- Messages

- 5,187

- Reaction score

- 5,360

- Points

- 308

It's no secret that commercial real estate is in bad shape across the globe...

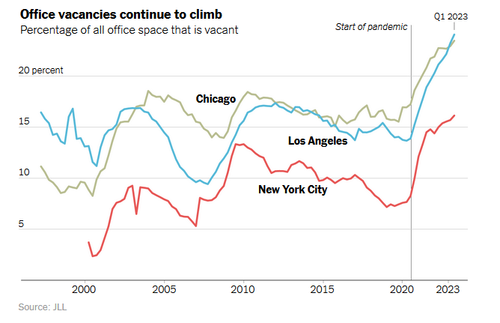

The cause? Thanks to the pandemic, working from home has become the norm in many industries - a phenomenon which has also heavily impacted mass transit systems in America's largest cities.

In downtowns from Chicago to Los Angeles, the physical layout of the 20th-century city is clashing with the new economy. Since the 1920s, single-use zoning has divided our cities into separate neighborhoods for home, work and play. Work-from-home and Netflix have made these distinctions irrelevant, but our partitioned urban fabric has yet to catch up.

To create a city vibrant enough to compete with the convenience of the internet, we need to end the era of single-use zoning and create mixed-use, mixed-income neighborhoods that bring libraries, offices, movie theaters, grocery stores, schools, parks, restaurants and bars closer together. We must reconfigure the city into an experience worth leaving the house for. Streets once filled by commuting crowds can be reinvigorated by those who really want to be there. -NYT

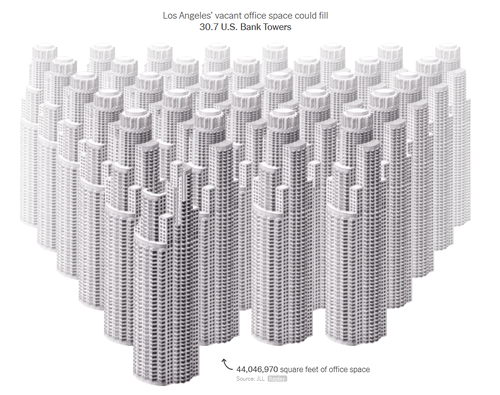

In Los Angeles, the vacant office space is equivalent to 30.7 US Bank Towers.

Glaeser and Ratti note that in 1980, futurist Alvin Toffler argued that information technology would render urban office environments more or less obsolete, as workers would instead use residential "electronic cottages."

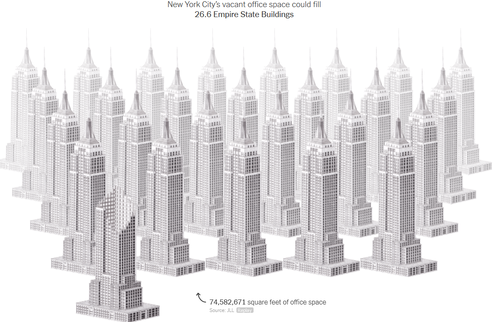

This sudden shift was a body blow to New York. Many offices remain empty, and the city lost more than 300,000 inhabitants from 2020 to 2021. No other American city experienced such a large numerical decline. Over the same period, Houston lost only 12,000 people, although the global commercial real estate services company JLL reports that Houston’s office vacancy rates are now even higher than New York’s. -NYT

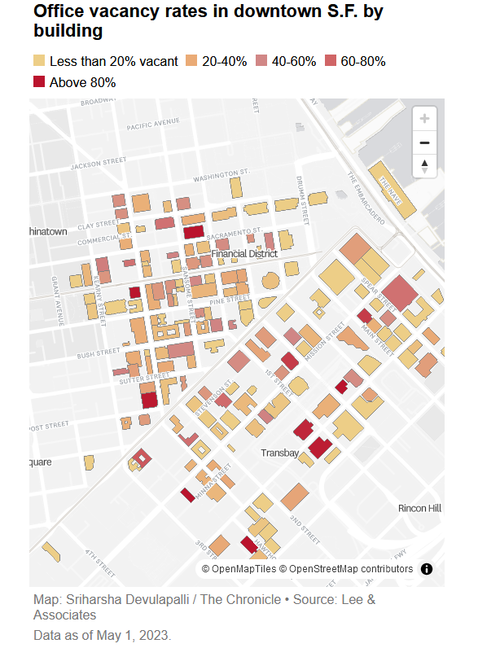

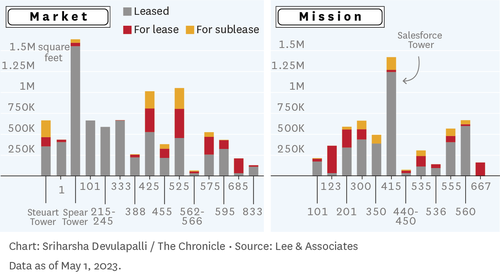

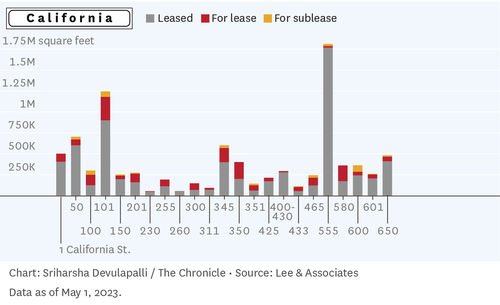

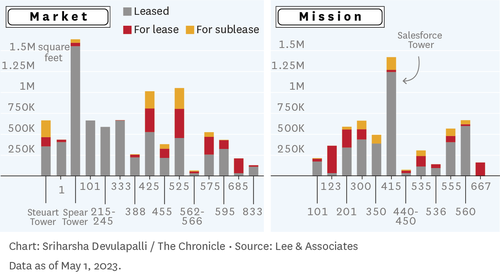

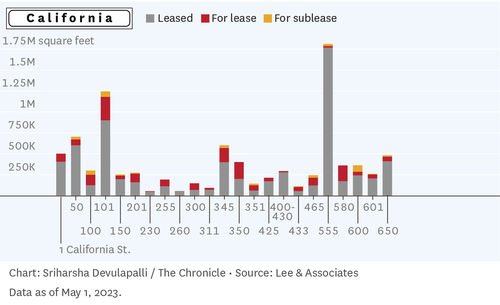

In San Francisco, the downtown area is experiencing its worst office vacancy crisis on record - with 31% of space available for lease or sublease, the SF Chronicle reports.

In the heart of the city, an astounding 18.4 million square feet of real estate is available — enough space to house 92,000 employees and the equivalent of 13 Salesforce Towers.

The Chronicle mapped and charted every major downtown office building’s vacancy, using data provided by real estate brokerage Lee & Associates.

According to the report, some of the emptiest buildings are those vacated amid layoffs by tech giants Salesforce and Meta - the former of which embraced remote work, and has listed office for lease at 50 Fremont, where 90% of the space is vacant.

Slack, a subsidiary of Salesforce, left its former headquarters at 500 Howard Street 95.4% vacant. It's also listed space at 45 Fremont St. for sublease, which is currently 60% vacant.

Meta, meanwhile, has listed all 435,000 sq ft of their 181 Fremont St. location for rent, as the city's 3rd largest tower currently sits 100% vacant.

According to Cody Kollmann, founding principal at Lee & Associates, "This is the first time in over a decade where office tenants in San Francisco have had any leverage or negotiating power against landlords. This is an incredible opportunity for tenants to exploit a commercial real estate market that is experiencing a historically high vacancy rate."

Landlords, meanwhile, need to offer more than just space according to some.

"The more an office building acts like a hotel, the more office tenants are attracted to it and the more likely they will stay," said David Klein, managing principal at Lee & Associates.

"I strongly believe the office experience should be at the same level as luxury residential and hospitality," said Michael Shivo, owner of the Transamerica Pyramid - who's investing $250 million in a renovation of the landmark that's currently sitting 36.7% vacant.

"In the last two years, we’ve made our homes into our offices, now it’s time to make our offices feel like our homes."

www.zerohedge.com

www.zerohedge.com

- "It's Going To Be Ugly": Commercial Real Estate Predictions Turn Dire

- Morgan Stanley Slides As Credit Loss Provisions Surge Due To Commercial Real Estate Exposure

- State Of Commercial Real Estate: Sharp Spike In Office Delinquency Rates Coming

- CRE Crisis Crosses Atlantic: Sweden's Largest Commercial Landlord SBB Implodes After Getting Junked, Halting Dividend

- European Commercial Real Estate Values May Fall Up To 40%: Citi

The cause? Thanks to the pandemic, working from home has become the norm in many industries - a phenomenon which has also heavily impacted mass transit systems in America's largest cities.

In downtowns from Chicago to Los Angeles, the physical layout of the 20th-century city is clashing with the new economy. Since the 1920s, single-use zoning has divided our cities into separate neighborhoods for home, work and play. Work-from-home and Netflix have made these distinctions irrelevant, but our partitioned urban fabric has yet to catch up.

To create a city vibrant enough to compete with the convenience of the internet, we need to end the era of single-use zoning and create mixed-use, mixed-income neighborhoods that bring libraries, offices, movie theaters, grocery stores, schools, parks, restaurants and bars closer together. We must reconfigure the city into an experience worth leaving the house for. Streets once filled by commuting crowds can be reinvigorated by those who really want to be there. -NYT

In Los Angeles, the vacant office space is equivalent to 30.7 US Bank Towers.

Glaeser and Ratti note that in 1980, futurist Alvin Toffler argued that information technology would render urban office environments more or less obsolete, as workers would instead use residential "electronic cottages."

This sudden shift was a body blow to New York. Many offices remain empty, and the city lost more than 300,000 inhabitants from 2020 to 2021. No other American city experienced such a large numerical decline. Over the same period, Houston lost only 12,000 people, although the global commercial real estate services company JLL reports that Houston’s office vacancy rates are now even higher than New York’s. -NYT

In San Francisco, the downtown area is experiencing its worst office vacancy crisis on record - with 31% of space available for lease or sublease, the SF Chronicle reports.

In the heart of the city, an astounding 18.4 million square feet of real estate is available — enough space to house 92,000 employees and the equivalent of 13 Salesforce Towers.

The Chronicle mapped and charted every major downtown office building’s vacancy, using data provided by real estate brokerage Lee & Associates.

According to the report, some of the emptiest buildings are those vacated amid layoffs by tech giants Salesforce and Meta - the former of which embraced remote work, and has listed office for lease at 50 Fremont, where 90% of the space is vacant.

Slack, a subsidiary of Salesforce, left its former headquarters at 500 Howard Street 95.4% vacant. It's also listed space at 45 Fremont St. for sublease, which is currently 60% vacant.

Meta, meanwhile, has listed all 435,000 sq ft of their 181 Fremont St. location for rent, as the city's 3rd largest tower currently sits 100% vacant.

According to Cody Kollmann, founding principal at Lee & Associates, "This is the first time in over a decade where office tenants in San Francisco have had any leverage or negotiating power against landlords. This is an incredible opportunity for tenants to exploit a commercial real estate market that is experiencing a historically high vacancy rate."

Landlords, meanwhile, need to offer more than just space according to some.

"The more an office building acts like a hotel, the more office tenants are attracted to it and the more likely they will stay," said David Klein, managing principal at Lee & Associates.

"I strongly believe the office experience should be at the same level as luxury residential and hospitality," said Michael Shivo, owner of the Transamerica Pyramid - who's investing $250 million in a renovation of the landmark that's currently sitting 36.7% vacant.

"In the last two years, we’ve made our homes into our offices, now it’s time to make our offices feel like our homes."

New York, San Francisco Office Buildings Are Absolute Ghost Towns | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero