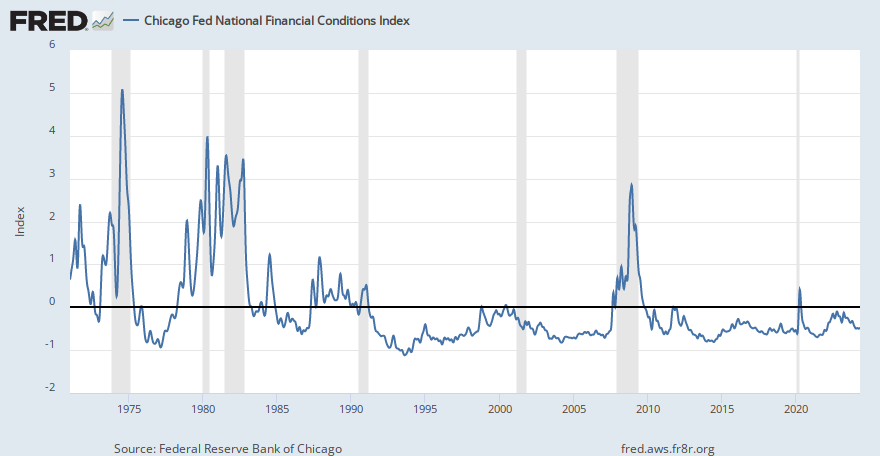

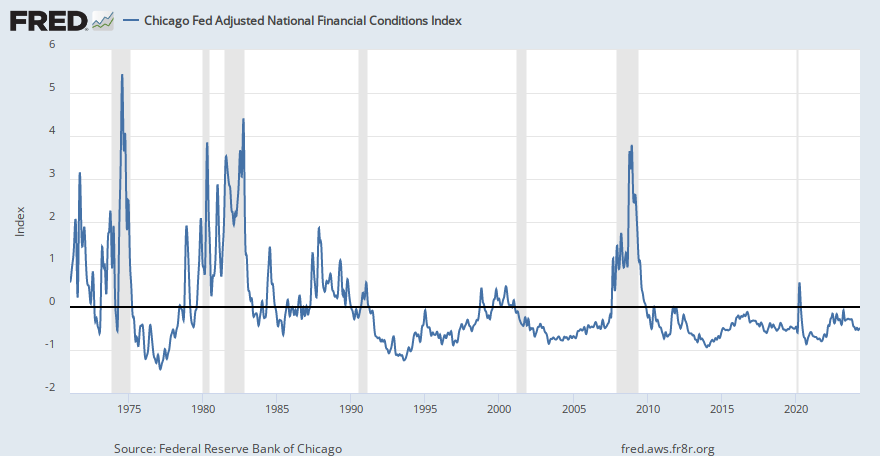

The Chicago Fed’s National Financial Conditions Index (NFCI) provides a comprehensive weekly update on U.S. financial conditions in money markets, debt and equity markets, and the traditional and “shadow” banking systems. Because U.S. economic and financial conditions tend to be highly correlated, we also present an alternative index, the adjusted NFCI (ANFCI). This index isolates a component of financial conditions uncorrelated with economic conditions to provide an update on financial conditions relative to current economic conditions.

...

Index Suggests Steady Financial Conditions in Week Ending February 24

The NFCI was unchanged at –0.41 in the week ending February 24. Risk indicators contributed –0.15, credit indicators contributed –0.14, and leverage indicators contributed –0.11 to the index in the latest week.

The ANFCI ticked up in the latest week to –0.41. Risk indicators contributed –0.16, credit indicators contributed –0.09, leverage indicators contributed –0.10, and the adjustments for prevailing macroeconomic conditions contributed –0.04 to the index in the latest week.

The NFCI and ANFCI are each constructed to have an average value of zero and a standard deviation of one over a sample period extending back to 1971. Positive values of the NFCI have been historically associated with tighter-than-average financial conditions, while negative values have been historically associated with looser-than-average financial conditions. Similarly, positive values of the ANFCI have been historically associated with financial conditions that are tighter than what would be typically suggested by prevailing macroeconomic conditions, while negative values have been historically associated with the opposite.

^ You can find the raw data and more detailed information on how the indexes are calculated on that page. You can find charts of the NFCI and ANFCI indices here:

Chicago Fed National Financial Conditions Index

Graph and download economic data for Chicago Fed National Financial Conditions Index (NFCI) from 1971-01-08 to 2023-02-24 about financial, indexes, and USA.

fred.stlouisfed.org

Chicago Fed Adjusted National Financial Conditions Index

Graph and download economic data for Chicago Fed Adjusted National Financial Conditions Index (ANFCI) from 1971-01-08 to 2023-02-24 about adjusted, financial, indexes, and USA.

fred.stlouisfed.org