swissaustrian

Yellow Jacket

- Messages

- 2,049

- Reaction score

- 0

- Points

- 156

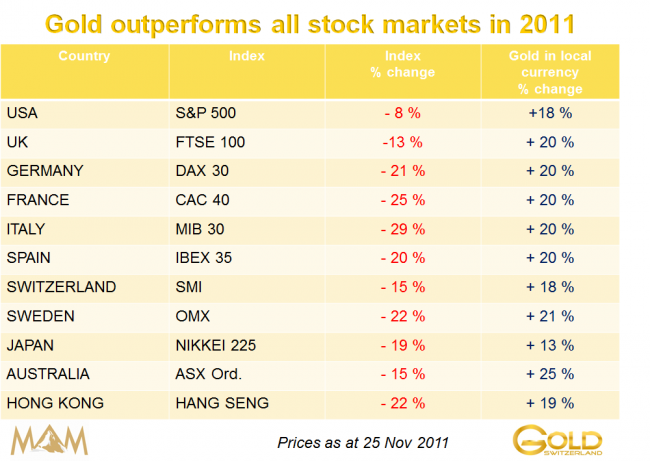

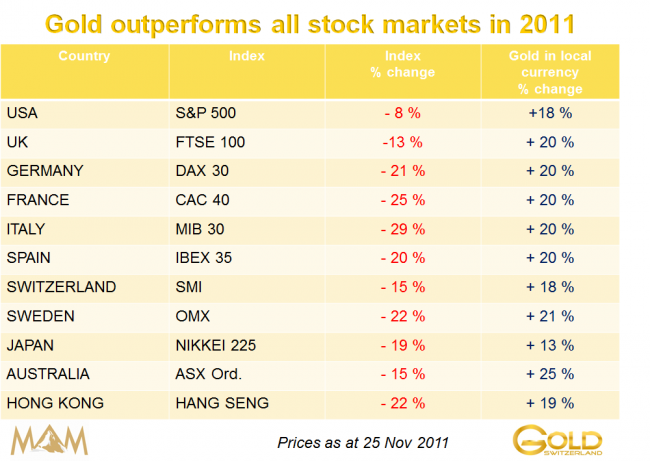

Chart by Matterhorn Asset Management ( www.goldswitzerland.com ), a company which employs some friends of mine

Additionally, the long term Dow-gold ratio

Additionally, the long term Dow-gold ratio

Last edited: