- Messages

- 27,011

- Reaction score

- 4,832

- Points

- 288

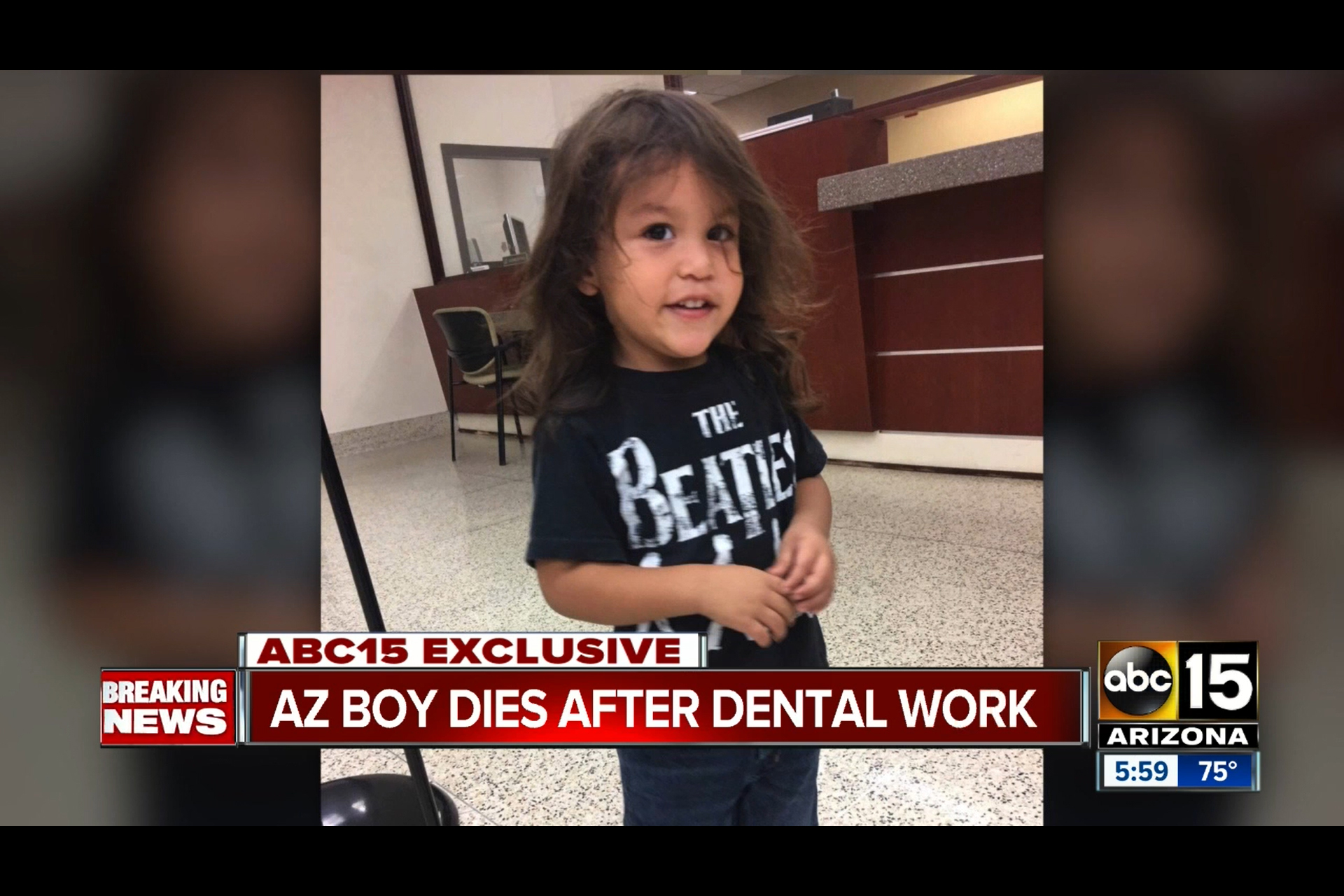

Hundreds of Hospitals Sue Patients or Threaten Their Credit, a KHN Investigation Finds. Does Yours?

By Noam N. LeveyDECEMBER 21, 2022Despite growing evidence of the harm caused by medical debt, hundreds of U.S. hospitals maintain policies to aggressively pursue patients for unpaid bills, using tactics such as lawsuits, selling patient accounts to debt buyers, and reporting patients to credit rating agencies, a KHN investigation shows.

The collection practices are commonplace among all types of hospitals in all regions of the country, including public university systems, leading academic institutions, small community hospitals, for-profit chains, and nonprofit Catholic systems.

Individual hospital systems have come under scrutiny in recent years for suing patients. But the KHN analysis shows the practice is widespread, suggesting most of the nation’s approximately 5,100 hospitals serving the general public have policies to use legal action or other aggressive tactics against patients.

Full article here:

Hundreds of Hospitals Sue Patients or Threaten Their Credit, a KHN Investigation Finds. Does Yours?

An examination of billing policies and practices at more than 500 hospitals across the country shows widespread reliance on aggressive collection tactics.