BullionStar

Fly on the Wall

- Messages

- 5

- Reaction score

- 7

- Points

- 8

Hello, PM Bug forum members! This is our first post. If you need some encouragement after this week's gold and silver slam, you may appreciate our optimistic new report about silver - "Why a Powerful Silver Bull Market May Be Ahead":

https://www.bullionstar.us/blogs/bullionstar/why-a-powerful-silver-bull-market-may-be-ahead/

Here are some highlights from the report:

1) Silver is quite cheap by historical standards. See the inflation-adjusted price of silver, for example:

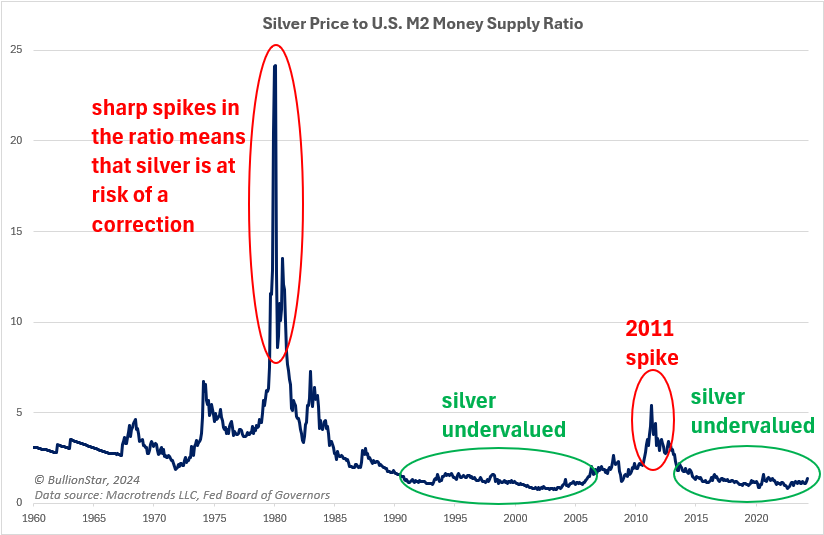

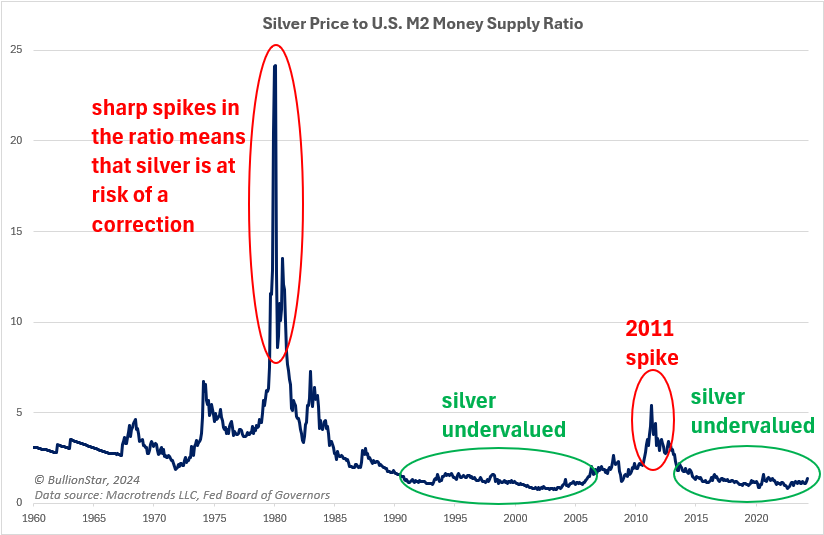

2) The ratio of silver’s price to the United States M2 money supply also shows that silver is quite undervalued by historical standards:

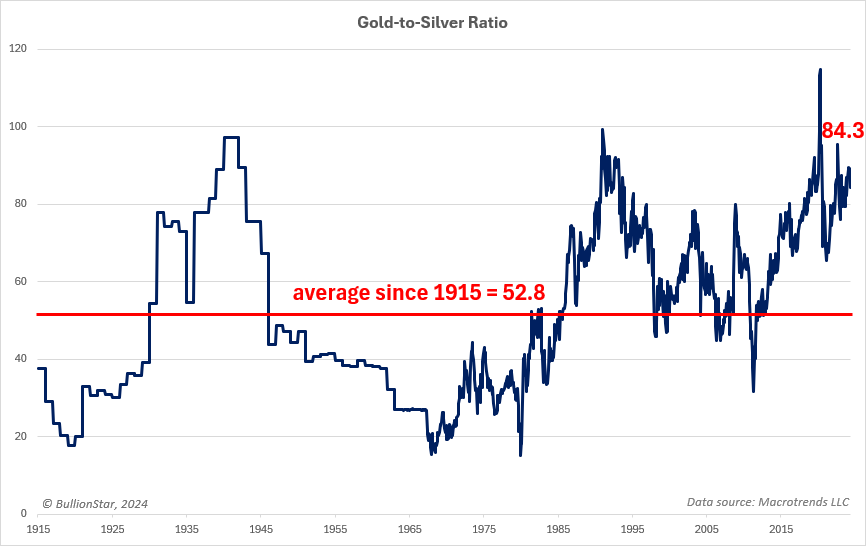

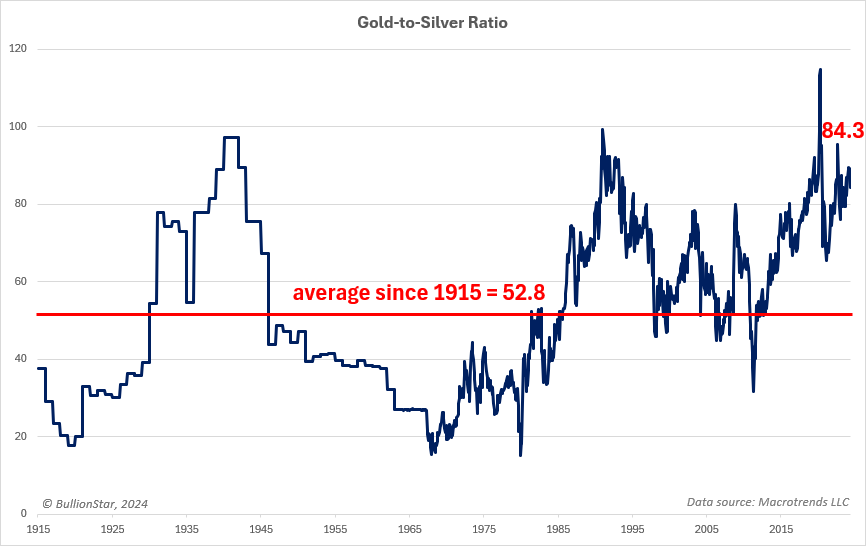

3) The current gold-to-silver ratio is a lofty 84.3, which means that silver is extremely undervalued relative to gold based on historical standards:

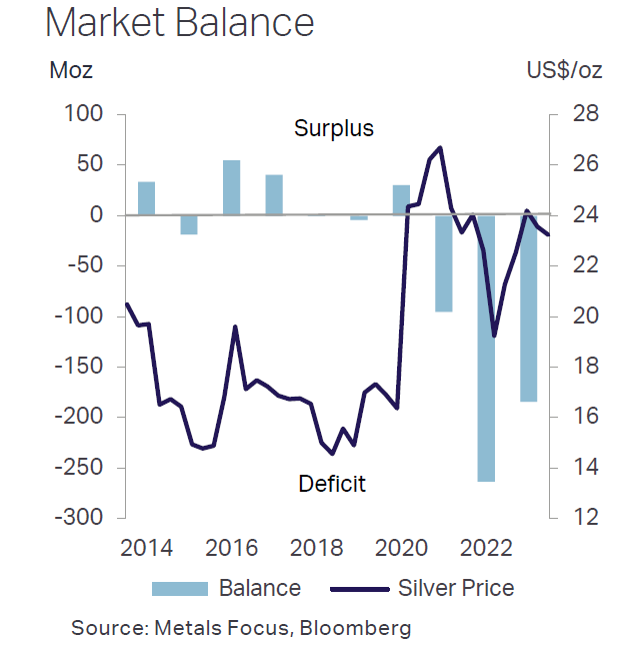

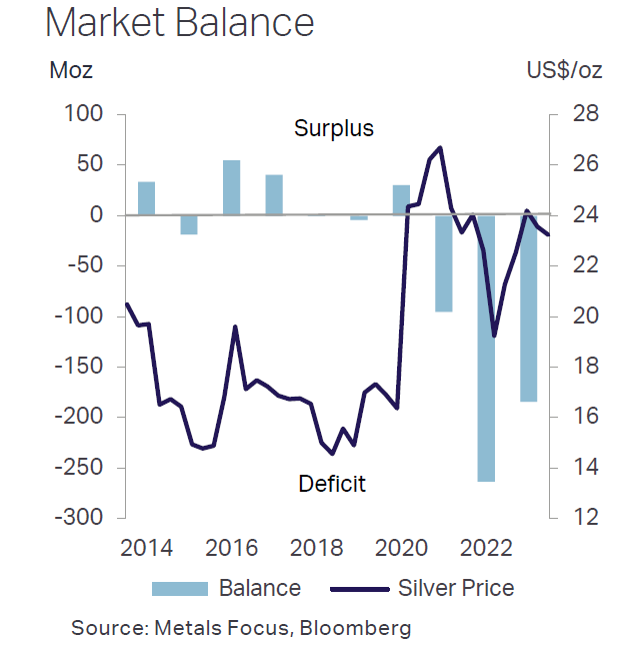

4) Strong demand for silver and lackluster supply growth has created a structural deficit in the silver market for the past few years:

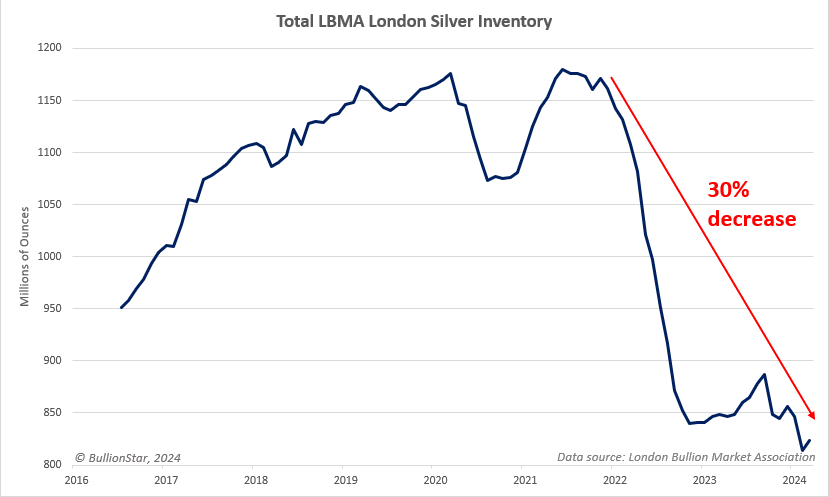

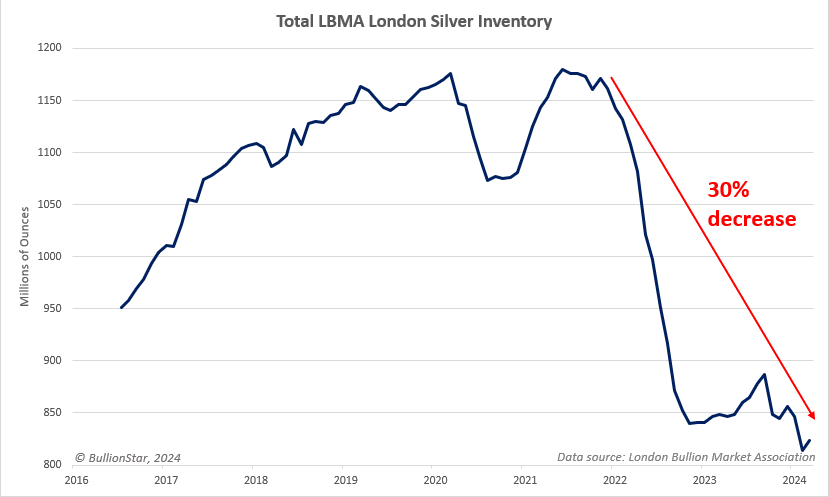

5) The past few years' silver deficit is causing the above-ground supply of silver to dwindle at a rapid rate:

6) Silver has recently broken out from a long-term triangle pattern, which means that a powerful bull market is likely ahead that could take silver to its prior 2011 highs of approximately $50 and even higher after that:

We hope you read the whole report, which has many more charts and additional points:

www.bullionstar.us

www.bullionstar.us

Please let us know what you think in the comments!

https://www.bullionstar.us/blogs/bullionstar/why-a-powerful-silver-bull-market-may-be-ahead/

Here are some highlights from the report:

1) Silver is quite cheap by historical standards. See the inflation-adjusted price of silver, for example:

2) The ratio of silver’s price to the United States M2 money supply also shows that silver is quite undervalued by historical standards:

3) The current gold-to-silver ratio is a lofty 84.3, which means that silver is extremely undervalued relative to gold based on historical standards:

4) Strong demand for silver and lackluster supply growth has created a structural deficit in the silver market for the past few years:

5) The past few years' silver deficit is causing the above-ground supply of silver to dwindle at a rapid rate:

6) Silver has recently broken out from a long-term triangle pattern, which means that a powerful bull market is likely ahead that could take silver to its prior 2011 highs of approximately $50 and even higher after that:

We hope you read the whole report, which has many more charts and additional points:

Why a Powerful Silver Bull Market May Be Ahead

A look at numerous factors that may drive silver back to its 2011 high of $50 — and possibly even higher.

Please let us know what you think in the comments!

Last edited by a moderator:

This post may contain affiliate links for which PM Bug gold and silver discussion forum may be compensated.