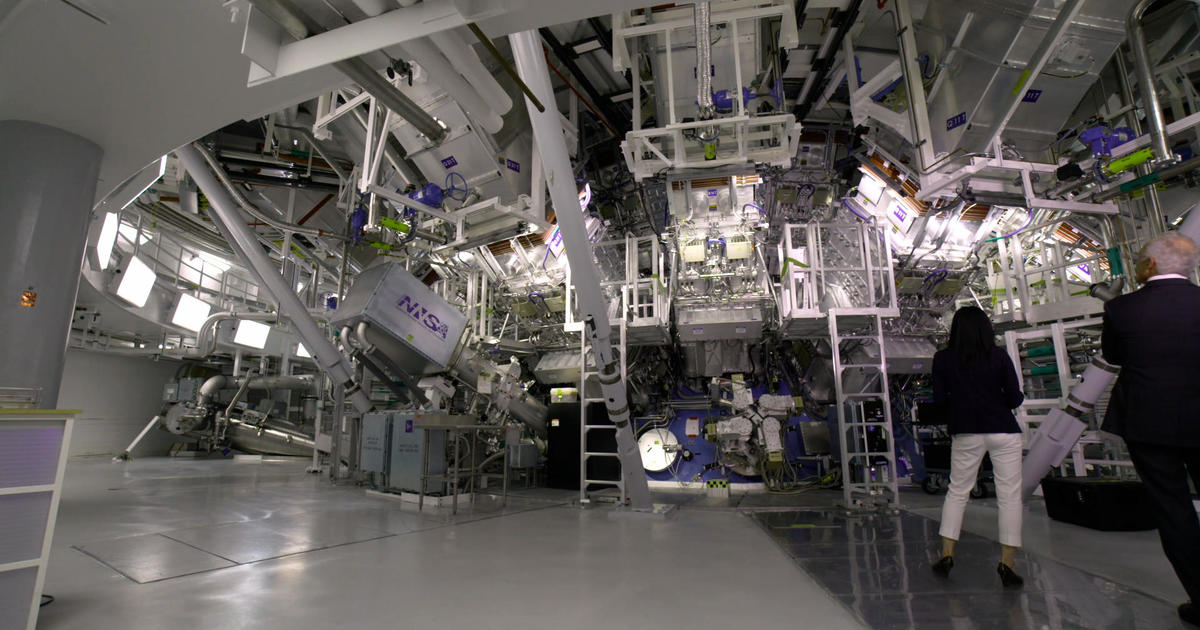

- TAE’s next-generation fusion technology is poised for commercial application. After more than 25 years of research and development, TAE has significantly reduced fusion reactor size, cost and complexity. TAE has built and safely operated five fusion reactors and raised more than $1.3 billion in private capital to date from Google, Chevron Technology Ventures, Goldman Sachs, Sumitomo Corporation of Americas, NEA, the visionary family offices of Addison Fischer, the Samberg Family, Charles R. Schwab, and others.

- Combined company to be governed by experienced management and board. Devin Nunes, TMTG Chairman and CEO, and Dr. Michl Binderbauer, TAE CEO and Director, plan to serve as Co-CEOs of the combined company; Michael B. Schwab, Founder and Managing Director of Big Sky Partners, is expected to be named Chairman of a planned nine-member board of directors.

Nunes said, “Trump Media & Technology Group built uncancellable infrastructure to secure free expression online for Americans, and now we’re taking a big step forward toward a revolutionary technology that will cement America’s global energy dominance for generations. Fusion power will be the most dramatic energy breakthrough since the onset of commercial nuclear energy in the 1950s—an innovation that will lower energy prices, boost supply, ensure America’s A.I.-supremacy, revive our manufacturing base and bolster national defense. TMTG brings the capital and public market access to quickly move TAE’s proven technology to commercial viability.”

Binderbauer said, “Our talented team, through its commitment and dedication to science, is poised to solve the immense global challenge of energy scarcity. At TAE, recent breakthroughs have prepared us to accelerate capital deployment to commercialize our fusion technology. We’re excited to identify our first site and begin deploying this revolutionary technology that we expect to fundamentally transform America’s energy supply.”

Transaction Details

Under the terms of the merger agreement, TAE and TMTG shareholders will each own approximately 50% of the combined company at closing, stated on a fully diluted equity basis.

Based on TMTG’s trailing 30-day VWAP share price as of market close on December 17, 2025, the transaction values each share of TAE common stock (on a fully diluted basis) at $53.89 per share.

Upon closing, Trump Media & Technology Group will be the holding company for Truth Social, Truth+, Truth.Fi, TAE, TAE Power Solutions and TAE Life Sciences, among others.

The transaction, which was approved by the boards of directors of both companies, is expected to close in mid-2026, subject to customary closing conditions, including shareholder and regulatory approvals.

TAE Technologies, a Leading American Innovator

Founded in 1998, TAE’s next phase focuses on deploying commercial, utility scale fusion energy. Planned power plants would provide reliable, affordable, carbon-free electricity and industrial heat without the risks of nuclear meltdown, radioactive waste, or proliferation. These advancements position TAE to offer dispatchable, affordable energy at a time of surging power demand.

In addition to its fusion business, TAE has two partially-owned subsidiaries — TAE Power Solutions and TAE Life Sciences. The power business has developed innovative energy storage and power delivery systems to serve multiple industries, including A.I. data centers, industrial users, and electric vehicles. TAE Life Sciences has developed a biologically targeted radiotherapy to treat cancer patients.

The TAE team consists of more than 400 employees, including 62 Ph.D. holders. The company has been granted over 1,600 patents, reflecting its leadership in fusion innovation. Binderbauer is globally recognized as a pioneering scientific mind, credited with more than 100 technology patents and numerous awards.

Leadership and Governance

Schwab said, “Through my involvement with TAE over the two decades, I’ve watched first-hand their commitment to science and the promise of applying fusion power to help solve the world’s demand for clean, abundant, affordable energy. With the infusion of TMTG’s significant capital, TAE is on the precipice of scaling its leading technology to usher in a new era of energy abundance. The world needs energy, and fusion is the clear answer.”

Nunes and Binderbauer will serve as co-CEOs of the combined company. Nunes will continue to lead all Trump Media brand operations. Binderbauer will manage TAE Technologies.

The combined company will be managed by a nine-member board of directors, comprised of two directors from TMTG—includes Nunes and Donald J. Trump Jr.—two directors from TAE—including Binderbauer and Schwab—and five other independent directors to be selected and named later. As noted above, Schwab is expected to be named board chair.

Advisors

For TMTG, Yorkville Securities is serving as lead financial and M&A advisor, Clear Street is serving as financial advisor, and DLA Piper (U.S.) LLP is serving as a legal advisor. For TAE, Barclays is serving as financial advisor and Baker Botts LLP is serving as legal advisor.

Joint Investor Call and Additional Information

Management of TMTG and TAE plan to host an investor call at 9 a.m. ET on December 18, 2025, to discuss the transaction. The call can be accessed here.

A webcast of the call, along with this press release and the supplemental slides, are available in the “investor” sections of the TMTG IR website at

https://ir.tmtgcorp.com/ and TAE’s website at tae.com.

In addition, TMTG plans to file the investor presentation with the SEC as an exhibit to a Current Report on Form 8-K prior to the call, which will be available on the SEC’s website at

www.sec.gov.

About TMTG

The mission of Trump Media is to end Big Tech’s assault on free speech by opening up the Internet and giving people their voices back. Trump Media operates Truth Social, a social media platform established as a safe harbor for free expression amid increasingly harsh censorship by Big Tech corporations, as well as Truth +, a TV streaming platform focusing on family-friendly live TV channels and on-demand content. Trump Media is also launching Truth.Fi, a financial service and FinTech brand incorporating America First investment vehicles.

Since going public in March 2024, TMTG has amassed total financial assets of $3.1 billion (as of third quarter 2025), including cash, restricted cash, short-term investments, trading securities, and digital assets.

About TAE

TAE Technologies is the world’s leading fusion power company, developing the most sustainable and economically competitive solution to bring abundant clean energy to the grid and carbon-intensive industrial processes. In addition, it operates subsidiaries TAE Power Solutions, which provides technology for energy storage and power delivery systems for batteries and electric vehicles, as well as TAE Life Sciences, which develops technologies and drugs for treating cancer patients.

...